Technical Checks For USD/CHF, EUR/CHF, GBP/CHF & CHF/JPY: 14.11.2018

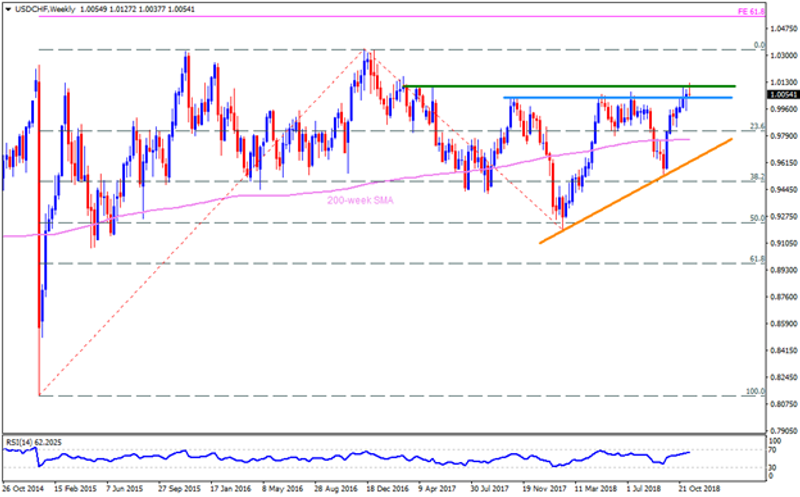

USD/CHF

Weekly closing beyond 1.0045 wasn’t enough for the USDCHF to register its strength as 1.0105-15 horizontal-region still stands tall to challenge the buyers, which if broken can escalate the pair’s rise to 1.0170 and the 1.0215 prior to highlighting the 1.0250 upside barrier. Given the successful price rally above 1.0250, the 1.0340 and the 61.8% FE level of 1.0550 may gain market attention. Alternatively, a W1 close beneath the 1.0045 could recall the 0.9980 and the 0.9900 as on the chart. During the pair’s extended downturn below 0.9900, the 0.9840 and the 200-week SMA level of 0.9765 would play their roles of important supports.

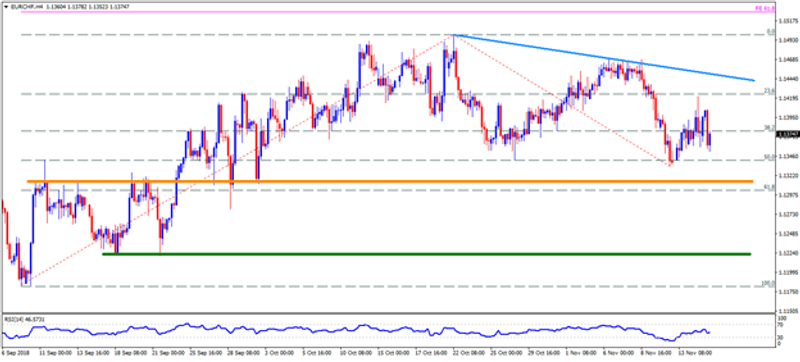

EUR/CHF

EURCHF failed to surpass 1.1400 resistance and is presently witnessing pullback moves towards 1.1330, breaking which 1.1315-10 and the 1.1260 seem crucial to watch. Assuming the pair’s additional weakness after 1.1260, the 1.1225-20 and the 1.1180 might become sellers’ favorites. In case the pair clears the 1.1400 hurdle, it can rise to 1.1435-40 area but immediate resistance-line around 1.1455 may confine its following advances. If at all the quote crosses 1.1455 mark, the 1.1470 and the 1.1500 could offer intermediate halts during its surge to 1.1530, including 61.8% FE.

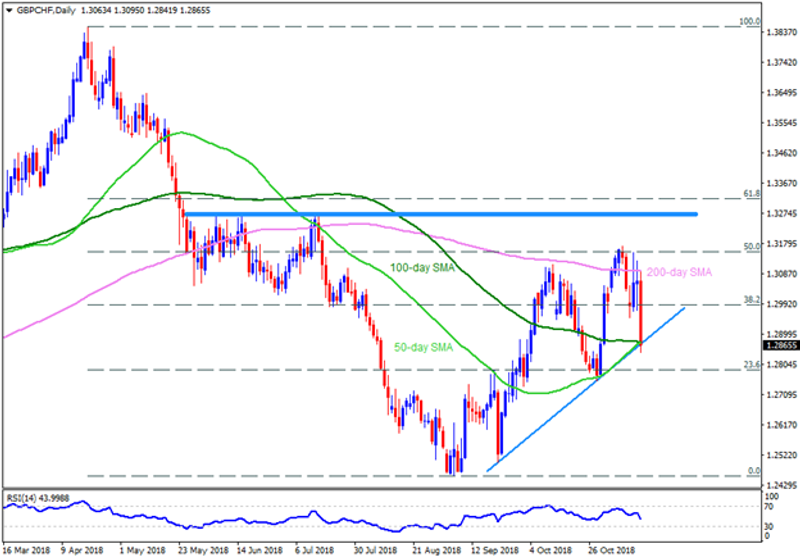

GBP/CHF

In spite of falling short of holding the 200-day SMA breakout, the GBPCHF’s downside is less certain as not only 50-day & 100-day SMA but eight week long ascending trend-line also limits the pair’s current declines near 1.2875-70. As a result, pair’s recovery to 1.2960 and then to the 1.3000 can’t be denied whereas 200-day SMA level of 1.3100 might keep being tough resistance to observe. Should prices continue trading northwards past-1.3100, the 1.3170 and the 1.3230 could please the Bulls. On the downside, the 1.2830, the 1.2750 and the 1.2720 are likely consecutive numbers that may rule the sentiment if 1.2875-70 confluence breaks. Assuming the pair’s refrain to respect the 1.2720, the 1.2600 and the 1.2535 might act as buffers ahead of highlighting the 1.2455 rest-point.

CHF/JPY

While three-week old ascending support-line seems restricting the CHFJPY’s south-run, adjacent downward slanting TL becomes a resistance worth following during the pair’s uptick. Hence, the 112.55 and the 113.10 are two important levels for the pair traders at the moment. Given the pair’s dip beneath the 112.55, the 112.10 & the 111.50 may come back as quotes, which if broken can push Bears to demand 61.8% FE level of 110.70. Meanwhile, an upside break of 113.10 could fuel the pair to 113.30 and then to the 113.60-70 resistance-zone. Moreover, pair’s sustained rise above 113.70 enables it to target the 114.10 and the 114.50 resistances.

This article was originally posted on FX Empire

More From FXEMPIRE:

AUD/USD Price Forecast – Strong Australian employment numbers push the Aussie higher initially

Silver Price Forecast – Silver markets have slight move to the upside

GBP/USD Price Forecast – British pound breaks down as more drama unfolds in London

EUR/USD Mid-Session Technical Analysis for November 15, 2018

Yahoo Finance

Yahoo Finance