Sun Life Financial (SLF) Q3 Earnings Top Estimates, Rise Y/Y

Sun Life Financial Inc. SLF delivered third-quarter 2022 underlying net income of $1.24 per share, beating the Zacks Consensus Estimate by 15.9%. The bottom line increased 1.6% year over year.

Insurance sales increased 35.7% year over year to $722.8 million (C$943 million), driven by increased sales in Canada, Asia and the United States.

Wealth sales were $33 billion (C$43.1 billion) in the quarter under review.

The value of new business decreased 20.2% to $196.23 million (C$256 million).

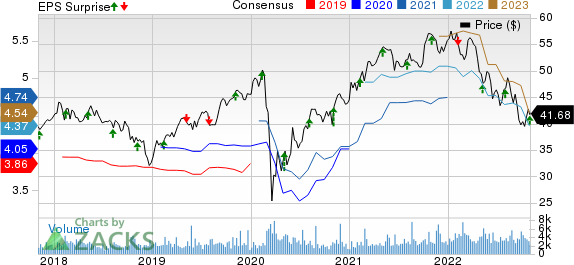

Sun Life Financial Inc. Price, Consensus and EPS Surprise

Sun Life Financial Inc. price-consensus-eps-surprise-chart | Sun Life Financial Inc. Quote

Segment Results

SLF Canada’s underlying net income decreased 6.5% year over year to $229.9 million (C$300 million).

SLF U.S.’ underlying net income was $165.6 million (C$216 million), up 77.5% from the prior-year quarter. The increase was driven by growth across all businesses, the contribution from the DentaQuest acquisition and favorable experience-related items.

SLF Asset Management’s underlying net income of $226.1 million (C$295 million) declined 26.3% year over year. The decrease was due to lower results in MFS Investment Management, reflecting declines in global equity markets and in SLC Management due to investment gains in the prior year and continued investments in the businesses.

SLF Asia reported an underlying net income of $134.14 million (C$175 million), which rose 9.9% year over year. The increase was driven by improved mortality, reflecting lower COVID-19-related claims, and higher investment gains and contributions from the joint ventures. It was partially offset by lower fee-based income due to equity market declines.

Financial Update

Global assets under management were $931.22 billion (C$1,275 billion), down 14.6% year over year.

Sun Life Assurance’s Minimum Continuing Capital and Surplus Requirements (LICAT) ratio was 123% as of Sep 30, 2022, down 100 basis points (bps) year over year.

The LICAT ratio for Sun Life (including cash and other liquid assets) was 129%, down 1400 bps year over year.

Sun Life’s return on equity was 7.6% in the third quarter, down 1000 bps year over year. The underlying return on equity of 15.5% contracted 10 basis points year over year.

The leverage ratio of 26.4% deteriorated 420 bps year over year.

Dividend Update

On Nov 2, the company’s board of directors approved a dividend hike of 3% to 72 cents per share. The amount will be paid out on Dec 30, 2022 to shareholders of record at the close of business on Nov 23.

Zacks Rank

Sun Life currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other Insurers

Of the insurance industry players that have reported third-quarter results so far, Kinsale Capital Group, Inc. KNSL, Everest Re Group, Ltd. RE and Arch Capital Group Ltd. ACGL beat the respective Zacks Consensus Estimate for earnings.

Kinsale Capital delivered third-quarter 2022 net operating earnings of $1.64 per share, which outpaced the Zacks Consensus Estimate by 15.5%. The bottom line improved 3.1% year over year. Total revenues rose about 31.5% year over year to about $217 million. The top line, however, missed the Zacks Consensus Estimate by 1.4%.

Gross written premiums of $284.1 million rose 43.8% year over year, driven by strong submission flow from brokers and a favorable pricing environment. Net written premiums climbed 38.2% year over year to $235.9 million in the quarter. Net investment income increased 71.2% year over year to $13.9 million in the quarter.

Everest Re Group’s third-quarter 2022 operating loss per share of $5.28 was narrower than the Zacks Consensus Estimate of a loss of $5.89 but wider than the year-ago loss of $1.34. Everest Re’s total operating revenues of $3.2 billion increased 9.5% year over year on higher premiums earned. The top line, however, missed the consensus estimate by 2.2%.

Gross written premiums improved 6.3% year over year to $3.7 billion, largely driven by double-digit growth in the Insurance segment. However, it missed our estimate of $3.9 billion. Net investment income was $151 million, down 48.5% year over year.

Arch Capital Group reported third-quarter 2022 operating income per share of 28 cents per share, which beat the Zacks Consensus Estimate by 16.7%. The bottom line, however, decreased 62.2% year over year. Gross premiums written improved 20.4% year over year to $3.9 billion.

Net premiums written climbed 31.2% year over year to $2.7 billion on higher premiums written across its Insurance and Reinsurance segments. Net investment income increased 45.9% year over year to $128.6 million and beat our estimate of $94.2 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Everest Re Group, Ltd. (RE) : Free Stock Analysis Report

Sun Life Financial Inc. (SLF) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance