What Do Singaporeans Think About the April 2023 Property Cooling Measures?

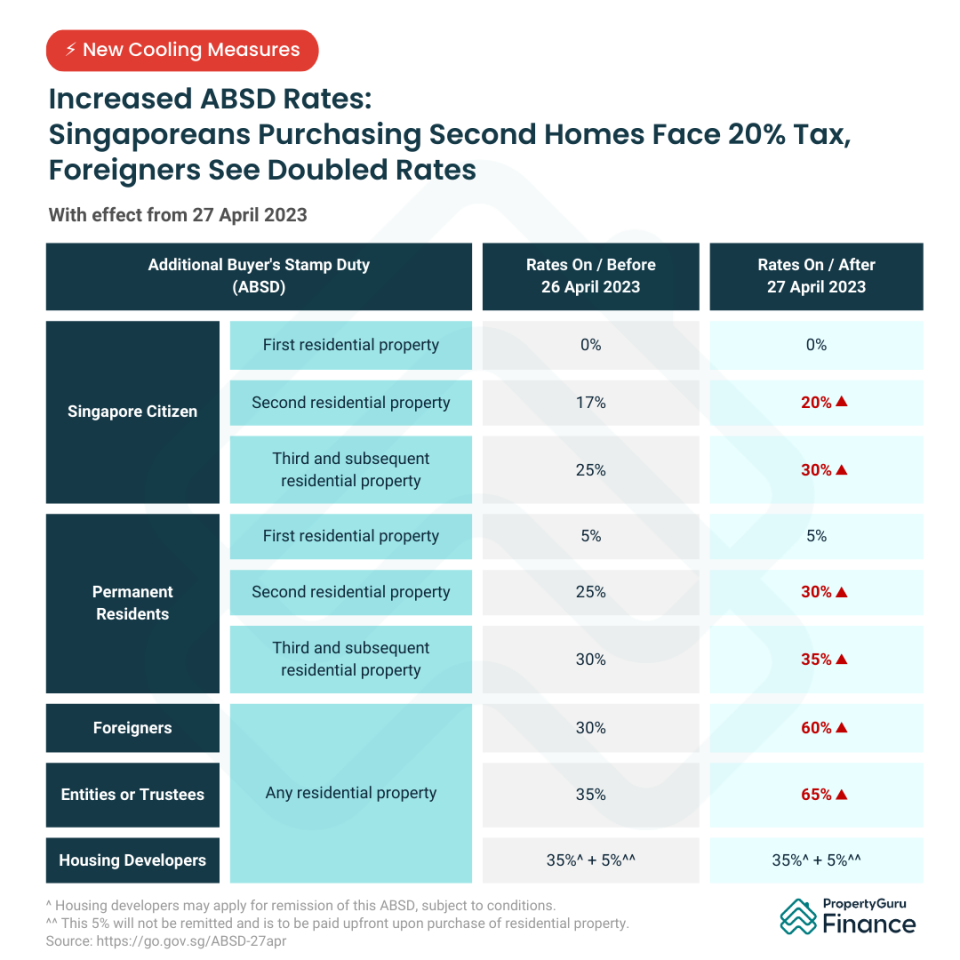

On 27 April 2023, the latest round of cooling measures went into effect, which saw raised Additional Buyer’s Stamp Duty (ABSD) rates for Singaporeans and PRs who were buying their second and subsequent purchases, as well as for foreigners, entities, and trustees.

This new round comes just seven months after the September 2022 property cooling measures and is the third round of cooling measures since December 2021. The Singapore government shared that the April 2023 property cooling measures were introduced after property prices in Q1 2023 showed “renewed signs of acceleration amid resilient demand”.

In order to “promote a sustainable property market and prioritise housing for owner-occupation”, the supply of both private and public housing will also be increased to cater to growing housing demand.

But what do Singaporeans think about the increased ABSD rates? Has it affected their property purchase decisions? Do they think there will be another round of property cooling measures announced soon and if yes, when? Let’s find out.

What Are the April 2023 Property Cooling Measures?

But first, here’s a quick summary of the April 2023 property cooling measures.

These new measures will affect about 10% of residential property transactions. The status quo is maintained for Singapore Citizens and Permanent Residents buying their first residential property.

In addition, the ABSD refund (subject to conditions) for those who purchase their second residential property and sell their first residential property within six months still applies.

Were Singaporeans Surprised by the April 2023 Property Cooling Measures?

Naturally, the implementation of property cooling measures after property cooling measures will impact homebuyers, some of who might even reconsider their property plans.

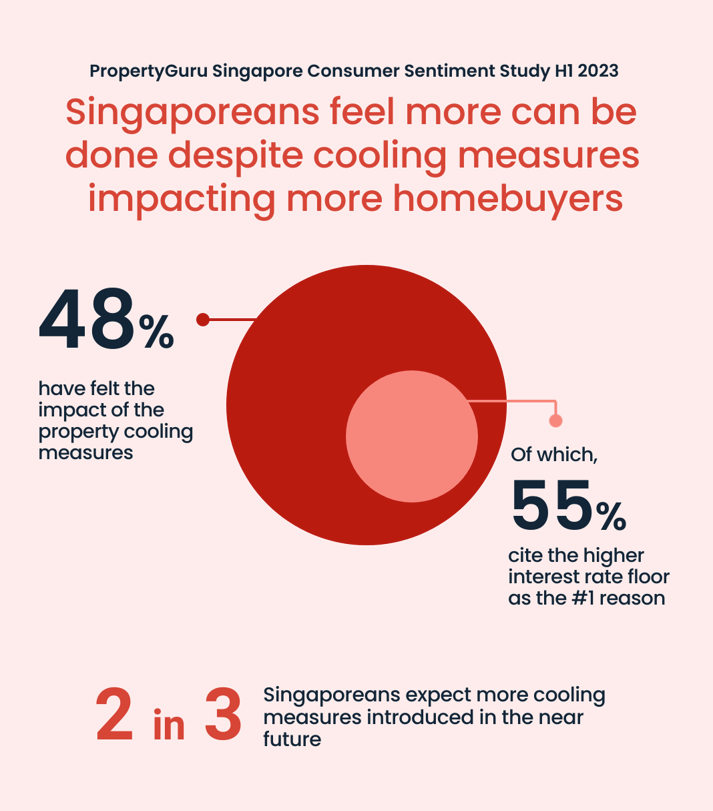

Our PropertyGuru Singapore Consumer Sentiment Study (CSS) H1 2023 released earlier in March 2023 found that 2 in 3 Singaporeans were expecting more cooling measures to be introduced in the near future. Of these Singaporeans, 20% thought it might happen within H1 2023 (and they were right!), while 47% felt it would happen before 2023 ends.

So it came as no surprise to many when the latest announcement came in close to midnight on 27 April 2023.

Despite 48% of those surveyed saying that they have been impacted by the recent waves of property cooling measures and 56% agreeing that the cooling measures have slowed the increase in property prices and value, Singaporeans still felt more could be done to cool the red-hot market.

Likely, this is due to how the perception of housing affordability has declined. According to the CSS H1 2023 survey, 37% felt they were now unable or definitely unable to buy a property, up from 25% in the previous wave.

What Do Singaporeans Think About the April 2023 Property Cooling Measures?

For First-time Home Buyers

Joseph Tan, 32, had been planning to buy a 5-room HDB resale flat in a mature estate with his fiancee. In light of the record-high HDB resale flat prices, he plans to wait it out for a less expensive property – likely a 4-room BTO flat – in a non-mature town.

“Frankly, I was expecting another round of cooling measures, just not this soon! However the new ABSD rates don’t impact me as this will be my first property,” he says.

For Property Investors

For Sylvia Lum, these cooling measures have hit her harder, as the 38-year-old is dabbling in property investment.

“It’s now harder to get a good Return on Investment (ROI) with the whole raft of measures currently in place, such as the higher interest rate floor and the increased ABSD rates.

Yes, rents are also increasing in tandem, but as a landlord, how much can you charge someone? With costs going up as well, for renovations and maintenance and repairs, I’m barely going to break even.”

Her fingers are crossed that there won’t be another round this year, but she’s only semi-hopeful.

For HDB Upgraders

Chua Yiying, 36, bought her BTO flat before the pandemic and is about to fulfil her Minimum Occupation Period (MOP). She is looking to upgrade to a private property. But the teacher is now on the fence about selling her flat, which is valued at close to $1 million as it’s in a mature estate and on a high floor.

The September 2022 property cooling measures deterred those with the financial muscle to buy million-dollar HDB flats. This is because private property owners ‘downgraders’ who were selling their properties to realise their gains now had to contend with a 15-month wait-out period.

While she is not as directly affected by the April 2023 property cooling measures, she is concerned that the double whammy will affect the resale potential of her HDB flat.

“Will I still be able to fetch this price after the MOP? Now that more cooling measures have been announced yet again, will the resale price of my flat dip? And if it doesn’t, can I find a suitable private property that I can afford if I do go ahead with the sale? So many questions.

I’m a maths teacher, so I look at patterns. The previous round was a nine-month gap [between the December 2021 and September 2022 cooling measures]; this time it’s seven months [between the September 2022 and April 2023 property cooling measures]. Will we be seeing another round in five months’ time?” she wondered.

Will There Be More Property Cooling Measures in the Near Future?

Property cooling measures are meant to curb demand for property and keep pricing growth sustainable; they are typically introduced when property prices hit a high and remain on a prolonged upward trajectory.

According to the PropertyGuru CSS H1 2023 report, against the backdrop of this pricey property landscape that seems to keep getting costlier, only 1 in 3 Singaporeans (33%) agreed that the September 2022 cooling measures have successfully promoted a stable and sustainable property market. This sentiment was more keenly felt among high-income individuals (38%), despite them being most affected by the spate of cooling measures.

In the upcoming CSS H2 2023, we will survey Singaporeans about how they feel about the April 2023 property cooling measures to assess if the sentiment has shifted. But whether there will be more property cooling measures, all we can say is that the Government is keeping a close eye on the property market.

For more property news, content and resources, check out PropertyGuru’s guides section.

Looking for a new home? Head to PropertyGuru to browse the top properties for sale in Singapore.

Need help financing your latest property purchase? Let the mortgage experts at PropertyGuru Finance help you find the best deals.

Yahoo Finance

Yahoo Finance