[Survey] How Much Do Parents Hope To Receive From Their Children When They Start Working?

Monthly contributions can be tricky. Even if your parents are not dependent on the money you contribute in any way, how much should you be giving?

We conducted a survey with 80 respondents to get a better understanding of how much parents hope to receive from their children when they start working.

Before we begin, we want to stress that the amount to give to your parents each month really depends on your family situation and various other factors. No one have the right to tell you what’s the correct amount to give. It’s between you and them.

A Few Things To Consider

#1 How much is your salary? Obviously, a higher salary would allow you to give your parents more each month. Telling your parents how much you earn would give them a better understanding of how much you are contributing.

#2 How Many Siblings Do You Have? If you have 2 other siblings, the “pressure” on you to provide for your parents is somewhat reduced. However, if you are an only child, it would not be surprising for you to contribute more than what your peers with siblings are contributing.

#3 What Are Your Other Responsibilities And Commitments? As a working adult, you might have other finances to take care of. Do you have children yourself? Are you paying off a loan? Are you saving up towards a big-ticket item, such as a house?

#4 Are Your Parents Still Working? Whether your parents are still working affects how dependent they will be on the money you give them. Besides their own salary, your parents might have other sources of income such as their CPF payout, rental from other properties or investments.

#5 Will Your Parents Be Dependent On The Money Given? This depends on the lifestyle your parents are used to and how much savings they have, be it in the form of cash, equities or other investments. Most parents would have planned ahead for their retirement, and should have sources of income even after they stop working.

Is It A Must For Children To Give Money To Their Parents Every Month?

As much as our parents might not need the money at all, more than half of the respondents indicated yes, it is a must for children to give money every month. However, 25% of our respondents think this is optional.

Read Also: How Saving 10% Of Your Income And Your Annual Bonus Can Change Your Retirement Completely

To Give A Fixed Sum Or A Percentage?

68% of the respondents would prefer a fixed amount rather than a percentage.

Should children be giving their parents more when they start to earn more? The survey result seems to suggest this isn’t really what parents are looking for. By giving a percentage of our salary rather than a fixed amount, your parents will receive more when your pay increases, or less if your pay reduces, or if you lose your income. Of course, you can also increase the fixed amount you give your parents when you get a pay raise or when there are changes to your stage of life (e.g. when your currently working parents stop working, you might consider giving more).

How Much Parents Hope To Receive?

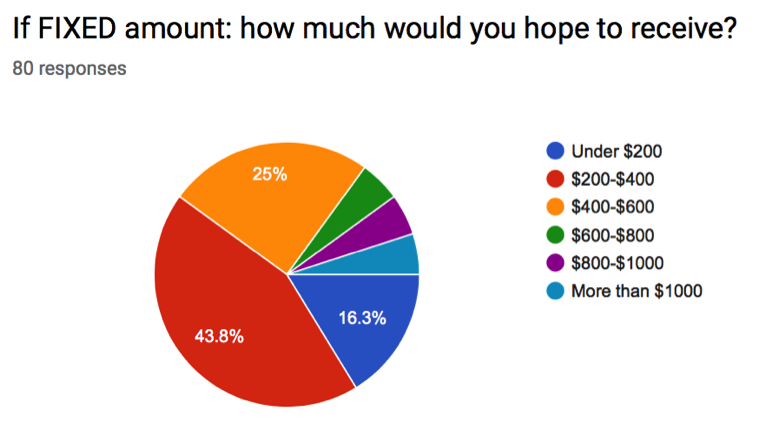

If given a fixed amount:

If they were to receive a fixed amount of money each month, majority of our respondents chose to receive $200-$400 and 25% of our respondents chose $400-$600. Interestingly, 16% of our respondents opted to receive less than $200, although there are also respondents that hope to receive more than $1000.

If given a percentage:

When it comes to receiving a percentage of salary as monthly income, a good 42% of our respondents chose to receive 5%-10%. How much they receive would then be dependent on how much their children earn.

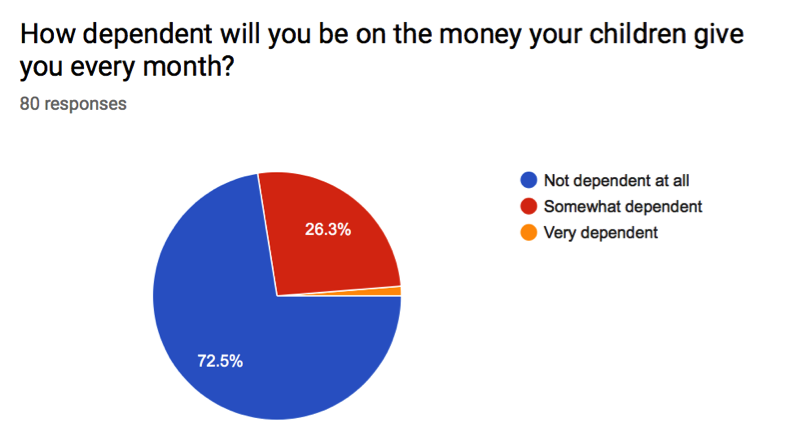

Are Your Parents Dependent On The Money?

More than 70% of our respondents shared that they will not be dependent at all on the money given by their children each month. About a quarter of our respondents shared that they will be somewhat dependent on the money given by their children.

Some people see it as must for children to give money to their parents every month. It only makes sense to give back and provide for the ones that have given you everything when you were growing up. There is also no harm adding to their retirement fund even if they are still working and have enough to live on when they retire.

Talk to your parents your monthly contributions and their retirement plans. Will you be giving them the money individually or as a pair? It is possible to start out by giving a smaller amount with your starting salary and to give more when you are financially stable and drawing a higher income.

How much you give your parents every month varies from person to person. How much are you giving or planning to give your parents when you start working? Share with us and our other readers in the comments section below.

To view the full results of our survey, click HERE.

Read Also: How Much Money Are Parents Giving Their Primary School Kids?

The post [Survey] How Much Do Parents Hope To Receive From Their Children When They Start Working? appeared first on DollarsAndSense.sg.

Yahoo Finance

Yahoo Finance