Stratasys Earnings: What to Watch on Nov. 1

Stratasys (NASDAQ: SSYS) is slated to report its third-quarter 2018 earnings before the market open on Thursday, Nov. 1.

The company is on track to be the second of the two big pure-play 3D printing players to report, as 3D Systems is scheduled to release its earnings on Oct. 30.

Stratasys stock is essentially flat -- up 0.6%, to be exact -- in 2018 through Oct. 19, while the S&P 500 has returned 5.1% so far this year. 3D Systems stock gained 92.3% over this period.

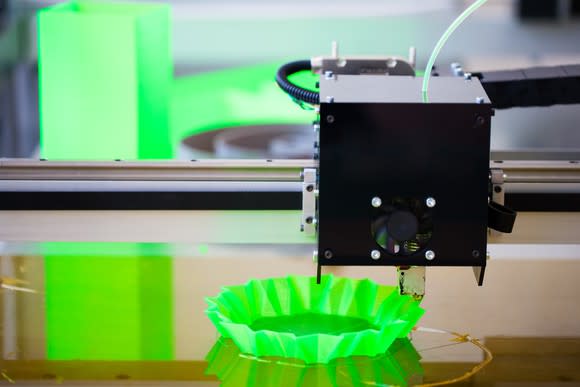

Image source: Getty Images.

Key numbers

Here are the year-ago quarter's results to use as benchmarks.

Revenue | $155.9 million |

Adjusted earnings per share (EPS) | $0.08 |

Data sources: Stratasys and Yahoo! Finance.

Wall Street expects Stratasys to post adjusted earnings per share of $0.06 on revenue of $161.9 million, representing a year-over-year decline of 25% and growth of 3.9%, respectively. While long-term investors shouldn't place too much importance on the Street's near-term estimates, they're helpful to keep in mind because they often help make sense out of market reactions.

For perspective, last quarter, Stratasys generated revenue of $170.2 million, approximately flat with the year-ago period. GAAP loss per share narrowed 27% to $0.08, while adjusted EPS declined 12% to $0.15. In the first quarter, revenue declined 5.8% year over year, GAAP loss per share narrowed slightly, and adjusted EPS came in flat.

CEO search

Investors can probably expect an update on the progress of the CEO search during the earnings call. Stratasys has been without a permanent chief executive since June 1, the effective date of Ilan Levin's resignation. Elan Jaglom, the company's chairman of the board, has been serving as interim CEO. He's being assisted by David Reis, vice chairman of the board and executive director, who was CEO before Levin.

3D printer revenue

In the second quarter, 3D printer revenue declined 8.2% year over year, while it dropped 21% year over year in the first quarter. Stratasys doesn't provide unit sales data, so we don't know what's going on from this standpoint. The reason 3D printer sales are so crucial is that they drive sales of "consumables," or the high-margin print materials, as well as service contracts.

On that note, last quarter, consumables revenue increased 4.8% from the year-ago period. That's an improvement from recent quarters and reflects better utilization of the company's installed base of 3D printers. Customer support revenue, which primarily includes revenue from maintenance contracts, jumped 9.6%. On the earnings call, CFO Lilach Payorski attributed this solid result to "growth in our installed based of systems and improvement in our service contract attach rate."

Also on last quarter's earnings call, Reis addressed the decline in 3D printer revenue:

The reason we are seeing some decline, which I'm quite confident will improve in the coming quarters, is the fact that the market is flooded today with a lot of other products. [Our customers] ... and I don't blame them for it ... are looking to experiment and test [new products] coming to the market, including [offerings from] new entrants.

There can be little doubt he's primarily referring to HP Inc. and privately held Carbon, both of which have launched compelling, fast 3D printers in recent years.

More From The Motley Fool

Beth McKenna has no position in any of the stocks mentioned. The Motley Fool recommends 3D Systems and Stratasys. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance