Stock market live updates: Dow drops 1190 points amid coronavirus fears, S&P 500 sees fastest correction in history

Global financial markets plunged for the sixth consecutive day on Thursday, with coronavirus fears shaving over 1,100 points off the Dow (^DJI) — its biggest in history — and sending the S&P 500 (^GSPC) swooning to its fastest-ever correction.

[Click here to see what’s happening in Friday’s stock market trading session]

“Global markets were down $1.83 trillion today, with the U.S. down $1.33 trillion,“ S&P Dow Jones’ Howard Silverblatt said in an email. He added that over the past six days, global markets erased $6 trillion in wealth with U.S. markets losing $4 trillion.

Investors took fright amid the first coronavirus case in the U.S. involving a person who didn’t travel to an infected country and didn’t knowingly interact with someone who did. Meanwhile, California’s governor said the state is monitoring more than 8,400 people who could possibly have the virus.

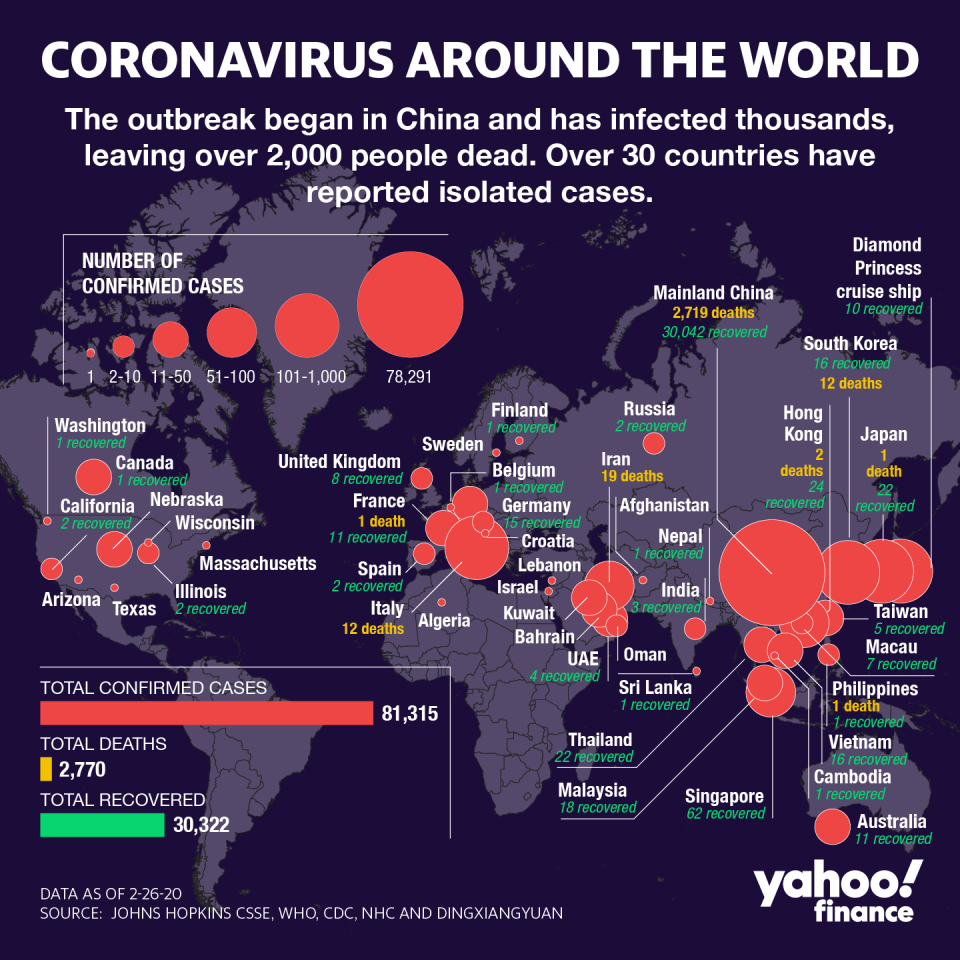

The virus continues to spread globally, with more than 82,000 cases and more than 2,800 deaths. The world’s biggest hot spots outside of China include Italy, South Korea, and Iran, where the death rate is higher than other hard-hit areas. Experts are becoming increasingly resigned to a worldwide spread of the disease, even as China’s new infections slow.

All of those developments hammered global markets.

The last six days saw the S&P 500 drop by 10% from its all-time high at rate faster than it ever has before, according to Deutsche Bank Securities.

*To be clear, a “correction” is characterized by a 10% decline from a recent all-time high. And so, while Black Monday (Oct. 19, 1987) saw the market crash in a single day, the peak in that cycle actually occurred two months earlier in August.

—

4:00 p.m. ET: Dow drops more than 1,100 points after news California is monitoring thousands of possible cases

S&P 500 (^GSPC): -4.42% or -137.63 points to 2,978.76

Dow (^DJI): -4.42% or -1,190.95 points to 25,766.64

Nasdaq (^IXIC): -4.61% or -414.29 points to 8,566.48

Crude oil (CL=F): -4.90% or -2.39 to $46.34 a barrel

Gold (GC=F): -0.10% or -1.60 to 1,641.50 per ounce

10-year Treasury (^TNX): -0.84% or -0.0110 to 1.2990

—

2:55 p.m. ET: Meanwhile, in the Treasury market...

In a sign of how aggressively investors are seeking out safe-havens, the 10-Year US Treasury Yield hit an intraday record low of 1.246%, according to Tradeweb data, while the 30-Year US Treasury Yield also set a fresh record at 1.783%.

The last time yields were this low? Yesterday.

—

2:05 p.m. ET: Stocks relapse on news that California is monitoring thousands of potential cases

The Golden State, which on Wednesday reported the first “community spread” case, is now monitoring 8400 people for potential coronavirus infections, according to Governor Gavin Newsom. Stocks had pared the day’s losses, but are now falling back toward session lows.

—

12:35 p.m. ET: Stocks still in the red, but cut losses by more than half

Whipsaw trading in midday brings major benchmarks well off their lows: At the day’s lows, the Dow had lost nearly another 1000 points. There’s no immediate trigger point but could signal that the current selling wave may be exhausting itself (too much too soon):

S&P 500 (^GSPC): 3,088.95, down 27.44 or -0.88%

Dow (^DJI): 26,700.11, off 257.48 or -0.96%

Nasdaq (^IXIC): 8,888.63, off 92.14 or -1.03%

Crude oil (CL=F): $47.17, off $1.56 or -3.20%

Gold (GC=F): 1,647.70. up $4.60 or 0.28%

10-year Treasury (^TNX): 1.3040, off -0.0060 or -0.46%

—

12:15 p.m. ET: JPMorgan shaves growth forecasts, says Fed may have to go to zero

The grim news surrounding the coronavirus outbreak keeps getting uglier with respect to global growth. On Thursday, JPMorgan Chase said it would shave 0.25 percentage points off its Q2 GDP estimates (to 1.5% from 1.75%).

While it expects a rebound in the subsequent quarters, it warned the “community spread” aspect reported on Wednesday was not built into current assumptions:

...If that were to occur the impact on growth would be difficult to quantify but almost certainly much larger than the trade-related effects we have thus far incorporated in our forecast, in our view.

Then there’s the question of monetary policy:

If our forecast is realized (which, as mentioned, has yet to incorporate any domestic community spreading) GDP growth in the first half of the year would average 1.25%, whereas for the full year (Q4/Q4) the median participant on the FOMC expects growth of 2.0%. Whether this shortfall is enough to “trigger a material reassessment” of the outlook is in the eye of the beholder. We continue to expect the Fed will reduce the target range for the fed funds rate by 25bp at the June FOMC meeting. With the expected adoption of flexible inflation averaging, a sub-trend outcome for GDP growth will make the attainment of above-2% inflation not credible as a forecast. That credibility will be further strained as growth now appears to be even softer heading into that meeting. If the growth situation necessitates more than one or two cuts then it is likely the next step is to move quickly and aggressively to the effective lower bound on interest rates, which we believe is 0.0%.

—

11:02 a.m. ET: IMF warns on virus’ impact to global growth

Via Reuters, the fast-spreading coronavirus will clearly have an impact on global economic growth and the International Monetary Fund is likely to downgrade its growth forecast as result, a spokesperson said.

—

10:40 a.m. ET: Selling intensifies, all major benchmarks deep in the red

An ugly day is getting uglier:

S&P 500 (^GSPC): 3,024.97, down 91.42 -2.93%

Dow (^DJI): 26,210.16, off 747.43 or -2.77%

Nasdaq (^IXIC): 8,682.66, off 298.11 or -3.32%

Crude oil (CL=F): 46.34, off $2.39 or -4.90%

Gold (GC=F): $1,656.50, up $13.40 or 0.82%

10-year Treasury (^TNX): 1.2610, down 0.0490 or -3.74%

And the mood on Wall Street is grim: Goldman Sachs now expects no earnings growth this year at all:

We have updated our earnings model to incorporate the likelihood that the virus becomes widespread. Our revised baseline EPS estimates are $165 in 2020 (previously $174) and $175 in 2021 (previously $183), representing 0% and 6% growth. Our reduced forecasts reflect the severe decline in Chinese economic activity in 1Q, lower end-demand for US exporters, supply chain disruption, a slowdown in US economic activity, and elevated uncertainty. Consensus forecasts imply EPS will climb 7% in 2020 and 11% in 2021.

—

10:10 a.m. ET: Tesla, Apple fall hard as China/virus fears bite

The darling of the electric vehicle market (TSLA) is getting the business end of investor coronavirus fears — as Apple (AAPL), the world’s most prominent consumer brand.

Tesla’s stock is tumbling by over 8% and Apple is down by nearly 6%, in what’s shaping up to be another ugly day on Wall Street. It underscores the risks associated with a multinational that is heavily reliant on China for manufacturing and demand: Both companies have major production facilities in the Middle Kingdom, and for Apple, China is a big market for iPhones.

__

9:55 a.m. ET: Door Dash to test the IPO waters

Softbank-backed food delivery app DoorDash has confidentially filed paperwork to go public, making it the latest startup to try and test the market. Two things to consider:

DoorDash is entering a very crowded food delivery space (UberEats, Postmates, Caviar, Seamless/GrubHub, et al) that’s getting more cutthroat by the day;

With coronavirus fears not likely to abate soon, it’s a less than ideal time for any company to float an offering.

—

9:45 a.m. ET: US outbreak would ‘almost inevitably cause a recession’

The global supply chain is arguably the biggest wild card in estimating whether the coronavirus will trigger a global downturn.

With that in mind, Paul Ashworth, Capital Economics’s top US economist, has a ray of sunshine take. The firm thinks there’s a “modest” 10% chance of a recession over the next 12 months with domestic data so healthy, but then there’s this:

Nevertheless, it is important to stress that the latest available economic activity data mostly only cover January, so they do not reflect the full impact of any supply chain-related disruption stemming from the outbreak in China. Furthermore, there is no way our models can incorporate the risk of a widespread coronavirus outbreak in the US which, just like it appears to have done in China, would almost inevitably cause a recession.

—

9:30 a.m. ET: Stocks plunge at the opening bell

Wall Street’s five-day selling wave continues unabated, as the coronavirus crisis takes on a life of its own amid soaring infection rates outside of China. Investors are selling virtually everything in sight, driving major benchmarks down around 2%.

Here’s where the markets stood when trading began:

S&P 500 (^GSPC): 3,051.23, down 65.16 or -2.09%

Dow (^DJI): 26,445.40, down 512.19 or -1.90%

Nasdaq (^IXIC): 8,732.37, down 248.40 or -2.77%

Crude oil (CL=F): -4.70%, or $2.29 to 46.44

Gold (GC=F): $1,654.70, up $11.60 or +0.71%

10-year Treasury (^TNX): 1.264 down -0.046 or -3.52%

—

7:55 a.m. ET: ‘The battle has been lost’: Here’s why China, HK rallied

After weeks of relative complacency, investors are now aggressively pricing in the possibility of a worldwide spread of the coronavirus. Ah, some might ask, but why did China and Hong Kong markets rise (Tokyo, South Korea and Taiwan all shed at least 1% in offshore trading)?

In a note to clients, Bannockburn Global Forex’s Marc Chandler hits the nail on the head:

A new phase of the Covid-19 is at hand. Yesterday was the first time that the number of new cases in the world surpassed the number of new cases China acknowledged. This confirms what we have known, namely that the battle for containing it in China has been lost.

Peter Boockvar at Bleakley Advisory Group was of the same mind:

While the S&P 500 is approaching its 200 day moving average of 3045 and the Euro STOXX 600 is basically sitting on its, interestingly the China H share index and the Hang Seng index both closed higher overnight. Maybe reflecting the belief that the rest of the world has to deal with this virus while the worst has passed in the region it first came from. Both are still down 5% year to date and lower on the week but I just wanted to point that out.

The coronavirus has been forcing multinational companies to assess the potential negative impact on their businesses. Wednesday evening, tech giant Microsoft (MSFT) warned that it would likely miss its revenue forecast for its personal computing business due to the illness, pushing its shares 3% lower in pre-market trading Thursday.

—

7:25 a.m. ET: Stock futures sink; Dow futures fall 250 points

U.S. stocks futures were pointing to a lower open Thursday, following European stocks lower after the U.S. reported its first case of “community spread” coronavirus.

Here were the main pre-market moves, as of 7:25 a.m. ET:

S&P 500 futures (ES=F): 3,082, down 28.25 points or 0.91%

Dow futures (YM=F): 26,659, down 255 points or 0.95%

Nasdaq futures (NQ=F): 8,770.25, down 80 points or 0.90%

Crude oil (CL=F): $47.55 per barrel, down $1.18 or 2.42%

Gold (GC=F): $1,651 per ounce, up $7.90 or 0.48%

The Centers for Disease Control and Prevention (CDC) confirmed the first U.S. case of coronavirus from unknown origin in Northern California. The agency said that it is unclear how the patient contracted the virus, because there is no travel history or exposure to an infected individual.

The new case in the U.S. comes after President Donald Trump held a news conference Wednesday evening addressing the coronavirus. Trump noted that the risk to the U.S. was “very low” and announced that Vice President Mike Pence would lead the U.S. response to the outbreak. The president also mentioned the stock market and said that markets should comeback from their recent rout.

There are over 82,500 cases of coronavirus worldwide and more than 2,800 deaths, as of Thursday morning. At least 47 countries are affected by the virus globally, and while South Korea is still the most heavily affected outside of China, other countries are beginning to take serious measures. Japanese Prime Minister Shinzo Abe ordered that all school remain closed through March.

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

Yahoo Finance

Yahoo Finance