A star tech and media banker shares his thoughts on dealmaking in 2017

Aryeh Bourkoff.

For Aryeh Bourkoff, the star tech, media, and telecom (TMT) banker and founder of the boutique bank LionTree, 2017 will be a year of uncertainty.

But it will also be ripe with opportunity, especially in the TMT and consumer spaces.

That’s the message Bourkoff gave his team in a year-end letter sent out in December.

“Politics and technology can be destabilizing forces… They challenge our economic and civil orders,” Bourkoff, who is a former vice chairman at UBS, wrote.

“I have always believed that in order to best serve the firm and our clients, we must understand new uncertainties, create strategies to account for them and remain nimble and alert to sudden shifts in the landscape.”

He referred specifically to the election of Donald Trump as US president and said that political shift could lead to a repatriation of cash, among other things. That could free up cash for mergers and acquisitions — especially for companies like Apple, Microsoft, Alphabet, Cisco, and Oracle, which combined hold some $500 billion in cash overseas.

But it’s not just going to be mergers, Bourkoff wrote:

“We’ll see companies test what it means to have the appropriate ratio of debt to equity. We’ll see PIPE (Private Investment in Public Equity) deals become more popular as a way to bridge the gap between investors with short-term needs and CEOs with long-term vision. This is a huge opportunity for private capital markets.”

He said the market is underpricing the risk these shifts pose as they create volatility and dislocation in asset prices.

‘The middle-man is increasingly pressured’

Within the media industry, specifically, Bourkoff said that technologies and distribution platforms will continue to evolve but the global appetite for content will remain constant.

“In this paradigm, value shifts to the bookends – the underlying content and the technology platforms that touch the end user – and the middle-man is increasingly pressured,” he said.

That could affect future dealmaking.

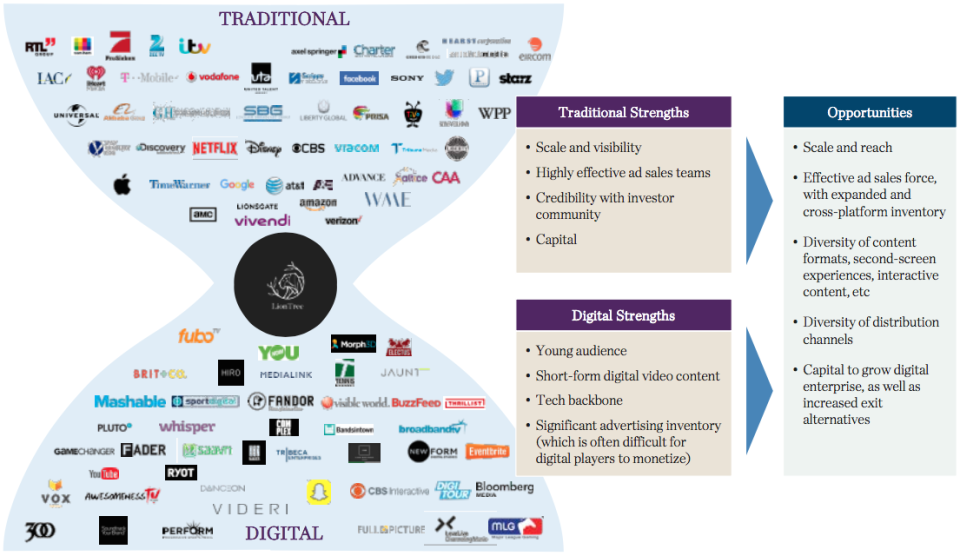

He said large media brands — like Time Warner, Comcast, and Verizon — and tech giants — like Apple, Netflix, and Facebook — have scale, access to capital, and global audiences. But they need to innovate and adapt to younger audiences and changing consumer preferences.

Their disruptors are companies like Snap, Buzzfeed, Jaunt VR, and Thrillist.

LionTree

“The convergence of traditional and digital media will yield content synergies, advertising scale across several platforms and sales force efficiencies,” Bourkoff wrote.

He added that this convergence does not mean that we’ll see more over-the-top streaming and skinny programming bundles. Demand for OTT falls sharply when prices rise, Bourkoff said, and the programming costs needed to create skinny bundles of channels will force prices so high that demand will ween.

Bourkoff said his firm’s deal pipeline included 50 mandated live deals at the end of the year.

“As we build out LionTree in 2017, I firmly believe it has never been more important to take a long-term investment view as it is now,” he said.

NOW WATCH: Harvard economist Rogoff explains why he is so optimistic about the economy under President Trump

The post A star tech and media banker shares his thoughts on dealmaking in 2017 appeared first on Business Insider.

Yahoo Finance

Yahoo Finance