SPX Sell-Off Rebounds off Slope Support

DailyFX.com -

SPX breakdown now testing initial slope support

Updatedtargets & invalidation levels

Looking for trade ideas? Check out DailyFX’s 2016 4Q Projections

SPX Daily

Chart Created Using TradingView

Broader Technical Outlook: A break of the objective monthly opening-range shifted the focus lower earlier this week with today’s decline encountering support at the 50% line of the descending pitchfork extending off the highs. Although we may see a near-term reprieve off this level, the outlook remains weighted to the downside while below the August lows at 2147- a breach above this mark is needed to alleviate further downside pressure. A break lower targets the 23.6% retracement of the 2016 range at 2103 & the 100% extension of the decline at 2094(note that the lower median-line parallel converges on this level over the next few days).

SPX 240min

Notes: A closer look at the index shows a sharp reversal off the 50-line today in New York with the advance now testing median-line resistance. If this week’s breakdown is the onset of a more meaningful reversal in the SPX, look for resistance to hold at 2147- this level converges on the 50% line into the close of the week.

From a trading standpoint I’d be looking to fade strength while below the median-line targeting objectives into confluence support at 2094 – an area of interest for exhaustion / long-entries.

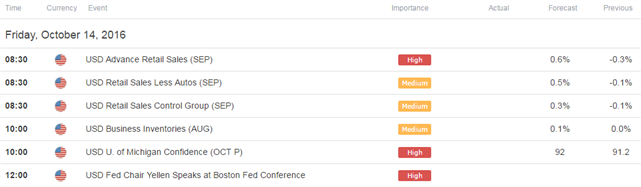

On the data front, look for the U.S. Advanced Retail Sales & the University of Michigan confidence surveys to offer up some volatility with Fed Chair Janet Yellen also slated for a speech tomorrow morning at the Boston Fed Conference. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount.

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

Relevant Data Releases

Other Setups in Play:

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance