STERIS (STE) Gains From Cantel Buyout, Supply Chain Issue Stays

STERIS STE business is gaining market share following the Cantel Medical acquisition. However, the continuous adverse impact by the current customer consolidation scenario is a major downside for the company’s business. The stock currently carries a Zacks Rank #3 (Hold).

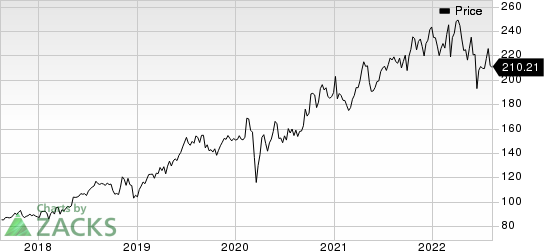

Over the past year, STERIS has outperformed the industry it belongs to. The stock has lost 3.2% compared with the industry’s 20.9% fall. STERIS’ first-quarter fiscal 2023 constant currency organic revenues increased 6% year over year. The company registered strong performances across three of its reporting segments in Q1. Growth was driven by organic volume as well as a 240-basis point favorable impact of price.

The net impact of acquisitions and divestitures added approximately $151 million to revenues in the quarter. Further, the company achieved approximately $20 million of cost synergies in the first quarter and is on track to achieve a total of $50 million in fiscal 2023. The expansion in gross margin is an added advantage.

In the first quarter of fiscal 2023, revenues improved 19% year over year, led by robust sales across the company’s Healthcare, AST and Life Sciences segments.

Revenues at Applied Sterilization Technologies improved 10% year over year on a CER organic basis. CER organic revenue growth was driven by increased demand from medical device and biopharma customers. Revenues at the Life Sciences segment rose 10% on a CER organic basis year over year on 5% growth in consumable revenues, a 24% rise in capital equipment revenues and flat service revenues.

STERIS plc Price

STERIS plc price | STERIS plc Quote

In June 2021, STERIS acquired Cantel Medical, a global provider of infection prevention products and services, primarily catering to endoscopy and dental customers. The integration is expected to strengthen and expand STERIS’ Endoscopy offerings, adding a full suite of high-level disinfection consumables, capital equipment and services as well as additional single-use accessories. The Cantel acquisition added approximately $40 million to the company’s fiscal 2022 revenues.

On the flip side, STERIS exited first-quarter fiscal 2023 with in-line earnings and a revenue miss. The company during the quarter faced significant supply chain and inflation-related challenges. In the quarter, strong capital equipment and service growth were offset by an organic decline in consumables, largely attributable to the timing of orders against very strong comparisons in the prior year.

Within AST, growth was somewhat limited by the timing of large capital shipments from the Mevex business unit. Dental segment revenues were limited by supply chain challenges. The lowered earnings and organic growth guidance for fiscal 2023 indicates that this gloomy trend will continue.

Stiff competition, pricing pressure and macroeconomic issues are other downsides.

Key Picks

Some better-ranked stocks in the broader medical space that have announced quarterly results are Quest Diagnostics Incorporated DGX, Molina Healthcare, Inc. MOH and Merck & Co. MRK.

Quest Diagnostics, carrying a Zacks Rank #2 (Buy), reported second-quarter 2022 adjusted EPS of $2.36, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $2.45 billion outpaced the consensus mark by 7.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quest Diagnostics has an earnings yield of 6.9% compared with the industry’s 3.9%. DGX’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average being 12.1%.

Molina Healthcare, having a Zacks Rank #2, reported second-quarter 2022 adjusted EPS of $4.55, which beat the Zacks Consensus Estimate by 4.8%. Revenues of $8.1 billion outpaced the consensus mark by 6.2%.

Molina Healthcare has a long-term estimated growth rate of 16.4%. MOH’s earnings surpassed estimates in the trailing four quarters, the average being 3.2%.

Merck reported second-quarter 2022 adjusted earnings of $1.87 per share, beating the Zacks Consensus Estimate of $1.67. Revenues of $14.6 billion surpassed the Zacks Consensus Estimate by 5.4%. It currently has a Zacks Rank #2.

Merck has a long-term estimated growth rate of 10.1%. MRK’s earnings surpassed estimates in the trailing four quarters, the average surprise being 16.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

STERIS plc (STE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance