How Should a New Startup in Singapore Find Funding?

This question originally appeared on Quora, and the answer that follows was provided by Thomas Wong, a local Singaporean.

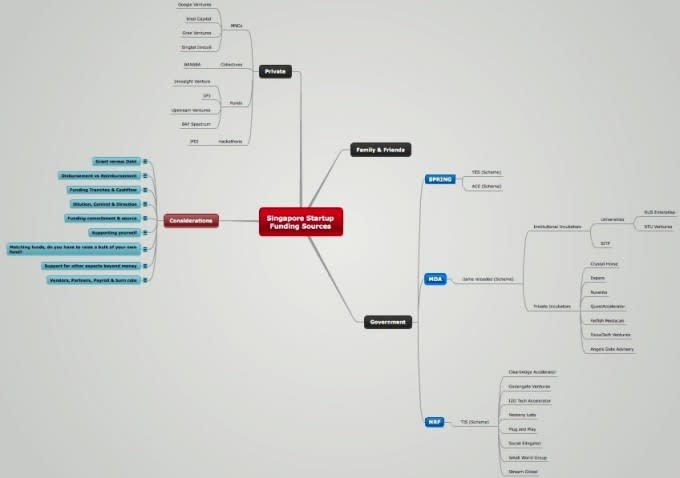

Thomas Wong, Local Singaporean I drafted up a few quick diagrams to explain the funding scene in Singapore. It's not complete, but might be helpful to some. There are three main sources to look into when starting out. Of course I am presuming you are not planning to fund it entirely on your own.

Friends and family

Private funding

Government funding

Friends & Family I've seen mixed advice on this aspect, and I agree that you'd mostly only get one shot at this. But I've seen enough businesses that exist on support from supportive family and friends, a famous one would be Sir Richard Branson. It's great to get started and get you off the ground, but you'd want to get familiar with raising funds from cold contacts/investors as soon as you can. Private Funding This is a pretty unmapped territory as there are a plethora of options. There are some networks like BANSEA, which pool together a mix of private investors and government linked ones as a collective of seed investors. There are also MNCs with funds dedicated to identify interesting startups to invest in, [like] Google Ventures, Gree Ventures, Intel capital, and even Singtel's Innov8. Recently, the entire Hackathon trend has been ported from the US to Singapore, where people who want to begin on their startup journey can participate in these thirty to ninety day events. They form a team, pick an idea, and patch together a product that they then pitch to investors at the end of the process on "demo day." There are private funds and investors, Innosight, DFJ, and some invest considerable amounts even at seed level. I personally know two companies who raised a million dollars from individual investors, without a technology or traction in place when they pitched. Basically, it's a jungle out there, you'll need to talk to people, do your own research, and keep your ears on the ground to identify which funds to approach. A good way if you have the connections, though, is to identify these funds from a higher level on the value chain. If you have friends in finance, fund managers, fund of funds, wealth managers, they might be able to give you a quick take and even introductions to the people running these funds. Most of these guys work with or fund these angel investors, venture capital, or seed investors. Government Funding The Singapore government has been working hard to lift entrepreneurial activity here for a while, and they have put in place number of schemes to facilitate that, each focusing on various industries and stages in a company's growth. I'll cover three of the more popular ones for fresh startups. Essentially there are three schemes I've come across that a fresh technology startup in Singapore would normally look into.

There is the ACE program administered by SPRING Singapore; they match about $50,000 to about $21,500 you raise on your own. (Thank you, Brian, for pointing out the original inaccuracy http://www.techinasia.com/startu... )

There is iJams reloaded, administered by MDA. It has two phases to its funding scheme. MDA works with private or institutional incubators to administer this fund. In the first phase, MDA will match $50,000 to about $10,000 that the founders or the incubator puts up. If the milestones are hit and the startup is eligible for phase two, MDA will match $100,000 to $100,000 raised by the founders or the incubator.

There is also a scheme under the NRF (National Research Foundation), TIS Technology Incubation Scheme. "NRF would co-invest up to the lower of S$500,000 or 85% of the incubator’s investment in a qualifying company, and grant the incubator the call option to buy over its investment at 1.1x before the second year, and 1.15x between the second and third year." Check out ( NRF reopens TIS, opens floodgate on early-stage tech investments in Singapore ) (James Chan, thanks for pointing out my confusion and original inaccuracy http://www.techinasia.com/startu... )

There seems to also be an NRF ESVF scheme which offers up to $3 million, though I don't have much details on this scheme ( NUS Entrepreneurship Centre )

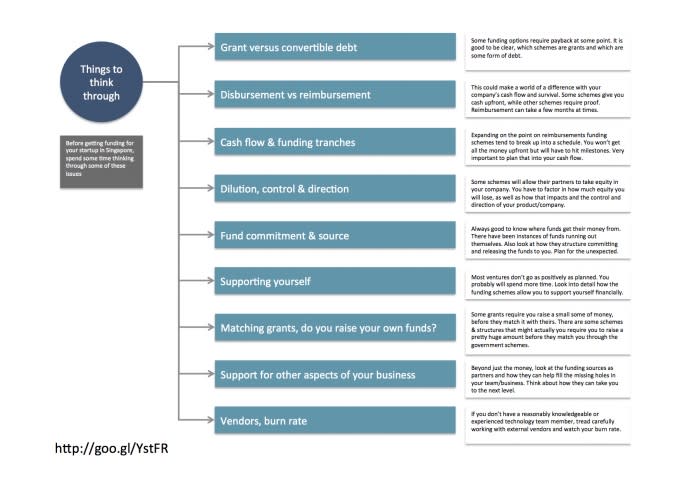

There are some nuances for each scheme that a founder should be aware of, between schemes and between the bodies that administer these schemes. Nuances On top of where to get funds for your startup, each funding scheme has its own set of advantages and intricacies. These are some things to think about when deciding which funding scheme would work for you.

I've shared a quick mind map with a few more details of the funding landscape in Singapore. It's not complete, but is a pretty good guide to founders fresh to the ecosystem. You can view it below.

More questions on Startup Advice and Strategy :

Yahoo Finance

Yahoo Finance