Singapore's JustCo plans to open in four new cities by Q1 next year

Co-working space operator JustCo plans to open centres in Seoul, Melbourne, Sydney and Taipei by the first quarter of 2019, as it forges ahead with its expansion plan.

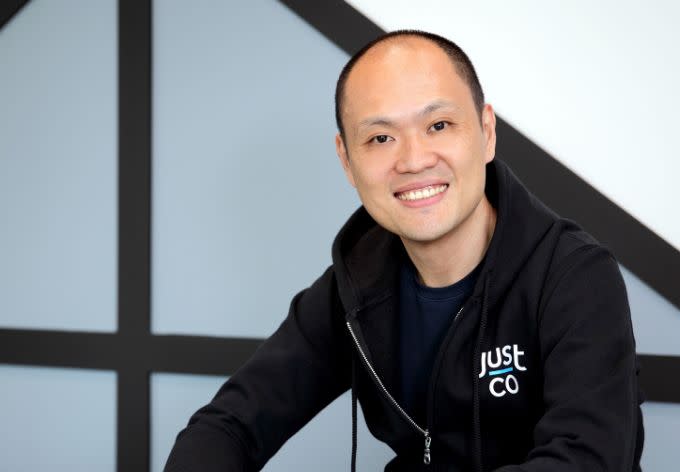

JustCo’s founder and chief executive officer Kong Wan Sing told Yahoo News Singapore that the company plans to open four centres in Seoul, two each in Sydney and Melbourne and four in Taipei.

It’s part of a blueprint to open 100 fully operational centres by 2020, up from the current 19.

On Friday (7 December), the company opened two new centres in Jakarta with its joint venture partner, Indonesian conglomerate Gunung Sewu. This takes the company’s total floor space to more than 650,000 square feet now, from 316,000 sq ft in 2017.

Kong added that JustCo plans to open its flagship centre in Sequis Tower in the first quarter of 2019.

On 6 December, JustCo officially opened a 60,000 sq ft centre in Marina Square, making it the only co-working centre in a mall with capacity for over 1,000 clients, or “members”. In October, its secured a lease for the entire second floor of China Square Central.

Flexible workspace stock in Singapore nearly tripled to about 2.7 million sq ft as of end-June, from approximately 1 million sq ft at the end of 2015, according to the Collier International report “Breaking New Ground” in September. For the full-year, Colliers expects total flexible workspace to grow between 30 to 35 per cent from a year ago, or an expansion of about 670,000 sq ft.

Colliers believes the increasing adoption of a ‘flex’ office component as part of corporations’ commercial leasing strategy – in sectors including banking and financial services, insurance, and technology – will be a crucial catalyst for the sustainable, long-term growth of the flexible workspace sector.

Based on Colliers research, the typical price of a dedicated desk within the Central Business District (CBD) ranges from $700 to $900 per month, implying an average lease rate of about S$7 to S$9 per sq ft monthly, assuming 100 sq ft of office space per desk.

By comparison, the average CBD premium and grade A gross effective rents in the second quarter was $8.82 per sq ft every month.

Collaboration and Community

“Now work is about cooperation and community and that’s why people want to come here instead of renting a space and renovating it,” said Kong. “Today, millennials make up about 50 per cent of the workforce and their attitudes and behaviour are very different. They like a lot of collaboration, not just in their personal lives but in their professional lives as well.”

Justco has about 18,000 members in Singapore. Corporations make up 60 to 70 per cent of JustCo’s clients, and start-ups account for 10 to 20 per cent, he said. They include Wilson Associates and BlackRock, Goodman Fielder and Allianz.

JustCo also helps to curate and manage Verizon Communication’s first Asian innovation space located within its 20,000 sq ft Singapore headquarters at Ocean Financial Centre.

JustCo has less than 10 shareholders, including two strategic investors, GIC Real Estate and Frasers Property investing a combined US$177 million in May, taking its valuation to over US$500 million. Thai developer Sansiri took a 6.09 per cent stake in JustCo in Series B funding for US$12 million completed in September last year.

The company plans to raise more funds in its Series D funding before the end of the second quarter, Kong said. He declined to say when the company will conduct an initial public offering.

Yahoo Finance

Yahoo Finance