Technical Checks For USD/CHF, EUR/CHF, CHF/JPY & AUD/CHF: 11.10.2018

USD/CHF

In spite of bouncing from the three-week long support-line, USDCHF couldn’t sustain its U-turn and is likely to revisit the 0.9860 rest-point, breaking which 0.9825 & 0.9800 could come back on the chart. Though, the 0.9770 horizontal-line may confine the pair’s declines past-0.9800, if not then 0.9755 & 0.9700 can appear in the sellers radar. In case the quote surpasses 0.9900 immediate resistance, a month old downward slanting TL, at 0.9955, followed by the 0.9985 and the 1.0000 round-figure, might please buyers. Moreover, pair’s successful trading beyond 1.0000 can avail 1.0035 and the 1.0065 as intermediate halts ahead of looking at the 1.01000 resistance-mark.

EUR/CHF

Unlike USDCHF, the EURCHF seems maintaining its reversal from near-term ascending trend-line but the 1.1445-55 resistance-region may challenge the pair’s advances. Should prices rise above 1.1455, the 1.1500 & 1.1525 can act as buffers during its rally to recent high around 1.1555. On the contrary, a dip beneath the 1.1385 TL support highlights the importance of 1.1340 and the 1.1310 numbers before diverting market attention to 1.1260 support-mark. Assuming the pair’s extended south-run below 1.1260, the 1.1220 & 1.1180 could become Bears’ favorites.

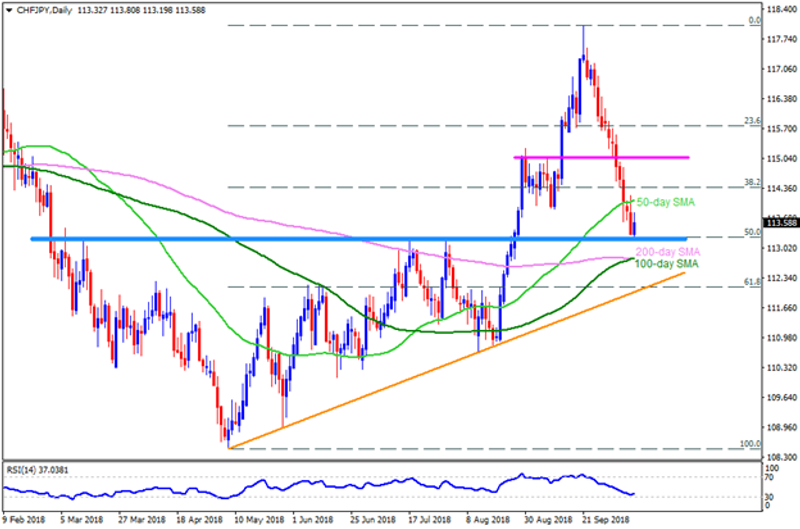

CHF/JPY

With the 113.25-15 support-zone triggering CHFJPY’s pullback moves, the pair may target the 114.00 and the 50-day SMA level of 114.10 prior to confronting the 114.70 & the 115.00-115.10 resistance-area. Given the pair’s ability to cross the 115.10 level, the 115.60, the 116.00 and the 116.65 might entertain the Bulls. Alternatively, a D1 close below 113.50 can quickly fetch the pair to 112.80-75 support-confluence, comprising 100-day & 200-day SMA. If at all the quote refrains to respect the 112.75, five-month old support-line, near 112.00, could limit the downside, failing to which can witness multiple supports between 111.50 and the 110.70.

AUD/CHF

AUDCHF’s uptick from 0.6970 may help it revisit the 0.7035 & 0.7060 north-side numbers but the 0.7085 resistance could restrict the pair’s additional upside. Let’s say the pair manages to conquer the 0.7085 hurdle, then it can rise to 0.7130 & 0.7175 levels with 0.7210 & 0.7225 to be observed during its further march. Meanwhile, the 0.6970 & the 0.6925 may confine the pair’s adjacent declines, breaking which 0.6870 become crucial to watch. In case 0.6870 fall short of holding the pair’s downturn, then the 61.8% FE level of 0.6800 could pop-up on the chart.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance