Sonoco (SON) Misses Q3 Earnings & Sales Estimates, Trims View

Sonoco Products Company’s SON third-quarter 2019 adjusted earnings increased 12.8% year on year to 97 cents per share. Earnings also exceeded the upper-end of management’s guidance of 88-94 cents. The reported figure, however, missed the Zacks Consensus Estimate of 91 cents, resulting in a negative surprise of 6.6%.

On a reported basis, including one-time items, earnings per share came in at 91 cents, compared with the year-ago quarter’s 72 cents.

Sonoco’s net sales came in at $1.35 billion, marginally down from the prior-year quarter’s $1.36 billion. This downside primarily resulted from lower volumes and stronger U.S. dollar, partly offset by increased sales from acquisitions. The sales figure also missed the Zacks Consensus Estimate of $1.38 billion.

Operational Update

Cost of sales came in at $1.09 billion compared with the $1.10 billion recorded in the year-earlier quarter. Gross profit during the third quarter totaled $265.5 million, up from the year-ago quarter’s $259.6 million. Gross margin came in at 19.6% compared with 19.0% reported in the comparable period last year.

Selling, general and administrative expenses totaled $120.3 million, down 11.5% year over year. The downside primarily resulted from acquisition-related costs. Adjusted operating income increased 12.1% year over year to $139 million during the July-September quarter. Operating margin came in at 10.3% compared with the 9.1% recorded in the year-ago quarter.

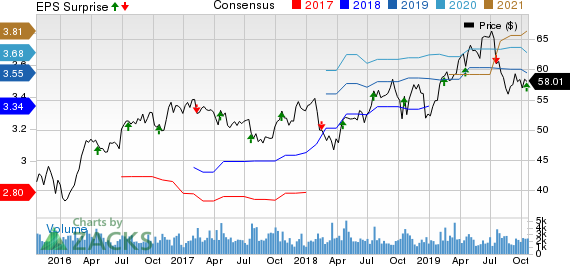

Sonoco Products Company Price, Consensus and EPS Surprise

Sonoco Products Company price-consensus-eps-surprise-chart | Sonoco Products Company Quote

Segment Performance

The Consumer Packaging segment reported net sales of $581.4 million, down 3.1% from $600.2 million recorded in the prior-year quarter. Operating profit inched up to $56.7 million from the $56 million witnessed in the comparable period last year.

Net sales in the Paper and Industrial Converted Products segment came in at $495.8 million, suggesting an increase of 6.9% year over year on the Conitex acquisition, partly offset by foreign exchange and lower volume. Operating profit totaled $59.4 million compared with the $53.9 million recorded in the comparable period last year.

The Display and Packaging segment’s net sales slipped 12.1% year over year to $145 million. The segment reported an operating profit of $8.9 million compared with $3.7 million reported in the year-earlier quarter.

The Protective Solution segment’s net sales came in at $131.7 million, down 2.9% year over year on lower volume. Operating profit of the segment jumped 34.6% year over year to $14 million.

Financial Performance

Sonoco reported cash and cash equivalents of $115.9 million at the end of the second quarter compared with $250.4 million at the end of the prior-year quarter. The company recorded cash flow from operating activities of $238.8 million in the reported quarter compared with $451.5 million in the year-earlier period.

As of the third quarter’s end, long-term debt was $1.18 billion compared with the $1.19 billion recorded at the end of 2018. As of Sep 30, 2019, the company’s total debt-to-capital ratio was 45.6% compared with 43.9% reported at the end of 2018.

Acquisition

This May, Sonoco signed an agreement to acquire Corenso Holdings America, Inc. from Madison Dearborn Partners, LLC, for a cash consideration of $110 million. The company completed the acquisition in August.

Guidance

For 2019, Sonoco now expects adjusted earnings per share guidance of $3.50-$3.54 compared with the prior estimate of $3.52-$3.62. The company reaffirmed its operating cash flow and free cash-flow guidance. Operating cash flow is expected between $435 million and $455 million and free cash flow is projected at $60-$80 million.

For the ongoing quarter, the company projects adjusted earnings per share of 72-76 cents compared with the year-ago quarter’s 84 cents. However, the company anticipates slowdown in customer orders in certain markets.

Share Price Performance

Over the past year, Sonoco has outperformed the industry it belongs to. The stock has appreciated around 5.9% compared with the industry’s loss of 24.1%.

Zacks Rank and Stocks to Consider

Sonoco currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are UFP Technologies, Inc. UFPT, Cintas Corporation CTAS and Sharps Compliance Corp SMED, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

UFP Technologies has a projected earnings growth rate of 8.1% for the current year. The stock has gained 34.1% so far this year.

Cintas has an estimated earnings growth rate of 12.74% for 2019. Shares of the company have rallied 58.9% year to date.

Sharps Compliance has an expected earnings growth rate of a whopping 500% for 2019. The company has gained 21.5% so far this year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sonoco Products Company (SON) : Free Stock Analysis Report

UFP Technologies, Inc. (UFPT) : Free Stock Analysis Report

Cintas Corporation (CTAS) : Free Stock Analysis Report

Sharps Compliance Corp (SMED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance