TechnipFMC (FTI) Q1 Earnings and Revenues Miss Estimates

TechnipFMCplc FTI shares declined almost 8% in after-hours trading on Wednesday after the company reported first-quarter 2020 adjusted loss of 11 cents per share. Meanwhile, the Zacks Consensus Estimate was of earnings of 22 cents. Moreover, the year-earlier quarter's adjusted earnings came in at 6 cents.This underperformance can be primarily attributed to the coronavirus-induced vulnerable market scenario and lower-than-anticipated profits from the Technip Energies (previously Onshore/Offshore) segment, which is the major contributor to the company’s bottom line. Precisely, adjusted EBITDA from the unit totaled $167.1 million, lagging the Zacks Consensus Estimate of $182 million.

Meanwhile, for the quarter ended Mar 31, the company’s revenues of $3.13 billion missed the Zacks Consensus Estimate by 8.8% but increased 7.5% from $2.9 billion a year ago owing to strong revenue contributions from the company’s Subsea and Technip Energies unit.

In the first quarter, this seabed-to-surface oilfield equipment and services provider’s inbound orders plunged 66.1% from the year-ago period to $2.09 billion.

The company’s backlog increased in the first quarter. TechnipFMC’s order backlog stood at $21.9 billion, improving 23.5% from the year-ago quarter.

Subsea: The segment’s revenues in the quarter under review were $1.25 billion, up 5.7% from the year-ago sales figure of $1.18 billion owing to solid inbound orders in the prior periods and strong activities in the United States as well as Norway. Meanwhile, adjusted EBITDA of $104.8 million declined 25% year over year due to operational adversity from the coronavirus and the absence of more favorably-priced backlog, which aided the prior-year quarter. Quarterly inbound orders slumped 56.2% to $1.17 billion while backlog rose 4%.

Technip Energies (Onshore/Offshore has been renamed Technip Energies and includes Genesis, Loading Systems and Cybernetix): This segment generated revenues worth $1.54 billion, increasing 15.9% from the prior-year quarter. Revenues were driven by TechnipFMC’s business of process technology as well as robust activity in Europe and North America. In the first quarter, this unit reported $167.1 million in adjusted EBITDA, down from $194.8 million in the prior-year quarter. Management attributed this downswing to weak project execution, particularly in the Yamal LNG project, and soft margin realization from early-stage projects including Arctic LNG 2. Inbound orders were down 82.1% to $560.6 million but the segment’s backlog jumped 39.6% year over year to $13.76 billion at the end of the quarter.

Surface Technologies: This is the company’s smallest segment that recorded revenues of $329.5 million, down 16.1% year over year, primarily due to slowdown in North American completions activity. This was partly offset by higher revenues from the international energy markets. Adjusted EBITDA was down 18.6% to $24.5 million due to volume and pricing woes in North America. The segment’s inbound orders and backlog dipped 0.5% and 3.6%, respectively, in the quarter under review.

Financials

In the reported quarter, TechnipFMC spent $83.5 million. Meanwhile, cash flow from operations for the quarter came in at $27.9 million. As of Mar 31, the company had cash and cash equivalents of $4.9 billion and a long-term debt of $3.8 billion with a debt-to-capitalization ratio of 48.5%.

Recently, the company lowered its dividend by 75% on an annualized basis to 13 cents per share due to the coronavirus pandemic resulting in crude price crash. TechnipFMC’s lowered payout will reduce its yearly cash outgo for 2020 by $175 million from 2019. It further plans to pay its 2021 dividend in quarterly instalments starting April next year.

Additionally, the company announced revised compensation through the year-end including a 30% salary cut for the chairman and CEO; a 30% reduction in the board of directors’ retainer and a 20% decrease in the salaries of executive leadership team.

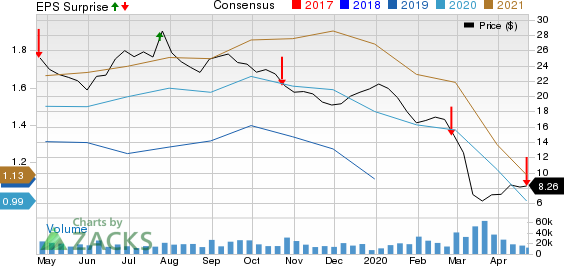

TechnipFMC plc Price, Consensus and EPS Surprise

TechnipFMC plc price-consensus-eps-surprise-chart | TechnipFMC plc Quote

2020 Guidance

TechnipFMC provided full-year guidance for its operating segments. The company expects revenues from the Subsea and Technip Energies units to be around $1 billion and $6.3-$6.8 billion, respectively. For the Technip Energies segment in particular, the revenue projection is a steep downward revision from the earlier range of $7.5-$7.8 billion. Further, the company set minimum EBITDA margin target of 10% for the Technip Energies segment. In a grim reminder of the difficult operating environment, the company expects subsea inbound orders in 2020 to fall by as much as 50% from the previous year.

Earlier this month, the London-based company slashed its 2020 capex guidance by 30% from the past projection due to the sudden oil price slump induced by the coronavirus pandemic. The company now anticipates to shell out $300 million as capital expenditures.

The company now chalked out a plan of action to determine additional savings of more than $220 million to cover all business segments and support functions. Total annualized savings are now estimated to exceed $350 million.

Zacks Rank & Stocks to Consider

TechnipFMC has a Zacks Rank #3 (Hold). Some better-ranked players in the energy space are Murphy USA Inc. MUSA, Comstock Resources, Inc. CRK and Southwestern Energy Company SWN, each stock carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comstock Resources, Inc. (CRK) : Free Stock Analysis Report

TechnipFMC plc (FTI) : Free Stock Analysis Report

Southwestern Energy Company (SWN) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance