GOP Tax Cuts Aren’t Boosting Wages

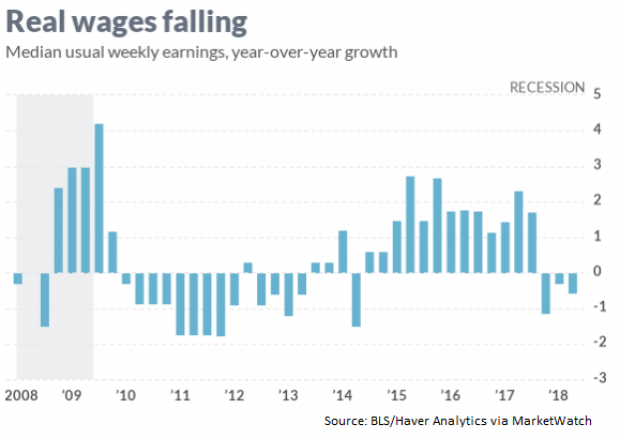

Inflation-adjusted wages have fallen for three straight quarters on a year-over-year basis, according to data released by the Labor Department Tuesday. MarketWatch’s Steve Goldstein provided a chart that shows a dismal picture for real wages this year:

Bloomberg’s Noah Smith said that while it’s too soon to reach a definitive conclusion, it does appear that the Republican tax cuts are failing to provide much of a boost for American workers. The only thing that’s booming is stock buybacks, while business investment is only moderately higher and wages are falling. “Huge, immediate gains for wealthy shareholders combined with tepid increases in business investment and decreases in real wages don’t paint a flattering picture of the tax cut’s impact so far,” Smith wrote.

While it’s still possible that the corporate tax cuts will boost long-term growth in a way that significantly benefits American workers, the lackluster results so far suggest another possibility: “Corporate taxes were really the last hope for the tax-cutting strategy,” Smith said. “But if even that doesn’t provide more than a small momentary fiscal stimulus, then we’ve reached the end of that approach’s usefulness.”

Yahoo Finance

Yahoo Finance