Teradyne (TER) Q1 Earnings & Revenues Surpass Estimates

Teradyne Inc. TER reported first-quarter 2020 earnings of $1 per share, surpassing the Zacks Consensus Estimate of 86 cents. The figure also increased 85.2% year over year and 13.6% sequentially.

Moreover, revenues of $704.4 million increased 43% year over year. The figure surpassed the Zacks Consensus Estimate by 5.8% and came within the guided range of $670-$710 million.

Inside the Headlines

Approximately 69% of revenues came from semiconductor testing platforms, 17% from the System Test business, 9% from Industrial Automation and the remaining 5% from the Wireless Test business.

The increase in total revenues was driven by strength in Semiconductor Test and System Test businesses. However, headwinds from COVID-19-related impacts on global manufacturing activity impacted the Industrial Automation segment.

Teradyne’s Industrial Automation segment declined 9% year over year in the first quarter due to manufacturing sector headwinds on a global basis.

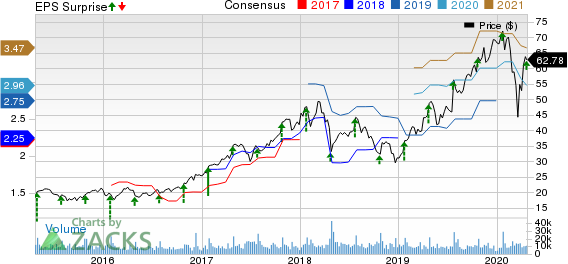

Teradyne, Inc. Price, Consensus and EPS Surprise

Teradyne, Inc. price-consensus-eps-surprise-chart | Teradyne, Inc. Quote

Margins

Pro-forma gross margin was 57.6%, down 60 basis points (bps) from the prior-year quarter. The decrease was due to an unfavorable product mix.

Total operating expenses (selling and administrative & engineering and development) of $196.5 million increased 9.9% year over year. As a percentage of sales, both selling & administrative expenses and engineering & development costs decreased from the year-ago quarter.

Operating margin came in at 29.3%, up 1,050 bps from the year-ago quarter.

Balance Sheet

At the end of the first quarter, Teradyne’s cash and cash equivalents were $593.5 million, lower than $773.9 million in the prior quarter.

During the quarter, the company repurchased $79 million of its common stock and paid $16.7 million as dividends.

Guidance

Management expects second-quarter 2020 revenues in the band of $690-$800 million. Non-GAAP earnings per share from continuing operations are likely to be in the range of 86 cents to $1.16.

The Zacks Consensus Estimate for second-quarter revenues and earnings per share is pegged at $617.9 million and 71 cents, respectively.

Zacks Rank and Key Picks

Currently, Teradyne carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector include Stamps.com Inc. STMP, Fiverr International Lt. FVRR and Wayfair Inc. W, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Stamps.com, Fiverr International and Wayfair is currently projected at 15%, 11.6% and 23%, respectively.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teradyne, Inc. (TER) : Free Stock Analysis Report

Wayfair Inc. (W) : Free Stock Analysis Report

Stamps.com Inc. (STMP) : Free Stock Analysis Report

Fiverr International Lt. (FVRR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance