Southwest (LUV) Shares Gain on Raised Q2 Revenue Guidance

Southwest Airlines LUV improved its revenue guidance for the second quarter of 2022 as it sees a continued increase in bookings for the summer and a strong load factor (percentage of seats filled by passengers). Following this raised guidance, shares of the company gained 6% at the close of business on May 26.

For the second quarter, LUV expects operating revenues to increase 12-15% from the comparable period in 2019. Previously, the company expected the same to rise 8-12%. Southwest attributed its improved guidance, despite escalating fuel prices, to continued strength in passenger yield. The airline expects to reap strong profits and operating margins, excluding special items, in the second quarter and the remainder of the year.

Southwest, sporting a Zacks Rank #1 (Strong Buy), still anticipates capacity, measured in available seat miles (ASMs), to decline 7% in the second quarter. The company maintains its expectation for cost per available seat mile (CASM), excluding fuel, at an increase of 14-18% in the current quarter from the comparable period in 2019. You can see the complete list of today’s Zacks #1 Rank stocks here.

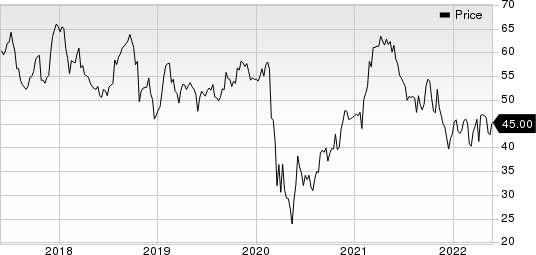

Southwest Airlines Co. Price

Southwest Airlines Co. price | Southwest Airlines Co. Quote

However, with escalating fuel prices amid the Russia-Ukraine war, Southwest now expects economic fuel costs per gallon to be $3.30-$3.40 in the second quarter compared with $3.05-$3.15 estimated earlier.

With Omicron fears having faded, airlines are witnessing a surge in travel demand for the summer. Buoyed by this optimism, they are raising expectations for the second quarter. Apart from Southwest, JetBlue Airways JBLU improved its guidance for the second quarter, which drove its shares up 3.4% at the close of business on May 26.

JetBlue, carrying a Zacks Rank #4 (Sell), has been seeing steady improvement in its operational performance, following the investments it made to improve operations for the summer. With improved completion factor despite weather and air traffic control disruption, JBLU now expects its capacity to increase 2-3% in the second quarter compared with the 2019 level from 0-3% estimated earlier.

Owing to the strong demand environment and expectations of June revenue per available seat mile (RASM) to increase more than 20% from the 2019 level, JBLU anticipates second-quarter revenues to climb at or above the high end of the previously guided range of 11-16%. The company continues to expect CASM, excluding fuel, to increase 15-17% in the second quarter from the 2019 level. However, the estimate for fuel price per gallon has been raised to $4.08 from $3.79 expected previously.

Earlier this month, United Airlines UAL improved its unit revenue projection for the June quarter owing to the healthy air-travel demand scenario. UAL expects total revenue per available seat miles (TRASM: a measure of unit revenues) for second-quarter 2022 to increase in the 23-25% band from the second-quarter 2019 actuals. Per the previous TRASM forecast, provided last month while releasing first-quarter 2022 results, the metric was expected to increase roughly 17% from the second-quarter 2019 actuals.

United Airlines anticipates capacity to decline roughly 14% in the current quarter from the second-quarter 2019 levels (the earlier forecast had predicted a contraction of roughly 13%). However, due to rising oil prices, this Chicago-based carrier, currently carrying a Zacks Rank #3 (Hold), increased its average aircraft fuel price per gallon forecast to $4.02 from $3.43 expected earlier.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance