Technical Checks For EUR/USD, AUD/USD, NZD/USD & USD/CAD: 14.11.2017

EUR/USD

Having successfully cleared the 1.1680-85 horizontal-line, the EURUSD presently struggles with nearly a two-month-old descending TL, around 1.1715-20, in order to justify its strength. However, overbought RSI on H4 indicates brighter chances of the pair’s pullback to 1.1700 and then to the 1.1685-80 supports. Should the quote drops beneath 1.1680, an immediate ascending trend-line, at 1.1650, becomes important to watch, which if broken could further fetch prices to the 1.1615, the 1.1575 and then to the early-month low near 1.1550. In case of the pair’s ability to extend the latest recovery beyond 1.1720, the 1.1750, the 1.1780 and then the 1.1810 can entertain buyers. Moreover, sustained trading above 1.1810 could help the Bulls target 1.1835, the 1.1860, the 1.1880 and the 1.1900 consecutive resistances.

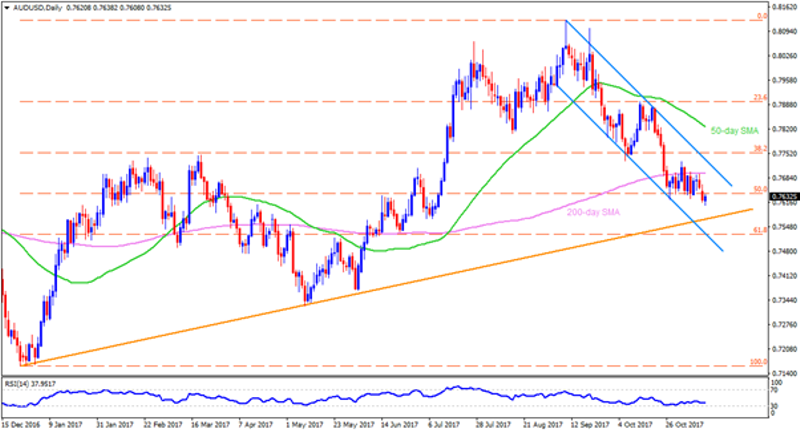

AUDUSD

Repeated failures to surpass the 200-day SMA level of 0.7700 finally dragged the AUDUSD below 0.7630-25 support-zone that opens the door for its dip to 0.7600 round-figure. Though, a bit broader trend-line number of 0.7565 and lower-line of an intermediate channel, at 0.7525, might limit the pair’s following downside. Given the pair’s extended south-run after defeating 0.7525, the 0.7500 and the 0.7470 can appear in sellers’ radar. Alternatively, a daily close above 0.7630 could again propel the pair to aim for 0.7670 ahead of confronting the 0.7700 mark. If at all optimists dominate after 0.7700 breaks, the channel resistance of 0.7735 could challenge their strength, which if cleared may help to witness the 0.7745, the 0.7800 and the 50-day SMA level of 0.7835 on the chart.

NZD/USD

Unlike EURUSD, which is still struggling with two-month-old descending TL, the NZDUSD has already reversed from the same-length trend-line resistance, at 0.6945 now, and is currently indicating 0.6830 re-test. If the pair weakens below 0.6830, the 0.6815 again has a crucial role to play, failing to which can portray a plunge towards 61.8% FE level of 0.6740 support. Meanwhile, 0.6890, the 0.6920 and the 0.6945 trend-line may keep restricting the pair’s near-term advances, breaking which can accelerate the recovery in the direction to 0.6980 and then to the 0.7010. During the pair’s additional rise beyond 0.7010, the 0.7045-55 horizontal-region seems a strong barrier to conquer in order to target for 0.7100 and the 0.7120 resistances.

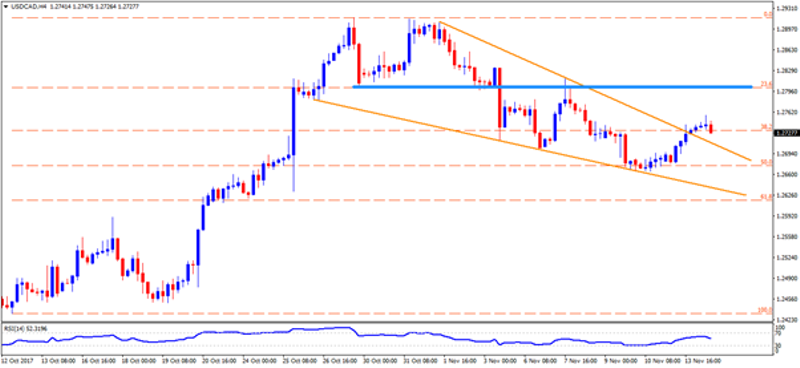

USD/CAD

Even after confirming the Bullish formation, “Falling-Wedge”, on a short timeframe, the USDCAD witnesses pullback towards 1.2710 re-test, which if broken could negate the upside signaling pattern and may further drag the pair to 1.2685 and then to the 1.2660. Should prices continue to decline after 1.2660, the 1.2630 and the 1.2600 should be observed closely as they are the gate-keepers for 1.2550 & 1.2520 support-levels. On the upside, 1.2755 and the 1.2780 are likely nearby resistances that can confine the pair’s up-moves ahead of pushing them to confront the 1.2800 – 1.2805 horizontal-area. Given the trade, sentiment remains favorable to buyers and portrays the 1.2805 break, the 1.2840, the 1.2870 and the 1.2900 could well be expected to following levels while being long.

Cheers and Safe Trading,

Anil Panchal

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance