Pound sheds gains as DUP rules out backstop concession to break Brexit deadlock

Pound returns to sit flat on the day as DUP pours cold water on deal hopes

Europe recovers after deep losses on Tuesday

HKEX chair says it may return to bid for other exchanges again in future

US bans Chinese company behind 1.3 million UK CCTV cameras over spying allegations

Jeremy Warner: How can grown-ups get to this? Merkel’s ‘nein’ risks calamity in chaotic, no-deal Brexit

Wrap-up: Investors look the future

That’s a wrap — quite a slow day in London, with a dearth of significant corporate of economic news meaning investors got their mojo back free from any major shocks.

For a while, it looked like Wednesday could be another day of big shifts for the pound, but things quieted down after that morning spike. Stocks markets saw a solid-enough recovery, closing up about a third of a percent.

Tomorrow is a big day — though immediate shifts are unlikely, the arrival of Chinese envoys in Washington puts us on the road to a possible breakthrough on one of the biggest issues casting a cloud over markets.

Still, the last round of talks ended in a pretty ugly fashion, so there are no guarantees.

I’ll be back tomorrow with more news on business, markets and economics. Join me then!

Chart of the day...

In case you managed to miss the day’s major drama, here’s a graph that sums up the kind of Wednesday it has been:

Rebekah Vardy is more searched than Brexit in the UK today. pic.twitter.com/ZwUgOtCSxB

— GoogleTrends (@GoogleTrends) October 9, 2019

Read more here: Coleen Rooney claims she caught fellow WAG Rebekah Vardy giving fake stories to tabloids

For the latest on Brexit, head here:

Also-risers: London Stock Exchange Group, Hargreaves Lansdown and BAE Systems gain ground

With less than half an hour of trading left, here are more of the companies moving up on the FTSE 100 today:

London Stock Exchange Group has grabbed the spot of top riser, up about 2.5pc currently amid chatter following the Hong Kong exchange group’s decision to pull its offer for the London bourse operator. Although a report this morning suggesting HKEX was looking to take a second swing at taking over LSE was later watered down, the end of merger fever has given investors a chance to take a broader look at the company’s future: in particular its renewed ability to to focus on its takeover of Refinitiv as part of a major pivot into the financial data space.

Hargreaves Lansdown, which has had a pretty torrid October so far after some downbeat commentary from analysts, is on track from is first rise in eight sessions. Liberum initiated coverage of the company at a “buy” rating this morning, saying that, alongside rival IntegraFin, Hargreaves offers “best-in class” service, which analysts said was “likely to lead to share gains”.

BAE Systems is also climbing, after securing a $148.3m contract from the US army to produce 43 M88A1 ‘Hercules’ heavy-lify vehicles, that offer capability to extract damaged vehicles from the battlefield.

EasyJet shares rise after HSBC lifts price target

After falling yesterday after a mixed response to a its trading update, shares in EasyJet have recovered slightly today, up around 3pc currently. HSBC analyst Andrew Lobbenberg lifted the group’s price target for the airline’s shares from £12.50 to £13, saying Brexit will “dominate” its share performance in the near term. He wrote:

In the absence of a no-deal Brexit, we think EasyJet should benefit this winter from the failure of Thomas Cook... the benign capacity environment, and restructuring in Berlin.

Wall Street joins relief rally as investors hold breath for trade talks

US stock indices have joined the rally that has already taken hold in Europe (their first upbeat open in three sessions), and with Donald Trump focused on attacking Democrats, we might be in for a surprise-free final day before talks begin.

Round-up: Bank of England warns Facebook over digital currency, Johnson & Johnson ordered to pay man £7bn, A-list make-up brand top £100m revenues

Here are three big stories from the business desk today:

Bank of England fires warning shot at Facebook over Libra digital currency: The Bank of England has hardened its stance over Facebook's plans for a digital currency, saying the Libra initiative will have to meet the “highest standards of resilience”.

Johnson & Johnson told to pay £7bn to man who grew breasts after taking autism drug: Drug maker Johnson & Johnson could face a wave of legal action after it was ordered to pay $8bn (£6.6bn) to a man who grew breasts after taking one of its medicines.

Make-up brand Charlotte Tilbury hits sales of £100m: A make-up brand popular with chef Nigella Lawson and lawyer Amal Clooney has clocked up revenues of £100m for the first time as speculation swirls over a takeover.

These five charts show how Brexit has impacted the pound

With the pound now sitting fairly flat on the day, let’s take a look at the currency’s movements over a longer time period, to help make sense of its twists and turns (and put them in context).

Some of this data is historical, so will be slightly approximate, but hopefully it gives a sense of where we are. I’ve charted the pound against the dollar in each instance, as the relationship are a longer history and has been less prone to volatility on both sides lately.

(Please give the charts a moment to load, especially if you are on a slow internet connection.)

And finally...

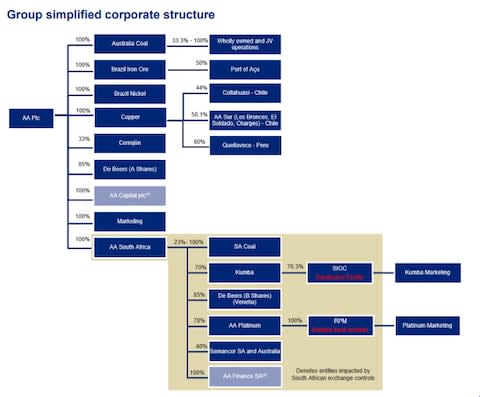

Anglo American among top FTSE 100 risers; analysts say platinum strength is under-acknowledged

Mining firm Anglo American is one of the biggest climbers on the FTSE 100 today, up nearly 2pc currently.

The company received some upbeat commentary this morning from Royal Bank of Canada analysts, who said the company’s corporate structure, though cumbersome, was ultimately beneficial.

In general, we think the current structure, although not ideal, is probably not worth the hassle and disruption of a break-up and provides some important diversification and cash flow benefits...

Here’s what that structure looks like:

Organisational charts aside, the the analysts added that strong prices for platinum presented an upside for the group — one which had not been properly reflected in its share price. They wrote:

In our view, the significant improvement in outlook for [platinum group metals], and the commensurate rally in Amplats has not been read through into Anglo American.

BT plans return to high streets as part of rebranding push

Shares in BT are up about 1.5pc currently, after the telecoms giant unveiled plans to overhaul its image and improve its customer service offering ahead of a potential ultrafast broadband rollout.

BT will relaunch its EE with co-branding, putting its logo on bricks-and-mortar stores for the first time since the early 00s.

It will also expand its tech support team, and return all its call centres to UK locations.

The strategy has been unveiled as the company prepares for talks with the government over a major project of fibre broadband rollout, which is one of the Government’s key infrastructure pledges.

Links of London enters administration

High street jewellery retailer Links of London has gone into administration after failing to find a buyer.

Matt Smith, joint administrator from Deloitte, said:

The company has had to contend with difficult trading conditions that have impacted the whole retail sector.

The directors have been seeking alternative solutions, including consideration of a CVA, refinancing or sale, but have unfortunately been unable to conclude such a transaction.

In light of ongoing cash flow pressures, this has left the directors with no choice but to place the business into administration.

The company — whose products were worn by the Duchess of Cambridge in her engagement photos — has reportedly received interest from Mike Ashley of Sport Direct.

Links of London gone into administration. Deloitte appointed. Business will continue to trade while a buyer is sought. Solvent sale attempted but no can do

— Jonathan Eley (@JonathanEley) October 9, 2019

Lunchtime wrap: Five things you need to know

Things are moving fairly slowly currently (words I always end up regretting), so here’s a quick round up of what happened this morning:

The pound jumped up from a one-month low against the dollar following a report that the EU was prepared to make a major concession on the Irish backstop, but pared back gains after the DUP criticised the proposals.

The FTSE 100 has enjoyed a solid recovery, amid a chunky relief rally on European stock markets ahead of trade talks between the US and China.

Hong Kong’s stock exchange has refused to rule out bidding for other stock exchanges after withdrawing a £32bn offer for its London rival earlier this week.

Hundreds of Thomas Cook stores and up to 2,500 jobs are set to be saved after Hays Travel struck a deal to buy the failed company’s entire store portfolio.

EDF has announced that repairs of 66 faulty welds at a nuclear plant under construction in western France will boost the project’s cost by 14pc to €12.4bn, adding further financial strain to the cash-strapped atomic power giant.

BBC: Greene King takeover gets approval

Shareholders have accepted a takeover bid for Greene King by Hong Kong’s CKA, the BBC reports.

CKA, owned by Hong Kong billionaire Li Ka-shing, bought the FTSE 250 brewer and pub chain for £4.6bn in August.

Here’s more on the takeover: Fears over fate of Greene King pubs and Suffolk brewery in wake of £4.6bn takeover

Mistaken identity? Hays trading volume leaps as Hay Travel grabs Thomas Cook store portfolio

As we pass midday, the FTSE is holding gains amid a general European rally, while the pound is sitting a little higher than where it started the London session.

Now, far be it for me to question the invisible hand of the market, but FTSE 250 recruiter Hays Plc is experiencing a remarkably high volume of trading, with 1.2m shares swapping hands today.

Given there’s no major news around the sector or the company itself today, it is possible that some investors may have got it mistaken with Hays Travel, which just took over 555 Thomas Cook retail locations.

Either way, shares are up 2pc, so Hays Plc investors should be happy.

FT corrects report: China considers buying 10m tonnes more soybeans per year, not $10bn more of agricultural products

The Financial Times has just posted a correction to its story on Chinese farm spending (see 10:56am update). Apparently China is considering buying 10m more tonnes of soybeans a year, not spending $10bn more on agricultural products overall. Here is the altered piece, and here is the correction:

That appears to be a substantially less significant move. I will add a note to the earlier post.

Sterling settles again as DUP pours cold water on backstop proposal

The pound is sinking back towards where it stood before that Times report, meaning it is once again sat around one-month lows against the dollar. Separately, EU sources have told Reuters that a breakthrough on a Brexit deal is unlikely.

Pizza Express round-up

Pizza Express become the centre of attention earlier this week, after revelations it had entered talks over its substantial debt levels. Here are three key reads to understand what is going on at the restaurant chain:

How over-ambitious expansion plans left future of Pizza Express on a knife edge

Why Pizza Express’s problems could be a tragedy for live music

FT: China offers to increase US agricultural purchases

(Update: The FT has issued a substantial correction to this story, please see 11:47am post)

News is coming thick and fast now! The Financial Times reports that Chinese officials are offering to raise annual purchases of US farm products by $10bn a year, in a bid to smooth an interim agreement to stave off new tariffs hikes. It reports:

Despite US sanctions announced this week against Chinese companies and officials allegedly involved in human rights abuses in Xinjiang, Mr Liu’s team is offering to boost annual agricultural purchases to $30bn annually, from about $20bn at present.

China would also make a raft of changes to non-tariff barriers that have long frustrated the US Department of Agriculture and American farmers.

China offers to buy extra $10bn of US goods to ease trade war https://t.co/kK3fZfkxuz

— fastFT (@fastFT) October 9, 2019

OECD puts tech giants in its sights with proposals for global tax shake-up

The OECD has unveiled plans to make multinationals pay more tax, in a move that would majorly shake-up rules and put pressure on tech giants.

Reuters reports:

Governments will get more power to tax big multinationals doing business in their countries under a major overhaul of decades-old cross-border tax rules outlined on Wednesday by the Organisation for Economic Cooperation and Development.

The rise of big internet companies like Google and Facebook has pushed current tax rules to the limit as such firms can legally book profit and park assets like trademarks and patents in low tax countries like Ireland regardless of where their customers are.

Earlier this year more than 130 countries and territories agreed that a rewriting of tax rules largely going back to the 1920s was overdue and tasked the Paris-based OECD public policy forum to come up with proposals.

The move is likely to benefit countries such as the UK, but could create pressure on Ireland and other countries that offer favourable tax arrangements.

OECD proposes long-awaited plan to make multinationals pay more tax: Revolution in corporate taxation would stop digital giants shifting profits round the world to minimise tax bills. Winners would be large countries incl Germany, France, Italy, UK, US. https://t.co/htHpO702uPpic.twitter.com/ha1f3WTpUO

— Holger Zschaepitz (@Schuldensuehner) October 9, 2019

European stocks advance on reports China open to partial trade deal

Stock indices across Europe have jumped in recent minutes, after Bloomberg reported that China is still open to agreeing a partial trade deal with the US despite sanctions and tariffs.

Citing a source close to the talks, Bloomberg reported:

Negotiators heading to Washington for talks starting Thursday aren’t optimistic about securing a broad agreement that would end the trade war between the two nations for good, said the official, who asked not to be named as the discussions are private.

But China would accept a limited deal as long as no more tariffs are imposed by President Donald Trump, including two rounds of higher duties set to take effect this month and in December, the official said. In return, Beijing would offer non-core concessions like purchases of agricultural products without giving in on major sticking points, the official said, without offering further details.

That has pushed the Europe-wide STOXX 600 to gains of more than 0.9pc.

Correction: HKEX/LSE

Quick correction to my 8:43am post: Bloomberg has issued a correction to the report I based the post on, clarifying that Laura Cha said the Hong Kong exchange operator wasn’t ruling out discussions with other bourses. She did not, however, say HKEX would reconsider withdrawing its LSE bid. I’ll go correct the earlier wording now, sorry for any confusion.

Hays: Thomas Cook stores will reopen with ‘immediate effect’

Hays Travel says it will be reopening Thomas Cook stories with “immediate effect” where possible, adding that it has already taken on 25pc of Thomas Cook’s former retail staff, but would aim to employ all 2,500 who had lost their jobs.

Full report: Thomas Cook jobs saved as Hays Travel grabs stores

Here’s our breaking news report on Hays Travel’s deal to buy failed tour operator Thomas Cook’s 555 bricks-and-mortar stores:

This is wonderful news, up to 2500 Thomas Cook staff have a new home. It’s also rather surprising. I can only think that landlords have indicated a willingness to accept some steep cuts to the rents they charge. pic.twitter.com/Y8vZLkztgI

— Joel Hills (@ITVJoel) October 9, 2019

Pound’s gains fade slightly

The sharp jump in the the pound has wilted somewhat in recent minutes, with some Conservatives immediately starting to accuse of Brussels of organising a ‘blame game’ — exactly what the EU accused Boris Johnson of doing earlier.

You can follow the latest political updates here: Brexit latest news: The Government is set to announce its Brexit ‘decision day’ as MPs plan to hold a special Saturday sitting after the EU summit

Hays Travel buys entire Thomas Cook retail estate, securing ‘significant number’ of jobs

Hays Travel will buy the entirety of Thomas Cook’s retail estate, according to the Insolvency Service and special managers from KPMG.

The travel agent will take over many of the 555 stores, with the rest going to other independent travel agents that are part of a consortium.

KPMG partner Jim Tucker said the deal: “provides re-employment opportunities for a significant number of former Thomas Cook employees, and secures the future of retail sites up and down the UK high street.”

The takeover will more than quadruple the number of travel agent shops operating under Hays.

John and Irene Hays, managing director and group chair of Hays Travel, said:

Thomas Cook was a much-loved brand employing talented people. We look forward to working with many of them.

Sterling leaps on report that EU willing to make backstop concession

The pound has leapt in the last couple of minutes, after a report in The Times that the EU is preparing to offer a mechanism for the Northern Irish assembly to unilaterally exit the controversial backstop arrangement after a set number of years.

EU diplomatic sources now prepared to concede unilateral revocation of the withdrawal treaty by Stormont after a period of time, the date of 2025 has been mooted, as long as both communities agree to it

— Bruno Waterfield (@BrunoBrussels) October 9, 2019

The paper reports:

Diplomatic sources close to the talks said European governments are prepared to concede a unilateral revocation of the withdrawal treaty by Stormont after a period of time. The date of 2025 has been mooted, as long as both communities agree to it.

Last week’s proposals from the UK contained a controversial measure which the EU said would essentially give the DUP a veto. It is one of the major sticking points to getting a deal.

Traders have been raising their bets that the Government will seek a Brexit extension , as hopes of a deal splutter and the October 31 deadline nears.

Just Eat shares climb after Dutch suitor delivers strong results

Just Eat is leading risers on the FTSE 100 today, after Takeaway.com, the Dutch peer it is set to merge with, posted an 87pc rise in orders and said it expects the two food-delivery companies to have completed their tie-up by the end of the year.

Takeaway.com said it had processed 41.6m orders in the third quarter of the year. It is preparing for a shareholder meeting in December, which may be when it presents the plans for a tie-up formally to investors.

Here’s our latest on the saga:

RBC analyst Sherri Malek said the Takeaway.com results were “slightly light”, but said the company’s route to profitability was clear.

Shares rise for Ladbrokes owner GVC despite pressures on high street

Shares in GVC Holdings, owner on betting shop Ladbrokes, are up about 3.5pc currently after it said it will make more profit than expected this year despite an ongoing slump in its shops. My colleague Michael O’Dwyer reports:

Like-for-like sales fell 18pc in the three months to September, which the company blamed on a cut in the maximum stake at fixed odds betting machines in April from £100 to £2.

However, the industry has also been hit by the decline of the high street and the rise of online and app-based betting. GVC confirmed it still expects to close 900 shops in the next two years. It has shut 41 since the beginning of July.

Sales from betting machines fell by more than a third against the same period last year but the decline in UK store performance was less severe than the company had feared.

HKEX Chair: Not ruling out revisiting LSE takeover bid

(This post has been corrected after a wire error, see 10:30am update for details)

The chair of Hong Kong Exchanges and Clearing, Laura Cha, has said the group isn’t ruling out talks with other exchanges, after it pulled a £32bn bid for the London Stock Exchange.

Speaking at an event in Singapore, Ms Cha said she was disappointed the LSE deal didn’t go through, but said HKEX didn’t want to go hostile.

Our latest reporting says London Stock Exchange investors are attempting to kick start a bidding war for the London bourse following HKEX’s withdrawal.

Top LSE shareholders are pushing other global exchanges, including the US Intercontinental Exchange (ICE), to mount a last-ditch bid for the company which could scupper its own plans for a £22bn takeover of data business Refinitiv, my colleague Harriet Russell writes.

Read more here: Investors rush to whip up bidding war for London Stock Exchange after Hong Kong walks away

Chief City Commentator Ben Marlow has given his verdict on the takeover escapade:

This tale of woe will be remembered as one of the more bizarre episodes that the Square Mile has seen in a long time. Poorly timed, badly executed, and facing insurmountable obstacles, the approach seemed doomed from the outset.

Read his full thoughts here: Hong Kong’s star-crossed bid for the LSE was doomed from the start

European stock markets grab mild gains

European markets have opened narrowly in the green after some difficult trading yesterday, where negative sentiment was driven by the apparent Brexit talks breakdown, and nerves ahead of trade talks between the US and China (due to begin tomorrow).

Sterling has regained some ground tomorrow, after falling sharply after Downing Street briefed journalists that a phone conversation between Angela Merkel and Boris Johnson had ended at an impasse.

American stocks sink: what happened on Wall Street?

US stocks had a painful session yesterday, with a slump in the closing minutes of trading leaving the Nasdaq down 1.7pc, and the benchmark S&P 500 not far behind at -1.6.

What’s going on on Wall Street? The main thing to go by appears to be the US-China trade war, with Washington slowly ramping up measures against the Asian economic superpower.

In its latest move, the White House has placed sanctions on Chinese officials connected to the mass incarceration, forced movement and surveillance of China’s Uighur Muslim group. It comes after more Chinese firms were added to the US’s trade blacklist, and follows reports that Washington was looking at ways of restricting cash flows to China.

Read more here: US restricts Chinese visas over Uighur violations, drawing angry response from Beijing

Separately, the heat is still very much on Donald Trump, as Congressional Democrats begin impeachment proceedings against the President. The White House has said it will not comply with requests for interviews and testimony, putting the country on course for a constitutional crisis. Here’s more:

Agenda: Brexit deal “essentially impossible”

Good morning. The pound sunk to its lowest level in more than a month against the dollar and euro yesterday, after an apparent breakdown in Brexit talks.

The currency fell below $1.22 during the session, sharply sinking after No 10 sources said Angela Merkel, the German chancellor had described the prospect of a deal without Northern Ireland remaining in the Customs Union as “overwhelmingly unlikely”.

Reports from the BBC and Sky said Boris Johnson, the Prime Minister, claimed the demand meant a deal was “essentially impossible”.

5 things to start your day

1) The next Metro Bank chairman: who might replace flamboyant founder Vernon Hill? Few bosses in the UK banking sector are as eccentric as American billionaire Vernon Hill, the Metro Bank founder who has compared opening a bank account in London to “having your teeth drilled” and initially made a fortune running Burger King franchises.

2) Europeans have followed Brits and fallen in love with online shopping: While Britain has led the way in its adoption of e-commerce, with online purchases as a share of total retail sales above 15pc and well on their way to 20pc by 2021 according to Euromonitor, Europe is now also fast becoming a market of online shopping devotees.

3) A Chinese CCTV firm with over one million cameras in Britain has been blacklisted by US President Donald Trump for allegedly spying on persecuted Muslim minorities.

4) In July, Boeing announced it expects to pay airlines $4.9bn in coming years to cover cancelled 737 Max flights. The model has been grounded for months after two fatal crashes. Now pilots are suing the aircraft manufacturer for $100m (£82m) for allegedly “deliberately misleading” them about the scandal-hit 737 Max aircraft. The case could spark a wave of lawsuits around the world.

5) The US Federal Reserve has confirmed its openness to further rate cuts while adding it will begin expanding its balance sheet in response to recent unexpected funding issues. Chairman Jerome Powell appeared to confirm market expectations of a 25 basis-point cut at its October meeting on Tuesday night, stating the Fed will “act as appropriate to support continued growth, a strong job market, and inflation moving back to our symmetric 2pc objective”.

What happened overnight

Asian stocks fell the most in a week on Wednesday as the United States and China's broadening dispute over trade and foreign policy showed little sign of coming to an end, weighing on global economic growth.

MSCI's broadest index of Asia-Pacific shares outside Japan was down 0.44pc. Chinese shares fell 0.47pc after briefly touching a five-week low. Australian shares were down 0.76pc.

The US Treasury yield curve steepened in Asia after US Federal Reserve Chair Jerome Powell signalled further interest rate cuts and the resumption of bond purchases to address a recent spike in money markets rates.

US stock futures rose 0.22pc in Asia, but sentiment was weak after the S&P 500 ended 1.56% lower on Tuesday in response to the US visa restrictions.

Japan’s Nikkei slid 0.7pc, its biggest decline in a week. Hong Kong shares are down 0.66c, nearing a four-week low due to persistent worries about often violent protest against China's rule of the former British colony.

Coming up today

Trading update: GVC

Economics: Mortgages (US)

Yahoo Finance

Yahoo Finance