All in on tech: Investors own more technology stocks now than they have in at least 9 years

Money managers are more heavily invested in technology stocks than they have been in at least nine years, a survey of portfolios shows.

"[Fund] managers appeared to have doubled-down on their winners," increasing exposure to technology-related stocks in portfolios by more than 14 percent for the year-to-date period, according to a new report from Bank of America Merrill Lynch.

Managers are 24 percent more overweight the tech sector relative to its weighting in the S&P 500 , marking a new record in the firm's data history dating back to 2008, equity analyst Savita Subramanian explained in a Friday note to clients.

Amazon , Alphabet and Apple offer some of the best examples of tech companies that continue to rip higher in the market, posting earnings after earnings report that blow past Street expectations.

On Thursday, Google's parent company, Alphabet, reported better-than-expected first-quarter profit and sales, which were fueled by growth in mobile search and ongoing strength in YouTube ad sales, the company said.

On Friday, both the Nasdaq and the Nasdaq 100 indexes reached all-time intraday highs, with Alphabet, Amazon, Facebook and Microsoft having the most positive impact on the Nasdaq 100 through morning trading.

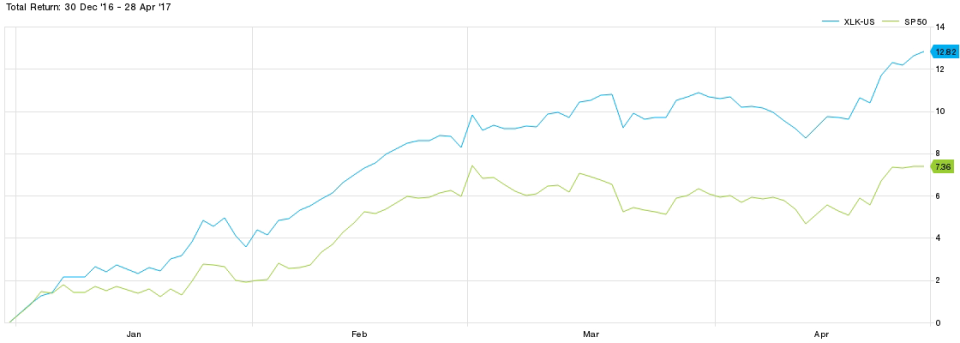

For the year, the Technology Select Sector SPDR (XLK ) has risen more than 12 percent, compared with the S&P 500's nearly 7 percent gain. That's the best return among the market's major sectors.

But the equity strategist believes this is not necessarily a good thing for tech investors.

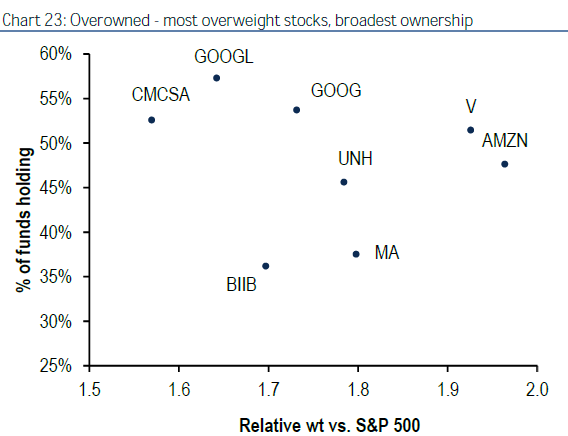

"Buying the 10 most underweighted stocks and selling the most overweight stocks ... has generated alpha in past years," Subramanian wrote. This implies that, despite the excitement in the sector, it might be time to for a sell-off in tech.

"[S]o far performance in 2017 has bucked the trend," she added.

'Overowned stocks'

Source: BofA Merrill Lynch

The Bank of America report said that managers are at least 10 percent overweight discretionary stocks today, following tech, the highest level seen across portfolios in seven months.

Investors are most underweight materials stocks — about 8 percent — since 2010, and are the most underweight energy equities since before the U.S. presidential election, Subramanian said.

Some of the most "neglected" stocks relative to the S&P 500, as tracked by the investment research group, include Alliant Energy , Advanced Micro Devices and H&R Block .

XLK (blue) vs. SP50 (green) performance year to date

Source: FactSet

— CNBC's Patricia Martell and Gina Francolla contributed to this report.

Yahoo Finance

Yahoo Finance