The stock market has stopped reacting to the Federal Reserve

On Wednesday, the Federal Reserve will announce its latest monetary policy decision.

Expectations are for the Fed to keep its benchmark interest rate target unchanged at a range of 1%-1.25% while also announcing it will begin paring down the size of its more than $4 trillion balance sheet.

This announcement is largely technical in nature. And given that many expect financial markets to take this change in Fed policy in stride, it doesn’t seem likely a large reaction from investors will follow.

But recent market responses indicate that whether or not a big policy shift is announced, the stock market has all but stopped swinging in response to Fed announcements.

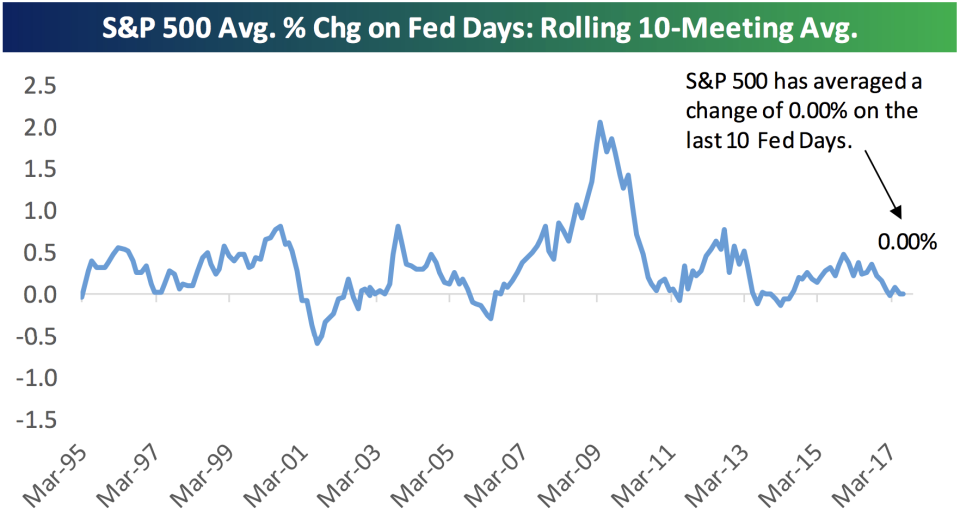

In a note to clients published Tuesday, analysts at Bespoke Investment Group noted that the average percentage change for the S&P 500 after the last 10 Fed meetings is 0%. For perspective, after the financial crisis, this measure was all the way up to 2%, indicating markets were reacting sharply to news from the central bank.

And so just as markets have seen volatility come down of late, so too has volatility around Fed decisions declined.

Additionally, average one-day moves on Fed announcement days has also plunged in recent meetings, with this measure declining to 0.4%. As recently as late 2015, the average move on a Fed announcement day was around 1%.

Now, while recent volatility in response to Fed announcements has declined, Fed days have still been very positive for the stock market since 1994, with the S&P 500’s average one-day gain coming in at 0.31% against 0.03% for all stock market days.

And in a great bit of data mining, Bespoke finds that if an investor had only owned the S&P on Fed days they’d be up about 78% since 1994; owning all other trading days would see a gain of about 191%.

Considering Fed announcements account for just 3% of all trading days, it is truly remarkable how much of the market’s total return has come on these days, and how big of a role the Fed played in stabilizing investor confidence after the financial crisis.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance