How your tax bracket could change in 2018 under Trump's tax plan, in 2 charts

AP/Alex Brandon

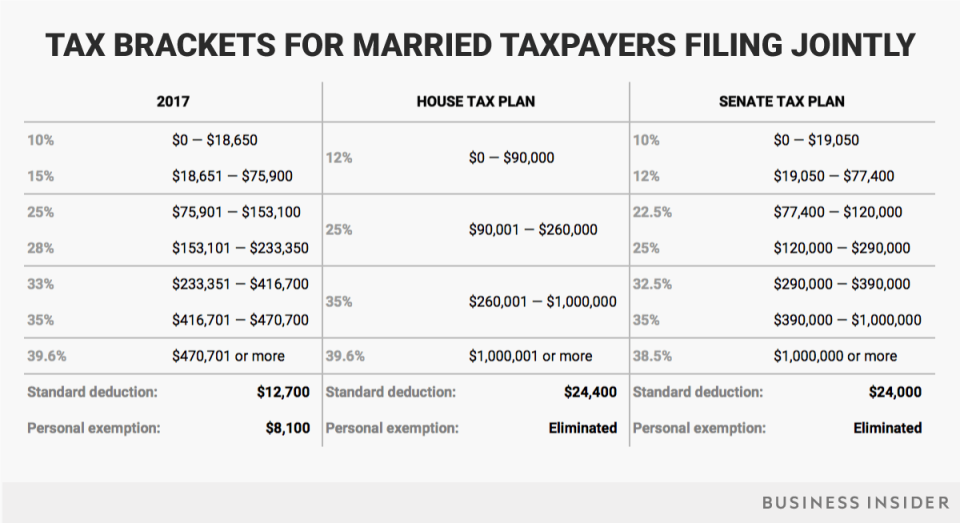

There could be new tax brackets in 2018 if tax legislation is enacted under President Donald Trump.

The House Republicans' tax bill proposes reducing the current seven tax brackets to four.

The Senate Republicans' tax bill proposes keeping seven brackets but changing the income ranges.

Both plans propose eliminating the personal exemption and increasing the standard deduction.

House and Senate Republicans have taken two different approaches in their attempt to overhaul the US tax code by releasing separate proposals with sweeping changes.

House GOP leaders unveiled the Tax Cuts and Jobs Act last week and added last minute-adjustments this week. Senate Republicans, meanwhile, on Thursday debuted their tax legislation that contained some substantial departures from the House's version.

Business Insider put together two charts showing how both the House's tax plan and the Senate's tax plan could change federal income-tax brackets in 2018 compared with those in 2017.

First, for single filers:

Business Insider/Andy Kiersz

And second, for joint filers:

Business Insider/Andy Kiersz

Under the House's plan, there would be four federal income-tax brackets rather than the seven we have today. The brackets proposed are 12%, 25%, 35%, and 39.6%.

The Senate's version would keep seven brackets but at slightly lower rates and adjusted income ranges. The brackets proposed are 10%, 12%, 22.5%, 25%, 32.5%, 35%, and 38.5%.

About 70% of Americans claim the standard deduction when filing their taxes, and their paychecks will almost certainly increase if either tax bill passes.

In 2017, the standard deduction for a single taxpayer is $6,350, plus one personal exemption of $4,050.

The House plan would combine those into one larger standard deduction for 2018: $12,200 for single filers and $24,400 for joint filers.

Under the Senate proposal, these would be slightly lower, at $12,000 for single filers and $24,000 for joint filers.

Related:

For more news videos visit Yahoo View.

NOW WATCH: Here's how to figure out exactly how your take-home pay could change under Trump's new tax plan

See Also:

How your tax bracket could change under Trump's tax plan, in one chart

Here's what Trump's new tax plan means if you're making $25,000, $75,000, or $175,000 a year

Here's what Trump's new tax plan means if you're making $75,000 a year

SEE ALSO: Here's what Trump's new tax plan means if you're making $25,000, $75,000, or $175,000 a year

DON'T MISS: Senate Republicans are taking a shot at a huge tax bill — here are all the changes in it

Yahoo Finance

Yahoo Finance