Strong growth eases pressure on Hammond to slash deficit

Sustained economic growth is putting extra money into the public coffers and easing the pressure on Philip Hammond to cut spending or hike taxes in his first budget, according to economists at the EY Item Club.

Britain’s economy should grow at 1.7pc this year, the analysts believe, predicting that the Office for Budget Responsibility will hike its forecast from the 1.4pc estimate given in November at the time of the Autumn Statement. After that growth should be stable, and EY does not expect any more big changes to the forecast between now at 2021.

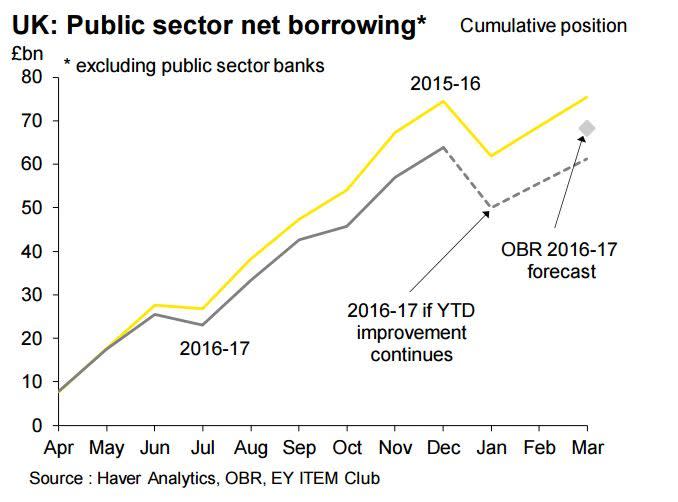

As a result the deficit for 2016-17 should be £65bn - down £3bn from the previous estimate.

With higher tax revenues the Chancellor has no extra “black hole” in the finances, the Item Club said, but he could use the wiggle room to loosen the purse strings in some areas such as social care.

“One area where a change of tack from the Chancellor seems likely is on day-to-day spending on public services,” the economists said.

“Austerity in this area saw noticeably little in the way of relaxation in November’s Autumn Statement. But with recent months producing increasingly adverse headlines on pressures faced by the health and social care budgets, the Chancellor may be compelled to provide more cash in these areas.”

Alternatives could include steps such as a cut in fuel duty to ease the rise in inflation caused by the fall in the pound.

Mr Hammond is seen as a cautious politician, however, and so no major changes are expected in the Budget - particularly as he could have used the Autumn Statement to change policies radically if he saw fit.

This year will have two budgets, one in March and one in the Autumn. From then on the Chancellor will deliver a Spring Statement and Autumn budget each year.

His run of good fortune with the economy may continue further into the future - economists anticipate some slowing of growth later in the year as inflation rises and hits household finances, but they do not predict any major slump.

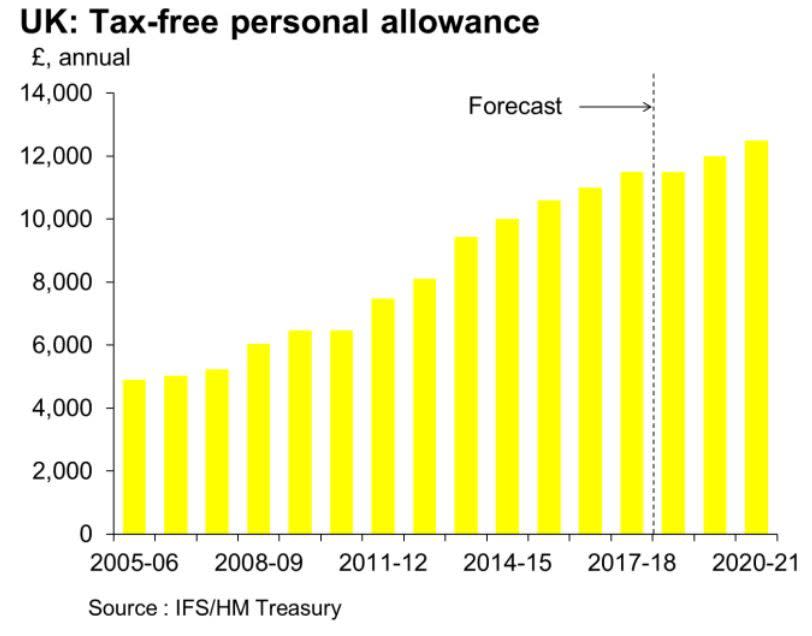

The current sustained growth has had an impact on the public finances in part because strong employment has helped to push up income taxes.

Alongside national insurance and capital gains tax that adds £10.1bn to the government’s haul compared with last year.

Substantial uncertainties remain in the forecast which the OBR has to make, however, particularly around the outcome of the Brexit negotiations.

“We would expect the OBR to base its new forecasts on the assumption that the Government is successful in its aims of negotiating transitional arrangements followed by a free-trade agreement,” the EY Item Club said.

“However, there are still some major gaps in the Government’s plans which will prevent the OBR from making a comprehensive judgement, such as the likely length of the transitional arrangements and the potential nature of customs arrangements.”

Extra consumer spending has pushed up VAT revenue by £3.6bn, and rising company profits mean corporation tax should net an additional £2.5bn.

The OBR may also look at migration numbers - the long-term future for GDP growth and government finances may be hit if immigration moves to a permanently lower level.

Yahoo Finance

Yahoo Finance