Skechers' (SKX) Q1 Earnings Beat Estimates, Sales Rise Y/Y

Skechers U.S.A., Inc. SKX reported sturdy first-quarter 2023 results, with the top and the bottom lines outpacing the Zacks Consensus Estimate and improving year over year. Results gained from strength in brands and demand for comfort technology products, aided by solid marketing and distribution capabilities. Also, continued broad-based strength globally, mainly in the company’s direct-to-consumer unit, as well as renewed growth in China further drove the performance.

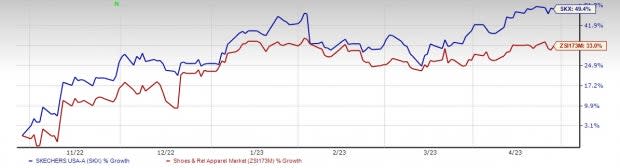

Over the past six months, shares of this presently Zacks Rank #3 (Hold) stock have increased 49.4%, compared to the industry’s 33% growth.

Q1 Highlights

Skechers posted first-quarter earnings of $1.02 per share, outpacing the Zacks Consensus Estimate of 61 cents per share. Also, the bottom line increased 32.5% from the year-earlier quarter’s tally.

Skechers U.S.A., Inc. Price, Consensus and EPS Surprise

Skechers U.S.A., Inc. price-consensus-eps-surprise-chart | Skechers U.S.A., Inc. Quote

SKX generated sales of $2,001.9 million, surpassing the Zacks Consensus Estimate of $1,836 million. The top line grew 10% year over year owing to a 21.1% increase in international sales, accounting for 63% of the overall sales for the quarter. We note that the company witnessed a 4.8% drop in domestic sales due to an 18% decline in the domestic wholesale business,stemming from inventory congestion headwinds. On a constant-currency basis, total sales grew 13.3%.

During the reported quarter, the company launched the Skechers Plus loyalty program in Canada, the United Kingdom, Germany and Spain, and anticipates rolling out the program to more countries.

The company is in the process of updating its present e-commerce platform in Chile, which is among the most productive international sites with plans to launch more e-commerce sites internationally.

Starting from the first quarter of 2022, Skechers reported segmental results for wholesale and direct-to-consumer operations, including its joint venture businesses. Both the company’s segments registered growth, with wholesale sales growing 3.5% and direct-to-consumer (DTC) rising 24.5%. The wholesale business represented 65% of the overall sales in the quarter.

Wholesale sales growth includes increases in Europe, Middle East & Africa (EMEA) of 20% and APAC of 24%. Wholesale average selling price per unit increased 5% while unit volume dipped 2%.

DTC sales growth included increases of 25% in domestic DTC sales and 24% in international DTC sales. DTC unit volume rose 27% and the average selling price slipped 2%. Also, growth of 29% in the Americas, 18% in APAC and 30% in EMEA aided the segment’s performance.

Region-wise, sales dipped 0.1% year over year to $945.9 million in the Americas while the metric increased 21.1% to $534.5 million in EMEA and 20.9% year over year to $521.5 million in APAC.

Image Source: Zacks Investment Research

Margins & Costs

Gross profit increased 18.7% year over year to $978.6 million. Also, the gross margin expanded 360 basis points (bps) to 48.9% due to a rise in average selling prices in the Wholesale and a higher mix of DTC sales.

Total operating expenses grew 16.5% year over year to $755 million. The metric, as a percentage of sales, increased 210 bps to 37.7%. Selling expenses jumped 18.8% from the year-ago period’s level to $128.6 million. Also, general and administrative expenses jumped 16% to $626.4 million. Increased costs were due to the labor, warehouse and distribution expenses, along with elevated facility costs, including rent and depreciation.

Other Financial Aspects

As of Mar 31, 2023, cash and cash equivalents totaled $760 million, while short-term investments amounted to $89.5 million.

Skechers ended the quarter with long-term borrowings of $230.3 million and shareholders’ equity of $3,714.9 million, excluding non-controlling interests of $331.4 million. Further, the total inventory decreased 17.4% to $1,502.2 million.

In the first quarter of 2023, management repurchased roughly 676,000 shares of its Class A common stock for $30 million. As of Mar 31, 2023, $395.7 million was available under SKX’s share buyback program.

Store Update

In the reported quarter, management opened 56 company-owned stores while closing 25 stores. Store openings consisted of 18 in China, 13 in the United States, six each in Thailand and Vietnam, and three each in Germany and Israel.

In the second quarter to date, the company has introduced one company-owned store in the United States. It expects to open between 125 and 140 stores worldwide over the rest of the year.

As of Mar 31, 2023, SKX had 4,549 stores, including 548 domestic stores, 927 international locations, and 3,074 distributors, licensees and franchise stores.

Outlook

For 2023, management believes in accomplishing sales between $7.9 billion and $8.1 billion compared to the earlier view of $7.75-$8 billion. It now envisions earnings per share (EPS) between $3.00 and $3.20 versus the prior expectation of $2.80-$3.00. Total capital expenditures are likely to come in the $300-$350 million band for the year.

For the second quarter of 2023, SKX is likely to achieve sales between $1.85 billion and $1.90 billion and earnings per share of between 40 cents and50 cents.

Eye These Solid Picks

Here we have highlighted three top-ranked stocks, namely, Ralph Lauren RL, Oxford Industries OXM and Deckers DECK.

Ralph Lauren, a footwear and accessories dealer, sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

RL has a trailing four-quarter earnings surprise of 23.6%, on average. The Zacks Consensus Estimate for Ralph Lauren’s current financial-year sales and EPS suggests growth of 5.5% and 14%, respectively, from the year-ago corresponding figures.

Oxford Industries, which designs, sources, markets and distributes lifestyle products and other brands, carries a Zacks Rank #2 (Buy). Oxford Industries has a trailing four-quarter earnings surprise of 18.9%, on average.

The Zacks Consensus Estimate for OXM’s current financial-year sales and EPS suggests growth of 13.7% and 10.4% from the year-ago reported numbers.

Deckers, a footwear dealer, has a Zacks Rank of 2 at present. DECK has a trailing four-quarter earnings surprise of 31%, on average.

The Zacks Consensus Estimate for Deckers’ current financial-year sales and EPS suggests growth of 11% and 17.1%, respectively, from the year-ago corresponding figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Oxford Industries, Inc. (OXM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance