SONY Beats Q3 Earnings Estimates, Tweaks Full-Year Guidance

Sony Group Corporation SONY reported third-quarter fiscal 2022 net income per share (on a GAAP basis) of ¥263.89 per share ($1.87 per share), decreasing from ¥276.65 reported in the year-ago quarter. The Zacks Consensus Estimate for earnings was pegged at $1.40 per share.

Adjusted net income came in at ¥326.8 billion compared with ¥293.2 billion in the prior-year quarter.

Quarterly total revenues increased 13% year over year to ¥3,412.9 billion ($24,197.6 million). The Zacks Consensus Estimate was pegged at $25,024.1 million. The uptick was due to an increase in revenues in Game & Network Services (G&NS), Music, Entertainment, Technology & Services (ET&S) and Imaging & Sensing Solutions business segments, partially offset by the decline in Financial Services and Picture sales.

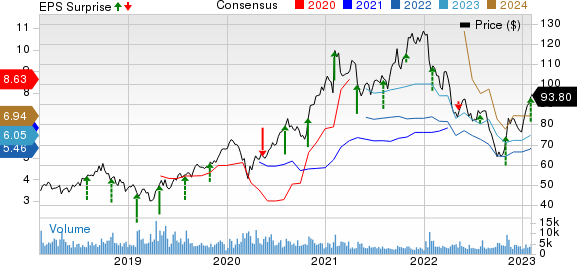

Sony Corporation Price, Consensus and EPS Surprise

Sony Corporation price-consensus-eps-surprise-chart | Sony Corporation Quote

Segment Results

In the quarter under review, G&NS sales were up 53% year over year to ¥1246.5 billion. Sales in the segment increased owing to the positive impact of the forex movement, first-party titles and improving hardware sales. The segment’s operating income was ¥116.2 billion compared with ¥92.9 billion in the prior-year quarter due to the positive impact of sales of first-party titles, partly offset by rising costs. In the quarter under review, the company sold 7.1 million units of Play Station 5.

Music sales increased 23% year over year to ¥363.7 billion in the third quarter. Sales from the segment were driven by higher recorded music and music publishing sales from paid subscription streaming services, partly offset by softness in the anime business for Visual Media & Platform. Operating income was ¥63 billion, up from ¥55.1 billion in the prior-year quarter, owing to the positive impact of the forex movement.

Picture sales decreased 28% year over year to ¥331.5 billion. The downtick was caused by lower sales for theatrical films and television licensing, partly offset by the positive impact of the acquisition of Bad Wolf and Industrial Media. Operating income was down to ¥25.4 billion compared with an operating income of ¥149.4 billion a year ago due to lower sales and no gain from the transfer of GSN Games business in the third quarter of fiscal 2021.

ET&S sales came in at ¥752.8 billion, up 10% year over year. The uptick was due to an increase in sales of digital cameras and favorable foreign exchange rates, partly offset by lower television sales. Operating income was ¥81.1 billion compared with ¥80 billion in the year-ago quarter.

Imaging & Sensing Solutions sales were up 28% year over year to ¥417.2 billion. Sales from the segment were driven by an increase in sales of mobile image sensors and favorable forex movement. Operating income was ¥84.9 billion compared with ¥64.7 billion in the prior-year quarter.

Financial Services sales were down 24% year over year to ¥359 billion. Sales were affected by a decline in revenues at Sony Life and a fall in net gains on investments in separate accounts. Operating income was ¥54.3 billion compared with ¥35.2 billion in the year-ago quarter, owing to the rise in OI and reversal of policy reserves at Sony Life.

All Other sales were down 8.4% to ¥25.1 billion in the fiscal second quarter. Operating income was ¥9.1 billion compared with ¥8.2 billion in the year-ago quarter.

Other Details

For the quarter under review, total expenses were ¥2,991.5 billion, up 16.2% year over year. Operating income was ¥428.7 billion, down 8%.

Cash Flow & Liquidity

For the nine months that ended Dec 31, 2022, Sony used ¥81.6 billion cash in operating activities compared with ¥808.6 billion of cash provided from operating activities in the prior-year period that ended Dec 31, 2021.

As of Dec 31, 2022, the company had ¥1,287.9 billion in cash and cash equivalents with ¥1,514.3 billion of long-term debt.

FY22 Outlook

Sony has provided the outlook for the fiscal year ending Mar 31, 2023. It now expects sales of ¥11,500 billion, up 15.9% year over year. The company previously had guided revenues to be ¥11,600 billion. The top-line performance is likely to be driven by improvement in GN&S, Music, Pictures and ET&S segment sales.

Net income is estimated to be ¥870 billion, declining 1.4% year over year. Earlier, net income was estimated to be ¥840 billion.

Operating income is now projected to be ¥1,180 billion, suggesting a decline of 1.9% year over year. Earlier, operating income was projected to be ¥1,160 billion.

Operating cash flow is now expected to be ¥550 billion, down 32.4% from the prior fiscal year.

Zacks Rank & Stocks to Consider

Sony currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology space are Arista Networks ANET, Jabil JBL and Super Micro Computer SMCI. Jabil sports a Zacks Rank #1 (Strong Buy), while Arista Networks and Super Micro Computer carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks 2022 earnings is pegged at $4.38 per share, rising 0.2 in the past 60 days. The long-term earnings growth rate is anticipated to be 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have increased 9.1% in the past year.

The Zacks Consensus Estimate for Jabil’s 2023 earnings is pegged at $8.37 per share, rising 2.3% in the past 60 days. The long-term earnings growth rate is anticipated to be 12%.

Jabil’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 8.8%. Shares of JBL have increased 32.8% in the past year.

The Zacks Consensus Estimate for Super Micro Computer’s fiscal 2023 earnings is pegged at $9.54 per share, up by 4.1% in the past 60 days.

Super Micro Computer’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 7.8%. Shares of SMCI have been up 108.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Sony Corporation (SONY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance