A Sneak Peek at Intel's Q2 2018 Earnings

On July 26, chip giant Intel (NASDAQ: INTC) is set to report its second-quarter earnings results and issue financial guidance for the third quarter of the year along with any potential updates to its full-year financial guidance.

Now, Intel already told us on June 21 -- the same day that it announced the resignation of now-former CEO Brian Krzanich -- that it had a great second quarter. Revenue came in at $16.9 billion, and earnings per share reached $0.99 -- both well above the company's prior guidance.

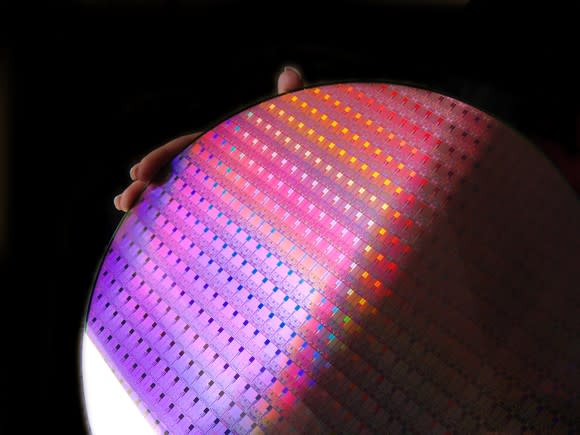

Image source: Intel.

In some sense, Intel's second-quarter results aren't going to be that interesting, since Intel's already spoiled them for us and we know that the company did well.

That being said, the market tends to be more forward-looking, so the numbers you'll probably want to watch are the guidance that Intel gives for the third quarter, any revision to its full-year guidance, as well as any insight into how 2019 is shaping up. Let's dive in a bit deeper into these three items.

Third-quarter guidance targets

Analysts are currently looking for Intel to report revenue of $17.64 billion for the third quarter of 2018 on average, with estimates ranging from $17.11 billion to $19.48 billion. The consensus figure would represent 9.2% year-over-year revenue growth from the same quarter last year.

As far as earnings per share goes, the consensus estimate sits at $1.08, with individual estimates ranging from $1.01 per share all the way to $1.31. If Intel guides earnings per share in line with consensus, that'd represent 6.93% growth -- a tad slower than consensus revenue growth estimates currently sit at.

How about the full year?

While the guidance that Intel gives for the third quarter will be in focus, Intel is one of those increasingly rare technology companies that provides fairly detailed full-year financial guidance, too.

In its last earnings release, Intel said that it expected to generate $67.5 billion in revenue and earnings per share of $3.85 (that's on a non-GAAP basis). Since Intel clearly performed better than expected during the second quarter, there's a good chance that the company's full-year results will come in better than it had previously expected, too.

Analyst consensus currently calls for the company to bring in $68.37 billion in revenue (slightly better than guidance) and earnings per share of $4 (also slightly better than guidance). Those are the targets that investors are likely going to judge Intel's new full-year guidance against.

Beyond the numbers

Even though Intel's financial results for 2018 look on track to be strong -- certainly quite a bit stronger than what Intel thought it'd achieve going into the year -- the stock doesn't reflect that good news. Right now, Intel shares are down about 9.3% from the 52-week high that it set back in early June.

A large part of that decline came following Krzanich's resignation. Although Intel said that his resignation was due to the discovery of an affair that he had with a subordinate (something that's forbidden by Intel's code of conduct), not everyone buys that explanation.

"It's hard for me to believe that they would let the CEO go for a relationship that [Krzanich] had from over 10 years ago," analyst Romit Shah with Nomura Instinet said in an interview with CNBC.

Beyond the uncertainty that the CEO resignation introduces, Intel is also facing difficulties bringing its 10-nanometer chip manufacturing technology into mass production. The technology had previously been slated to go into volume production in the second half of 2018, but now Intel is only committing to volume production in 2019. Note that this technology was originally supposed to be ready for volume manufacturing by the end of 2015 and has continued to slip.

Intel has long cited technology manufacturing leadership over the competition as a core competitive advantage, so seeing the company struggle to bring its 10-nanometer technology into mass production certainly isn't good for investor confidence.

More From The Motley Fool

Ashraf Eassa has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance