Singapore’s wealthy may not retire as comfortably as expected

There is a big gap between expectations and the reality of retiring comfortably, according to Standard Chartered’s new Wealth Expectancy Report 2019. The Wealth Expectancy Report 2019 results show that based on the existing saving and investment habits of emerging affluent, affluent and high-net-worth individuals (HNWIs) surveyed, nearly 50 per cent of the savers in Singapore will fall short of their desired retirement goal.

The Wealth Expectancy Report 2019 examines the saving and investment habits of 10,000 savers across 10 markets – China, Hong Kong, India, Kenya, Malaysia, Pakistan, Singapore, South Korea, Taiwan and the UAE. Savers refer to the emerging affluent, the affluent, and high net worth individuals (HNWIs) with varying market-specific

income bands

The Wealth Expectancy Report 2019 compares the wealth aspiration they have for retirement against the wealth they expect to accumulate by the time they reach their highest point of affluence, assumed to be at age 60 (wealth expectancy).

The difference between wealth aspiration and expectancy is defined as the wealth expectancy gap. Wealth expectancy is calculated by taking the total net wealth at age 60, including financial assets and property assets, less any liabilities such as mortgages and child-raising expenses. Total wealth expectancy does not include any available state pension or other benefit provisions. To calculate this gap, the total wealth expectancy is converted into monthly consumable wealth expectancy to enable direct comparison with monthly wealth aspiration.

Singapore’s wealth expectancy gap according to Wealth Expectancy Report 2019

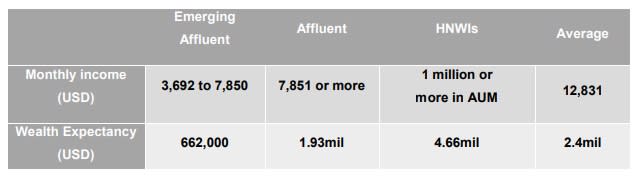

There is a sizable gap between Singapore respondents’ wealth aspiration and what they expect to achieve. With an average wealth expectancy of US$2.4 million (US$622,000 for the emerging affluent, US$1.9 million for the affluent and US$4.7 million for HNWIs) and based on the projected life expectancy of 91 years, Singapore respondents can expect to survive on an average of US$6,666 each month after retirement. This falls below their current average monthly income of US$12,831.

To sufficiently fund the lifestyle they aspire to have after retirement, the expected wealth created will only last the affluent 16 years, and the emerging affluent and HNWIs 19 years. Only 52 per cent of Singapore’s savers have crossed the halfway mark in reaching their wealth aspirations. While this place the Singapore respondents above the global average of 44 per cent, there remains the other half who are looking set to be disappointed come retirement.

Top financial goals according to Wealth Expectancy Report 2019

In Singapore, the emerging affluents’ financial goals are divergent from their more affluent peers. Saving for retirement is a top financial goal for two-fifths of the emerging affluent, which is more than any saver group in any other market and double Singapore’s affluent (23 per cent) and HNWIs (21 per cent). Interestingly, 22 per cent of HNWIs cite healthcare needs as a financial goal which is higher than the global average of 17 per cent.

Preferred financial tools to achieve wealth goals

Savings accounts, property investment and fixed deposit accounts are the top three preferred financial tools for Singapore respondents. Surprisingly, Singapore’s emerging affluent are second most likely of the 10 markets to focus on savings accounts (73 per cent), and the least likely to use real estate investment trusts (23 per cent). Singapore’s affluent and HNWIs, on the other hand, are open to more advanced investment products, such as equities and real estate investment trusts, which may play a role in helping them grow their wealth faster.

Interestingly, the affluent (40 per cent) and HNWIs (38 per cent) are more likely to utilize digital investment tools and online investment portfolios, as compared with 24 per cent of the emerging affluent surveyed. 71 per cent of the affluent felt that that managing their money digitally has helped them to feel more in control of their finances.

Legacy planning is a top concern for Singapore respondents. Singaporean savers are anxious about transferring their wealth to their children. Although 63 per cent of them do have a wealth transfer strategy in place, nearly half of them don’t feel sure of the best approach to take when it comes to transferring wealth to the next generation.

Dwaipayan Sadhu, Head of Retail Banking Singapore, said: “It is not easy, even for the affluent, to plan and achieve one’s retirement goals. This study shows that many are choosing savings accounts to grow their wealth, which affords capital protection and liquidity, at the expense of returns once inflation has been factored in.

“To close the wealth expectancy gap, we should also rely on a diversified portfolio of investments to lift and protect returns across market cycles. We can start by developing a better understanding of our retirement aspirations, risk appetite, and the market outlook.”

Mr Paul Ho, chief mortgage officer at iCompareLoan, said, “It is understandable why property investment is among the top three preferred financial tools for Singapore’s HNWI. Masterplan 2019 positions Singapore as a livable city, a global business gateway and tourist haven. With such positioning by the government, it is understandable why property investment volumes will be driven-up here. There is a lot of excess fluidity in the region and Singapore is seen as a safe haven for real estate investments.”

He added, “the Singapore government is also proactive in keeping the property market here stable. More recently, it drew up a slew of measures to curb a property bubble from being formed here. Investors see all such activities by the Government in a positive light. Although it curbs excessive speculation, these measures assures investors their investment is safe in a country where the rule of law, especially in economic matters, is paramount.”

The post Singapore’s wealthy may not retire as comfortably as expected appeared first on iCompareLoan Resources.

Yahoo Finance

Yahoo Finance