Steel Dynamics (STLD) Wraps Up Heartland Buyout for $400M

Steel Dynamics, Inc. STLD has completed the previously announced acquisition of Heartland Steel Processing, LLC, formerly known as Companhia Siderurgica Nacional, LLC (Heartland), from CSN Steel, S.L.U., for $400 million in cash (including $60 million of normalized working capital), subject to customary transaction purchase price adjustments.

The deal was funded with available cash with an expectation of near-term cash flow and earnings per share accretion. Per the company, the buyout will expand its total steel shipping capability to 12.4 million tons and annual flat roll steel shipping capacity to 8.4 million tons. Moreover, the additional exposure to greater width and lighter-gauge flat roll steel offerings will expand the company’s value-added product portfolio, boosting its position as one of the leading steel producers of North America.

Located in Terre Haute, IN, Heartland produces a range of higher-margin, flat roll steel by further processing hot roll coils into cold roll, pickle and oil and galvanized products.

Heartland has the capability to produce 1 million tons of cold roll steel annually, with galvanizing capacity of 360,000 tons. It has a continuous pickle line, a cold mill and a galvanizing line. Moreover, its equipment is well-maintained, upgraded and in excellent operating condition.

Historically, Heartland has primarily focused on galvanized products and has operated at low utilization rate. Future plans include utilization of the full capacity of the facility, providing high quality pickle and oil, cold roll and galvanized products. Additionally, geographic proximity of Steel Dynamics' certain fabrication locations and other flat roll operations provide opportunities related to production and logistics efficiencies throughout the supply chain and customer network.

Steel Dynamics’ shares have gained 4.3% in the past three months against the industry’s 4.6% decline.

Last month, the company provided an upbeat earnings guidance for second-quarter 2018. The company expects earnings for the quarter in the band of $1.46 to $1.50 per share. This is an increase from 96 cents recorded in the previous quarter and 63 cents earned a year ago.

Steel Dynamics expects profitability from its steel operations to improve meaningfully on a sequential basis in the second quarter on the back of higher steel shipments and metal spread expansion. Also, average quarterly steel product prices are expected to increase more than scrap costs. This is because prices of steel across the platform improved throughout the quarter aided by strong steel demand in the domestic market, the company noted.

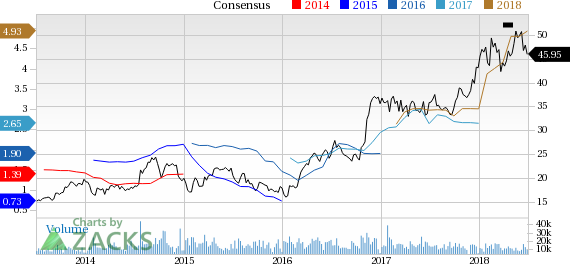

Steel Dynamics, Inc. Price and Consensus

Steel Dynamics, Inc. Price and Consensus | Steel Dynamics, Inc. Quote

Zacks Rank & Stocks to Consider

Steel Dynamics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth considering in the basic materials space are The Chemours Company CC, FMC Corporation FMC and Westlake Chemical Corporation WLK, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected long-term earnings growth rate of 15.5%. Its shares have gained 16.5% in a year.

FMC Corp has an expected long-term earnings growth rate of 14.3%. Its shares have moved up 21.3% in a year.

Westlake Chemical has an expected long-term earnings growth rate of 12.2%. Its shares have rallied 60.8% in a year.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FMC Corporation (FMC) : Free Stock Analysis Report

Chemours Company (The) (CC) : Free Stock Analysis Report

Westlake Chemical Corporation (WLK) : Free Stock Analysis Report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance