Tenneco (TEN) Surpasses Q3 Earnings & Revenue Estimates

Tenneco Inc. TEN posted third-quarter 2019 results, wherein adjusted earnings per share of $1.23 beat the Zacks Consensus Estimate of 97 cents, aided by stellar top-line growth in its Clean Air, Ride Performance and Motorparts divisions. However, the reported figure came in lower than the prior-years’ $1.66.

In the third quarter, Tenneco’s adjusted net income came in at $99 million compared with the $85 million recorded in third-quarter 2018.

The company’s quarterly revenues soared 82% year over year to $4,319 million, mainly aided by higher light vehicle, off-highway and other revenues. Also, the revenue figure surpassed the Zacks Consensus Estimate of $4,280 million. On a constant-currency basis, revenues were up 3%, year on year. Light-vehicle industry production declined 3% in the quarter.

Adjusted EBITDA (income before interest expenses, income taxes, non-controlling interests and depreciation, and amortization) was $387 million compared with the $366 million recorded in the prior-year quarter.

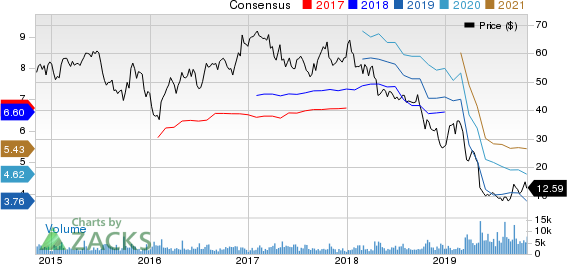

Tenneco Inc. Price and Consensus

Tenneco Inc. price-consensus-chart | Tenneco Inc. Quote

Segmental Results

The Clean Air division’s third-quarter revenues were $1.77 billion compared with the year-earlier figure of $1.6 billion.

Revenues in the Ride Performance division came in at $671 million compared with the $461 million recorded in the year-ago quarter.

The Powertrain division’s third-quarter revenues summed $1.08 billion.

The Motorparts division’s revenues were $794 million, significantly up from the $308 million generated in third-quarter 2018.

Financial Position

Tenneco had cash and cash equivalents of $389 million as of Sep 30, 2019, down from $697 million as of Dec 31, 2018. Long-term debt was $5.41 billion as of Sep 30, 2019, compared with $5.34 billion as of Dec 31, 2018. The debt-to-capital ratio stands at 77.23%.

Outlook

For the fourth quarter of 2019, the company expects revenues in the range of $3.95 billion to $4.05 billion. Further, adjusted EBITDA is projected at $295-$315 million.

Tenneco has revised its guidance for full-year 2019. It expects revenues of roughly $17.25-$17.35 billion and adjusted EBITDA between $1,425 million and $1,445 million.

Zacks Rank & Stocks to Consider

Tenneco currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks worth considering are Kinross Gold Corporation KGC, sporting a Zacks Rank #1 (Strong Buy), Iochpe-Maxion SA IOCJY and BRP Inc. DOOO, both carrying a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kinross Gold has an expected earnings growth rate of a whopping 210% for 2019. The company’s shares have surged 75.7% in the past year.

Iochpe-Maxion has an estimated earnings growth rate of 50% for the ongoing year. The company’s shares have appreciated roughly 4.6% in a year’s time.

BRP has a projected earnings growth rate of 18.49% for the current year. Its shares have gained around 11.1% over the past year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.5% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tenneco Inc. (TEN) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

BRP Inc. (DOOO) : Free Stock Analysis Report

Iochpe-Maxion SA (IOCJY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance