Singapore's Sea More Than Doubles Losses on E-Commerce Spending

By Yoolim Lee

Sea Ltd., operator of Southeast Asia’s biggest gaming platform, said losses more than doubled in the first quarter on rising costs at mobile-shopping unit Shopee as it strives to lure more users with shipping and other promotions.

The Singapore-based gaming and e-commerce company said its net loss during the three months ended in March was $215.6 million, compared with $73.1 million a year earlier. Total revenue rose 65 percent to $155 million.

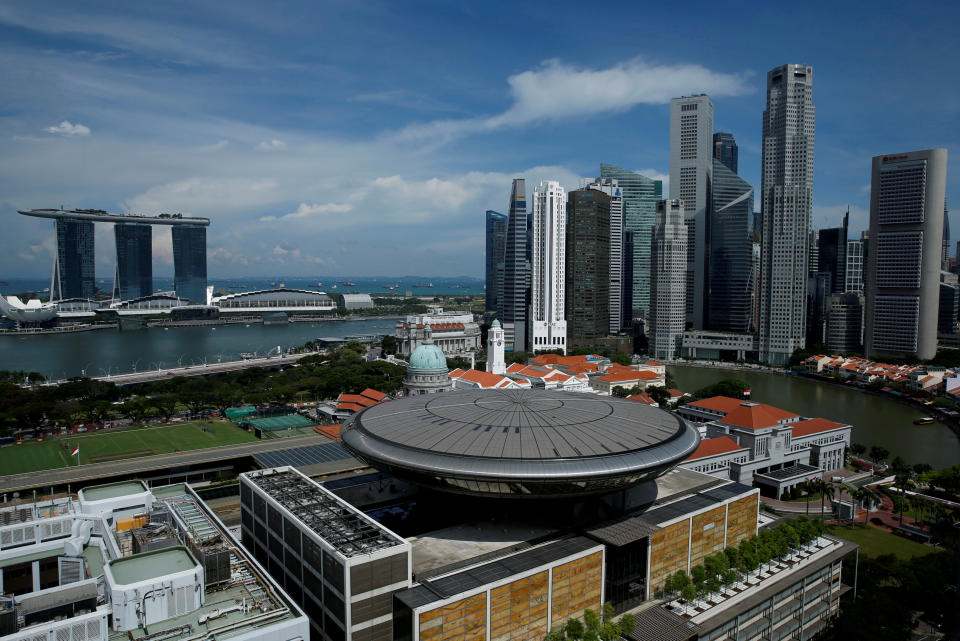

Sea, which initially modeled itself on China internet giant Tencent Holdings Ltd., has struggled since its initial public offering in October. It has invested heavily to expand beyond games into payments and e-commerce. Growing losses have weighed on its shares, which were sold in the IPO at $15 and closed at $10.64 in New York.

The company’s “gross margin will remain pressured and losses will widen as it invests in growth,” Bloomberg Intelligence analysts Matthew Kanterman and Andrew Eisenson wrote in a note ahead of Sea’s earnings report.

Sea said sales and marketing expenses more than double from a year earlier to $152.1 million. Sea has forecast Shopee’s gross merchandise value to reach $7.5 billion to $8 billion in 2018. Shopee’s first-quarter GMV was $1.9 billion, up from $648.3 million a year earlier.

To contact the reporter on this story: Yoolim Lee in Singapore at yoolim@bloomberg.net. To contact the editors responsible for this story: Robert Fenner at rfenner@bloomberg.net. Peter Elstrom

© 2018 Bloomberg L.P

Yahoo Finance

Yahoo Finance