Is Temasek Holdings New Five-year Corporate Bond Worth Looking At?

By Tay Hock Meng

Temasek Holdings (TH) has announced on 16 October 2018 that it will be issuing a five-year corporate bond with a coupon rate of 2.7 per cent per annum payable semi-annually on 25 April and 25 October each year, and maturing on 25 October 2023. The T2023 – S$ bond is issued through Temasek’s wholly-owned subsidiary, Temasek Financial (IV) Private Limited, under its $5 billion Guaranteed Medium Term Note Programme.

For the first time, TH is offering the public bond offer for retail investors, and up to $200 million is being offered to retail investors. There is another $200 million private placement for institutional, accredited and other specified investors. For retail investors, applications must be made in multiples of $1,000, subject to a minimum of $1,000. The retail applications can be made via internet banking or the ATMs of DBS Bank, POSB, OCBC or UOB. Retail investors may also apply through the mobile applications of DBS or POSB. For the private placement tranche, the minimum investment amount starts from $250,000, and offers are subject to multiples of $250,000.

Comparison To Similar-Type bonds

At a coupon rate of 2.7 percent payable semi-annually, the yield difference as compared to a similar five-year Singapore government bond is about 38 basis points (bps). The five-year Singapore government bond is trading at around 2.32 percent yield. The latest Singapore Savings Bond (SBNOV18 GX18110Z) has an interest rate at the five-year mark of 2.54 per cent, and its annualised return at the end of the fifth year is 2.22 per cent.

However, the bond offering, like any other fixed income instrument is subjected to interest rate risks. With the US Federal Fund Rate increased to 2.25 per cent in September 2018, and in anticipation of future rate hikes this December and next year, the pace of rising interest rates poses some risks on bond valuations as fixed income prices move inversely with interest rates. This means when interest rate rises, bond prices fall and vice versa.

The bond offering is also eligible for inclusion under the CPF Investment Scheme – Ordinary Account (CPFIS – OA), and the yield difference when compared to the CPFIS – OA is about 20 bps above the 2.5 per cent interest rate per annum CPF Ordinary account currently stands at.

Comparisons With Reits, 3M Singapore Swap Offered Rate and Bank Deposit Rates

According to SGX, the average distribution per unit (DPU) yield offered by the 34 Real Estate Investment Trusts (Reits), six stapled trusts, and three property trusts listed on SGX since 2009 has on average maintained a month-end yield of 6.3 per cent.

As for the 3-month Singapore Swap Offered Rate (SOR), it currently stands at 1.63 percent and has not shifted much on a month-on-month (MoM) basis according to a Phillip Securities research note published on 17 October 2018.

Compared to bank savings account rates offered by the local banks, the research found that, the five-year fixed deposit rates currently ranges between 0.75 percent to 1.2 percent. Moreover, with the many bonus saving plans offered by the major local banks, for example the UOB One Account, the OCBC 360 Account, the rates – including the rewards – could range from 0.8 percent per annum to as high as 3.2 percent. These bonus savings plans are simple to set up and merely requires the deposit account holder to meet certain conditions such as crediting their salaries, or to perform certain number of credit/debit card transactions.

Credit Quality Of Temasek Holdings

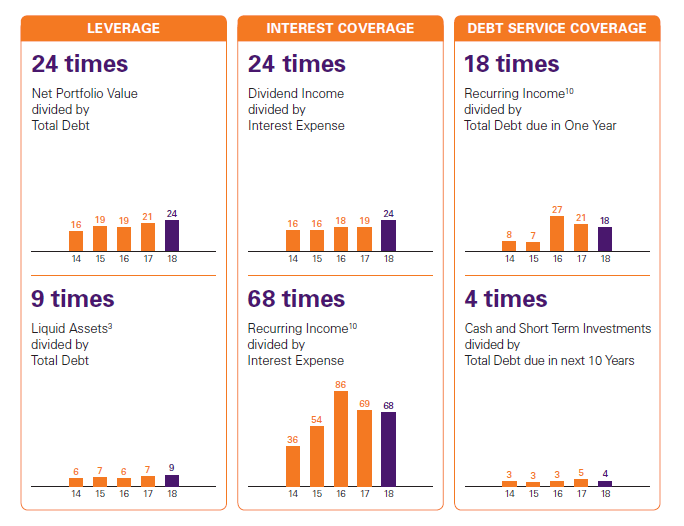

According to the product highlights, major credit ratings agencies like Moody’s and Standard & Poor’s have assigned a triple-A rating on the bond issue, and the entity, Temasek Holdings (TH). Moreover, the prospectus noted that TH, being the guarantor of the bonds has a total debt leverage of 24 times, and an interest coverage ratio as measured by dividend income against interest expense of 24 times.

Source: Prospectus of the five-year corporate bond offering, 17 October 2018

Comparison To Earlier Astrea IV PE Bond

Readers might recall that TH launched a retail bond offering in June 2018 known as Astrea IV Class A-1 bonds which was 7.4 times oversubscribed with all applicants who applied for $4,000 or less received their full allocations. The bond offer comprised of mostly Private Equity (PE) portfolios and it comes with an interest rate of 4.35 percent per annum maturing 10 years on 14 June 2028. There is also a five-year scheduled call date on 14 June 2023.

One of the key differences between that offering and the current five-year corporate bond offering by the same entity is the guaranteed feature available in the current five-year offering. Moreover, the term to maturity of the current bond offer is five years, while the PE bond offer in June has a term to maturity of ten years, though there is a scheduled call feature of five years.

Other Worthy Considerations

Apart from the various risks associated with the fixed income offering, such as interest rate, and duration (sensitivity of the bond valuations to the market interest rates), the product highlights did caution investors to note that the bonds are suitable to those who want regular income at a fixed rate rather than capital growth.

This group of investors would be prioritised ahead in payouts over share dividends as well as in insolvency situations. Investors must also be prepared to lose the principal investment if the issuer and the guarantor – TH in this case – fails to repay in the amounts due under the bonds, and must be prepared to hold on to the investment till maturity. Although the bonds will be listed on SGX Mainboard starting on 26 October 2018, there are no guarantees that the bond will be traded actively to provide liquidity.

Related Article:

Yahoo Finance

Yahoo Finance