Snap Gets Bullish Upgrade Ahead of Earnings Today

Snapchat parent Snap (NYSE: SNAP) is set to release second-quarter earnings results after the market close today. The company's first couple years in the public markets have been rough, but Snap has been putting together a turnaround. User metrics are stabilizing, and Snap is making improvements in its advertising platform. Formerly bearish BTIG Research changed its tune and upgraded its rating to buy earlier this year.

Snap just got another bullish vote from Wall Street ahead of its earnings report.

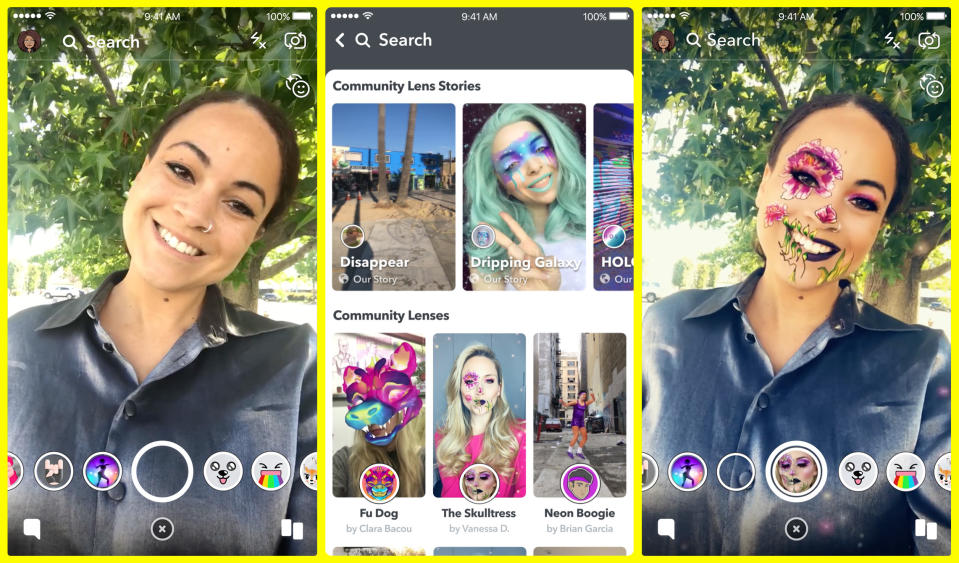

Image source: Snap.

Buying into earnings

Stifel is the latest firm to boost its rating on Snap shares, upgrading from hold to buy while increasing its price target from $13 to $17. Analyst John Egbert believes that Snap's management team was being cautious with its guidance for the second quarter, which calls for revenue of $335 million to $360 million, in part to accommodate potential hiccups as the company reorganizes its sales force.

"Although 2Q:19 could see noise related to a significant sales force reorg., we are increasingly optimistic about Snap's growth prospects in 2H:19 and beyond," Egbert wrote in a research note to investors. "We do not currently forecast a reacceleration in revenue growth but see a higher likelihood of one occurring in the next several quarters as the company continues to expands its advertiser base, foster engagement with premium monetizable content (Discover, Games), and improve engagement / retention on Android devices (particularly in emerging markets)."

On the last earnings call in April, Chief Business Officer Jeremi Gorman said Snap had implemented the reorganization as of April 1, splitting the sales team into three segments to better align with advertiser needs. "A significant portion of our U.S. revenue is transitioning between sales team members, and while we expect some disruption to our near-term business, we are confident that this is the right long-term structure," she said. "Our Enterprise sales team is focused on large brand advertisers with complex buying structures, and is now structured by vertical rather than by region." Snap promoted Luke Kallis to head of U.S. enterprise sales in May as part of the reorganization.

In terms of user metrics, Stifel estimates that Snap could add as many as 3 million daily active users (DAUs), compared to the 1 million DAUs that the Street is expecting Snapchat to gain. Any overperformance in DAU additions would be largely attributable to ongoing improvements in the Android version of Snapchat, which CEO Evan Spiegel has prioritized and framed as "absolutely critical to our strategy." Egbert says the Android revamp has had a "positive initial impact on user growth."

Investors won't have to wait long to hear if Snap is building on that momentum.

More From The Motley Fool

Evan Niu, CFA has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance