Taxes must be raised to highest level since 1940s to end austerity, IFS says

The Treasury may have to impose taxation levels not seen since the aftermath of World War II if the Government follows through on promises to end austerity, according to a prestigious think tank.

Theresa May’s commitment to loosen Government purse strings has been thrown into doubt by experts at the Institute for Fiscal Studies (IFS) and City economists.

The pledge would require either “substantial tax rises” or economic growth that far exceeds that currently predicted, the IFS said in its so-called Green Budget, a look-ahead at the Chancellor’s statement due on Oct 29.

Without either scenario the Government’s long-running commitment to eradicate the deficit - the gap between its income and spending - by the middle of the next decade makes it impossible to meet the spending required to end austerity, it found.

The deficit stood at £40bn last year, and the Government has already promised to increase spending in some areas such as the National Health Service.

There would be a £19bn black hole in the Government’s finances even if it were simply to maintain spending on public services in real terms by 2022-23, the IFS warned.

This move would still leave social security cuts worth £7bn “working their way through the system”, the IFS said.

Separately, US bank JPMorgan said that ending austerity "would only be possible if the Government experienced a productivity pick-up or abandoned one of its fiscal rules".

The IFS has determined that nearly £20bn will be needed to fund the “minimal definition” of ending austerity and this would have to come from a range of tax hikes.

One method could include a flat one-percentage point rise on VAT, all income tax rates and all national insurance contributions.

“Such an increase would still leave the UK’s tax burden ranked near the middle of OECD countries,” the IFS said. It would also be enough to fund the promised boost for the NHS of around £20bn.

The last time tax rises this big were introduced was in 1993. At that point Government revenues were at their lowest as a share of national income since WWII. Presently, they are at a 30-year high, according to the IFS.

The hike would take the UK's tax receipts to 35pc, around where they were in the late 1940s.

Other options could include dramatically curtailing some tax breaks. For instance “the absurdly generous treatment” of bequeathed pensions pots, the IFS suggested.

As it stands, pension savings are currently not included in a person's taxable estate after death. This loophole, combined with tax relief on some businesses and agricultural property, costs the Exchequer £1.2bn each year.

Citigroup, which contributed the macroeconomic forecasts in the Green Budget, said that weakness in UK growth since the referendum result has been broadly in line with its predictions. Growth had been forecast to be 2pc lower in the event of a leave vote.

Business investment had been particularly hard hit, and was 15pc lower than forecast before the Brexit vote, Christian Schulz of Citigroup said.

“However, provided the UK and the EU avoid no-deal a growth rebound in 2019 is likely,” Mr Schulz said.

Growth of 2pc by 2020 was possible, if a transition arrangement was “long enough”, he added.

Paul Johnson, head of the IFS, said that tight parliamentary margins meant that significant tax rises and further steep cuts to public spending were both unlikely to be put forward by the Chancellor.

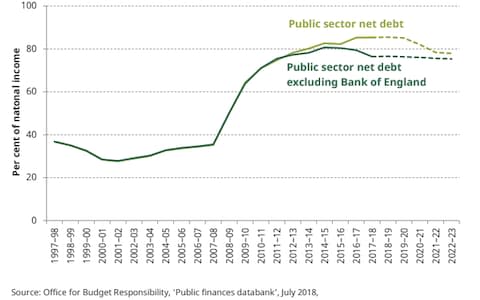

Instead, there was likely to be a fudge based on further borrowing, which did not offer a long-term solution to the UK’s £1.8 trillion public debt mountain.

“Unless you think [economic] growth is going to be really, really super strong you’re going to have to get the deficit down from its current levels,” said Carl Emmerson of the IFS.

Yahoo Finance

Yahoo Finance