The Tax Break That Small Businesses Need to Know About (Infographic)

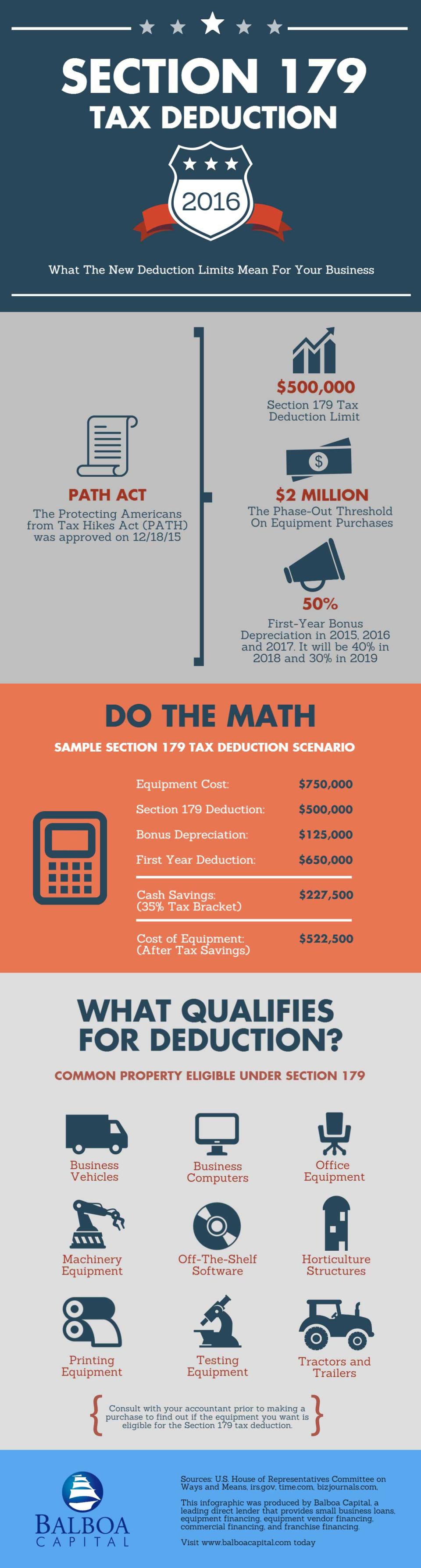

Did you know that you can get a tax deduction on equipment you purchase for your business? It's a part of the tax code called Section 179. It's been around for a while, but a $1.8 trillion spending bill passed by Congress at the end of 2015 permanently capped the tax break at $500,000.

Companies that spend $2 million in equipment -- anything from machinery, computers, chairs and desks, printers, testing apparatuses, business vehicles and even tractors -- can qualify for the Section 179 deduction.

Related: The Top 4 Tax Strategies To Save Your Business Money

The limit for Section 179 has been incrementally and temporarily raised over the past several years from its initial $25,000-a-year cap to $100,000 in 2003, and then $250,000 in 2008 in an effort to drive spending during the recession. It has been sitting at $500,000 since 2010, but it hadn't been permanently expanded until recently.

For more on what small-business owners need to know about how the tax break applies to them, check out the infographic compiled by Balboa Capital below.

Click to Enlarge+

Related: The 2 Glaring Mistakes Entrepreneurs Make When It Comes to Taxes

Yahoo Finance

Yahoo Finance