Technical Checks For USD/CHF, EUR/CHF, CHF/JPY & NZD/CHF: 19.12.2018

USD/CHF

Multiple failures to rise past the 1.0000-1.0005 region highlights the importance of short-term ascending trend-line, at 0.9900, for USDCHF traders, which if broken can quickly drag the pair to 0.9880 and then to the 0.9860 supports. However, 61.8% FE level of 0.9825 and the 0.9800 round-figure may restrict the pair’s further declines. On the upside, the 0.9960 and the 0.9985 could serve as immediate resistances for the pair before diverting market attention to 1.0000-1.0005 area for one more time. Assuming the pair’s ability to cross 1.0005 mark, the 1.0050, the 1.0080 and the 1.0110 might offer intermediate halts during the rally targeting 1.0130.

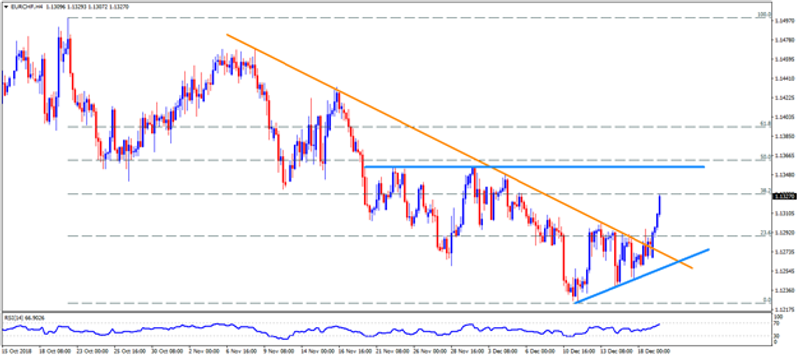

EUR/CHF

EURCHF successfully cleared a month old descending resistance-line and is heading towards 1.1355-60 resistance-zone. In case buyers refrain to respect the 1.1360 barrier, the 1.1380, the 1.1400 and the 1.1430 can appear on their radars. Meanwhile, the 1.1290 and the 1.1250 are likely adjacent rests that the pair may avail prior to visiting the 1.1230, the 1.1220 and the 1.1200 consecutive supports.

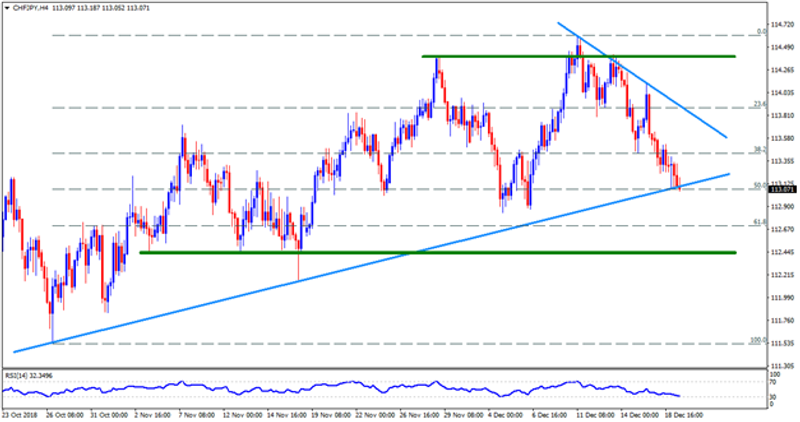

CHF/JPY

Eight-week long upward slanting support-line and near oversold RSI seem challenging the CHFJPY sellers aiming the 112.90 and the 112.45-40 levels to south. Should prices dip beneath 112.40, the 112.00, the 111.80 and the 111.50 might please the Bears. Given the pair’s U-turn from 113.10 support-line, the 113.45 and the 113.75 may entertain buyers, breaking which 113.95 TL resistance can play its role. If at all the quote surpasses 113.95 hurdle, the 114.35-40 and 114.60 could come back on the chart.

NZD/CHF

Having bounced off the 0.6745-40 region, the NZDCHF is witnessing recovery in direction to 0.6840 and then to the 0.6880-85 resistances. Though, pair’s sustained rally beyond 0.6885 enables it to confront the 0.6935, the 61.8% FE level around 0.6980 and the 0.7000 psychological-magnet. Alternatively, the 0.6755 and the 0.6745-40 can keep limiting the pair’s near-term downside. Let’s say the pair drops below 0.6740 mark, then it becomes vulnerable to plunge towards the 0.6700, the 0.6650 and the 0.6600 supports.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance