Teck Resources (TECK) Cuts Q3 Coal Sales View on Elkview Outage

Shares of Teck Resources Limited TECK have declined 10% since management lowered steelmaking coal sales guidance for the third quarter of 2022 to 5.5-5.9 million tons from the prior guided range of 5.8-6.2 million tons. This move reflects the impact of operational halts at its Elkview steelmaking coal hub due to a structural failure of the plant feed conveyor belt as well as the recent labor action at Westshore Terminals.

Production at TECK’s Elkview Operations in the Elk Valley of British Columbia will likely be stalled for 1-2 months while repairs are carried out. Meanwhile, Elkview will reschedule planned plant maintenance work, utilizing the plant downtime. Mine operations will focus on pre-stripping during the outage.

Assuming a brief suspension of plant activity, TECK expects the impact on 2022 steelmaking coal production to be around 1.5 million tons. Management currently maintained its previous production guidance of 23.5-24 million tons for steelmaking coal for the full year.

Teck Resources reported a steelmaking coal production of 5.3 million tons in the second quarter of 2022, down 17% year over year. Production was lower than the year-ago reading due to planned maintenance shutdown activities at its two largest processing plants in the quarter and challenges attributable to the reliability of processing facilities.

Management also pointed out that higher absenteeism and labor shortages persistently affect equipment operating hours. These workforce constraints are likely to continue in the near term due to record low unemployment rates across Canada, a strong performance across most sectors of the Canadian economy, which buoyed demand for labor, and a shortage of available local personnel.

Steelmaking coal sales volume was 6.3 million tons in the second quarter compared with 6.2 million tons a year ago. Realized steelmaking coal prices in the second quarter reached an all-time high of $453 per ton, marking a 315% surge from the prior-year quarter’s level. FOB Australia prices continued to increase in the second quarter and reached record levels, though the same declined thereafter from these peak levels.

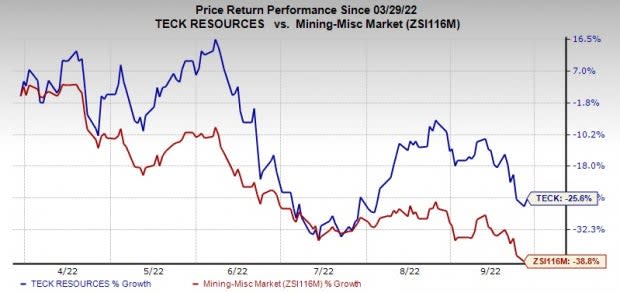

Price Performance

Image Source: Zacks Investment Research

Shares of Teck Resources have fallen 25.6% in the past six months compared with the industry’s decline of 38.8%.

Zacks Rank & Stocks to Consider

Teck Resources currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the basic materials space are Albemarle Corporation ALB, Daqo New Energy Corp. DQ and Sociedad Quimica y Minera de Chile S.A. SQM.

Albemarle, currently sporting a Zacks Rank #1 (Strong Buy), has a projected earnings growth rate of 425.3% for the current year. The Zacks Consensus Estimate for ALB's current-year earnings has been revised 63.7% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

ALB’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average being 24.2%. The stock has gained around 21% in the past six months.

Daqo New Energy, currently flaunting a Zacks Rank of 1, has an expected earnings growth rate of 177.5% for the current year. The consensus estimate for DQ's current-year earnings has been revised 9.8% upward in the past 60 days.

Daqo New Energy’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed the mark on one occasion, the average beat being 10.8%. DQ has gained around 11% over the past six months.

Sociedad has a projected earnings growth rate of 530.7% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 18.8% upward in the past 60 days.

Sociedad has a trailing four-quarter earnings surprise of 27.2%. SQM has rallied roughly 13% in the past six months. The stock carries a Zacks Rank #2 (Buy) at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

Teck Resources Ltd (TECK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance