US stocks close at fresh records as Trump rally continues; financials lead

U.S. equities closed higher on Thursday, notching fresh record highs, as a post-election rally continued following a key monetary policy announcement from the European Central Bank.

The Dow Jones industrial average briefly rose more than 100 points before closing about 60 points higher, with Goldman Sachs (GS) contributing the most gains. The blue-chips index has now posted gains in 19 of the past 23 sessions and 13 record closes since the election.

"This really is the Trump trade," said Phil Blancato, CEO of Ladenburg Thalmann Asset Management. "This trade is about the potential for a more pro-business economy."

"But I think interest rates have gone up too high too fast without an economic catalyst," he said. "I think people don't realize what this move in interest rates has done to some portfolios."

The S&P 500 closed 0.2 percent higher, with financials rising around 1 percent to lead advancers.

"We've had such a strong run up since the election," said Jeff Zipper, managing director of investments at the Private Client Reserve of U.S. Bank. "This rally based on seasonality, definitely has more room to run."

The Nasdaq composite advanced 0.4 percent. The three major indexes, along with the small-caps Russell 2000 and the S&P Mid Cap 400, all closed at record levels.

U.S. stocks traded in a narrow range for most of the morning, as investors digested the ECB's decision to hold rates steady.

The central bank also extended its quantitative easing program until December 2017, but will reduce purchases to 60 billion euros per month from 80 billion euros. In a news conference, ECB President Mario Draghi said "uncertainty prevails everywhere," but added the risk of deflation has largely disappeared.

"The biggest thing here is he's cutting down the pace of QE," said Peter Cardillo, chief market economist at First Standard Financial. "He's keeping his options open in case something goes wrong, a similar route taken by the United States."

The ECB was widely expected to announce it will continue with its massive trillion-euro bond-buying program at its meeting on Thursday, however some analysts were surprised at the details of the announcement.

"If the Governing Council uses the FOMC's playbook by tapering its activity in consistent increments in the future, then its balance sheet should continue to expand well beyond the end of 2017. The central bank also left the door open to return to an 80B euro target at any time and will buy securities yielding below its current deposit rate of -.40% as needed," said Jeremy Klein, chief market strategist at FBN Securities, in a note.

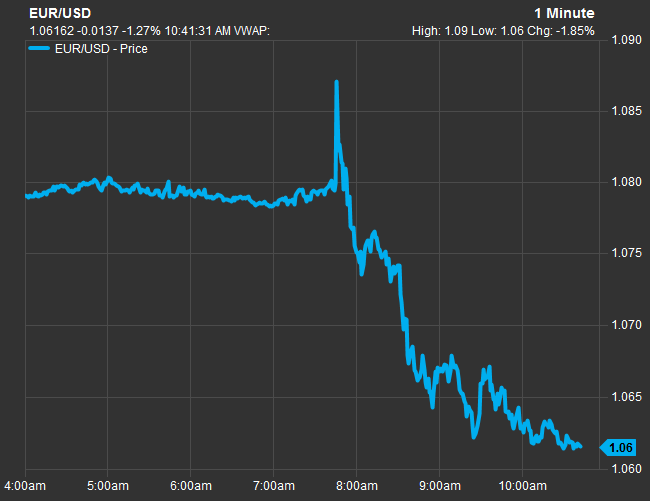

The euro (Exchange:EUR=) whipsawed following the ECB's announcement, trading just below $1.09 against the dollar before falling around 1.4 percent to $1.061. The U.S. dollar (STOXX:.DXY), meanwhile, rose 0.85 percent against a basket of currencies to trade at 101.1. Equities in Europe, meanwhile, rose sharply, with the pan-European Stoxx 600 index (^STOXX) advancing more than 1 percent.

Euro/dollar intraday chart

Source: FactSet

European sovereign bond yields spiked, with the 10-year German bund (Germany:DE10Y-DE) yielding 0.372 percent, while the Italian 10-year (Italy:IT10Y-IT) yield rose to 1.999 percent. U.S. Treasurys also fell, with the benchmark 10-year yield rising to 2.3944 percent.

In economic news, weekly jobless claims matched expectations at 258,000. "Bottom line, the story remains the same in that the pace of firing's remains modest," said Peter Boockvar, chief market analyst at The Lindsey Group.

Investors have been keeping a close eye on U.S. economic data as they prepare for a Federal Reserve meeting scheduled for next week. According to the CME Group's FedWatch tool, market expectations for a rate hike were above 95 percent.

Meanwhile, in oil markets, U.S. crude futures for January delivery (New York Mercantile Exchange: @CL.1) rose 2.15 percent to settle at $50.84 per barrel. First Standard's Cardillo said prices were receiving a boost, in part because of solid economic data from China released overnight.

China's November dollar-denominated imports grew 6.7 percent, the fastest pace of annualized growth since September 2013, while exports were up 0.1 percent in dollar terms. A Reuters poll of analysts had expected November exports to have fallen 5 percent from the previous year, while imports were forecast to drop 6.2 percent.

The Dow Jones industrial average (Dow Jones Global Indexes: .DJI) rose 63 points, or 0.32 percent, to 19,612, with Walt Disney leading advancers and United Technologies the biggest decliner.

The S&P 500 (^GSPC) rose 3 points, or 0.15 percent, to trade at 2,244, with financials leading seven sectors higher and industrials lagging.

The Nasdaq composite (^IXIC) advanced 15 points, or 0.3 percent, to 5,408.

About nine stocks advanced for every five decliners at the New York Stock Exchange, with an exchange volume of 615 million and a composite volume of 3.157 billion in afternoon trade.

The CBOE Volatility Index (VIX) (^VIX), widely considered the best gauge of fear in the market, traded about 2 percent higher, around 12.5.

Gold futures for February delivery (CEC:Commodities Exchange Centre: @GC.1) fell $5.10 to settle at $1,172.40 per ounce.

— CNBC's Aza Wee Sile and Sam Meredith contributed to this report.

On tap this week:

Thursday

Earnings: Sears Holdings (SHLD), Broadcom (AVGO), Restoration Hardware (RH), Ciena (CIEN), Hovnanian (HOV)

Friday

Earnings: Vail Resorts (MTN)

10 a.m. Consumer sentiment

10 a.m. Wholesale trade

More From CNBC

Top News and Analysis

Latest News Video

Personal Finance

Yahoo Finance

Yahoo Finance