Snap CEO Evan Spiegel Doesn't Quite Get Scalability

Snap (NYSE: SNAP) has a scalability problem, and investors should be a little concerned with CEO Evan Spiegel's ability to address it. In a recently leaked memo, Spiegel discussed the difference between size and scale, correctly pointing out that one does not equal the other. "Getting bigger is not a competitive advantage, unless you are also able to achieve scale," Spiegel wrote. Since Snapchat is a software product, it is fundamentally scalable. The tech industry realized this long ago, since software and services can be distributed at negligible incremental costs, which is why companies that sell software and services generally fetch higher valuation multiples.

But there are other telling signs in the memo that underscore Spiegel's naive understanding of scalability, which was obtained by Cheddar last week and definitely worth checking out.

Image source: Snap.

"Having a scalable business model isn't enough."

In the memo, Spiegel argues that Snap needs more than a scalable business model to succeed; it needs a scalable organization that becomes more productive as it grows. But Snap doesn't really have a scalable business model to begin with.

Specifically, Snap's unique hosting strategy, where it pays third-party cloud infrastructure providers for services, is the exact opposite of scalable. Once you get past the conceptual starting point that software is inherently scalable -- Spiegel reiterates that Snap only has to build Snapchat or new features once before deploying to millions of users -- you need to look at financial scalability.

Snap's cost structure does not scale well, because its costs rise commensurately with usage of its service. Snap desperately needs ad revenue to grow faster than hosting costs. In other words, its cost structure is highly variable, whereas a higher proportion of fixed costs is generally better for operating leverage. That allows a company to expand margins as it grows, spreading out fixed costs over a broader base, lowering average total costs.

Typically, investors would look at gross and/or operating margin trends (including seasonal factors) to gauge operating leverage, but Snap is such a young company that this exercise is meaningless. Snap has operated with negative gross margin throughout much of its history, and only reached positive territory in Q3 2016, with a positive 0.3% gross margin that quarter. Gross margin has swung between black and red in the quarters since.

Data source: SEC filings. Chart by author.

Outsourcing 100% of infrastructure needs does result in a capital-light model, which Snap is quick to point out -- capital expenditures were a mere $26 million in the third quarter -- but the savings there are more than offset by soaring hosting costs, which comprised nearly 75% of non-GAAP cost of revenue last quarter.

Snap's biggest achievement with scalability so far

But let's give credit where credit is due. Snap has made an incredibly important move toward scalability: launching its self-serve platform last summer. Transitioning away from a human ad salesforce and automating ad sales and auctions is an undeniably big step in improving operating leverage, despite a decline in ad prices.

On the November earnings call, Spiegel said that 80% of ad impressions were delivered programmatically in the third quarter, up from 0% a year prior.

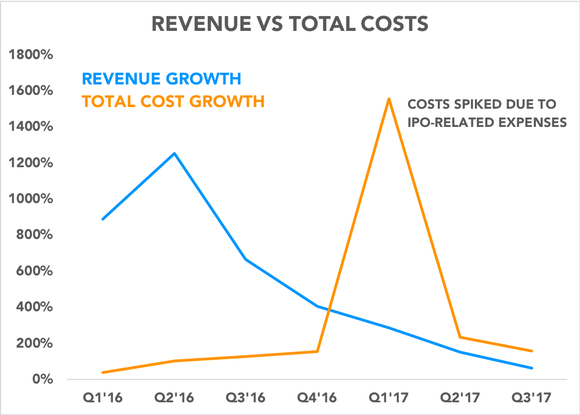

Costs are growing substantially faster than revenue

"If our revenues are growing substantially faster than our costs, we are scaling our business," Spiegel wrote. Throughout 2016, revenue growth skyrocketed, mostly from coming off such a small base in 2015, but expense growth consistently outpaced top-line growth throughout 2017. Note that the big spike in Q1 was due to the IPO, where Snap had to recognize massive stock-based compensation expenses in connection with going public, which included that massive bonus the company doled out to Spiegel for cashing out some shares in the offering.

Data source: SEC filings. Chart by author.

Considering how badly Snap needs revenue growth to outpace cost growth, investors should be concerned with the rapid deceleration of revenue growth.

By just about any measure, Snap has failed the most basic tests of financial scalability thus far. To be fair, Snap is extremely young, and many start-ups struggle with scalability in the early days. Going forward, if Snap wants to actually pursue scalability, the first thing it needs to do is build its own cloud infrastructure.

More From The Motley Fool

Evan Niu, CFA has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance