The 5 biggest issues for stocks now that Trump is president

Donald Trump has officially been sworn in as president of the United States.

And while Trump’s election sparked a stock market rally that sent the major US averages to new record highs, in recent weeks markets have been more or less flat. The major averages were higher on Friday, but sold off a bit after Trump was officially sworn in. All told though, not a whole lot is happening in markets on Friday.

But now that Trump is president, discussions about what the administration wants to get done are no longer off in the distance. And when it comes to the US economy and financial markets there are really just a few core issues that investors are likely to focus on.

In a note to clients out earlier this month, David Kostin, chief US equity strategist at Goldman Sachs, outlined the five issues that are most important to markets — and S&P 500 earnings — in 2017.

Here’s Kostin:

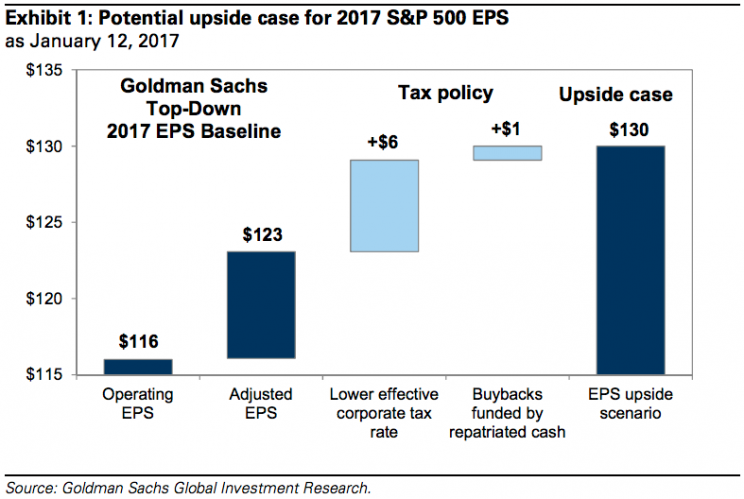

Corporate tax rate: Our economists expect the corporate statutory tax rate will be lowered to 25%, around the OECD average but above the Trump campaign (15%) and House Republican proposals (20%). All else equal, a statutory federal rate of 25% would boost S&P 500 EPS by 8%.

Destination-based border-adjusted tax: Under this system, US firms would bear no tax burden (or a reduced tax burden) for export revenues but would no longer be able to deduct import costs when calculating their tax bases. Our economists currently assign a probability of just 30% that this proposal will be enacted. This is due in part to the potentially difficult transition to such a system, which could prove to be a significant headwind for net importers.

Interest deductibility and depreciation policy: Changes to interest deductibility and the depreciation of capital investment appear more likely than a change to a destination-based system. However, numerous questions remain about implementation. For example, it is not yet clear whether or for how long interest payments on current debt would be grandfathered.

Fiscal spending: We estimate that infrastructure spending of $25bn per year (below the $100bn per year outlined in the Trump campaign proposal) would have a modest impact on real GDP growth, increasing S&P 500 EPS by about $1. Our sector analysts expect that construction materials companies would benefit significantly from an increase in infrastructure spending.

Regulation: The Trump Administration will have discretion in reshaping key regulations. Much uncertainty exists, but banks and midstream energy firms are likely beneficiaries of relaxed regulations.

Following Trump’s election, taxes were an issue that everyone in markets knew would dominate the discussion into 2017.

The official White House site, updated after Trump’s swearing in, outlined the administration’s plan on taxes and job creation as:

The plan starts with pro-growth tax reform to help American workers and businesses keep more of their hard-earned dollars. The President’s plan will lower rates for Americans in every tax bracket, simplify the tax code, and reduce the U.S. corporate tax rate, which is one of the highest in the world. Fixing a tax code that is outdated, overly complex, and too onerous will unleash America’s economy, creating millions of new jobs and boosting economic growth.

Earlier this week, comments from Trump made the border-tax adjustment issue seem like a potential hurdle for Trump getting a plan through Congress. And overall, it seems that trade is an issue on which Trump and current lawmakers simply do not see eye to eye.

On the White House site on Friday, Trump’s goals on trade were outlined as:

This strategy starts by withdrawing from the Trans-Pacific Partnership and making certain that any new trade deals are in the interests of American workers. President Trump is committed to renegotiating NAFTA. If our partners refuse a renegotiation that gives American workers a fair deal, then the President will give notice of the United States’ intent to withdraw from NAFTA.

In addition to rejecting and reworking failed trade deals, the United States will crack down on those nations that violate trade agreements and harm American workers in the process. The President will direct the Commerce Secretary to identify all trade violations and to use every tool at the federal government’s disposal to end these abuses.

The only thing, of course, that anyone can say with confidence is that no one, really, knows what happens next.

Yahoo Finance

Yahoo Finance