Singapore’s REITs – An oasis in the property market desert

Singapore’s property market has been in decline for the last three years. A number of factors have led to a prolonged slump in residential, commercial, and industrial real estate. Capital values are down and so are rentals.

Before the fall in real estate values took hold in 2013, the country had seen a sustained increase in prices in the five-year period beginning in 2008. Alarmed by this continuous appreciation in prices, the government introduced several ‘cooling measures’ to control values.

These had an immediate effect and led to a reversal in the growth in prices. The decline in prices that took hold in 2013 continued into 2014 and 2015. In the first two quarters of 2016, residential, retail and office property values continued to register declining values. But this seems to have picked up in the second half of the year.

Thankfully, there are many ways of investing in real estate.

REITs to the rescue

Amid the gloom in the real estate sector, real estate investment trusts have

Source: Thinkstock/Getty Images

remarkably well.

The SGX S-REIT Index of Singapore Exchange-listed REITs registered a return of 12.2% from the beginning of January to early July this year. This is significantly better than the 7.6% return recorded by the MSCI World REIT Index in the same period.

Singapore’s REITs, which are also known as S-REITs, enjoy several advantages that have led to a growing level of investor interest.

Why are REITs successful in a declining property market?

Source: Thinkstock/Getty Images

A REIT is essentially a fund that pools the money invested by individuals and other investors and buys income-generating real estate assets. The property that is purchased could include shopping malls, offices, industrial buildings and hotels.

These purchases yield rental income that is then distributed at regular intervals to investors.

REITs have been extremely successful because of a number of reasons:

Investors can get the benefits of owning property without having to spend time on all the documentation and procedural matters that are normally associated with real estate transactions.

Additionally, they can decide the amount that they want to invest. They can invest as much or as little as they want. Usually, property investment requires large sums of money.

Another important advantage is that it is possible to liquidate REIT holdings immediately. On the other hand, selling real estate that you own is a long-drawn and cumbersome affair.

Purchasing REITs allows for diversification of the real estate portfolio. A REIT can continue to perform well even if one of its investments does not turn out as planned.

REITs that focus on a particular sector, say commercial property or hotels, provide the opportunity for making targeted real estate investments.

Their regular cash flows from rentals allow investors to get a periodic return. If a REIT wants to retain its tax-exempt status, it is required to distribute at least 90% of its taxable income each year. This rule ensures that investors can expect a steady dividend inflow.

The income that is distributed to investors as dividends by REITs is tax-exempted.

Can REITs continue to perform well?

Ultimately the success of a REIT depends on the value and income-generating capacity of the underlying properties that it owns. Even the best-managed REITs will not be able to provide a sustained level of returns in the face of a falling real estate market.

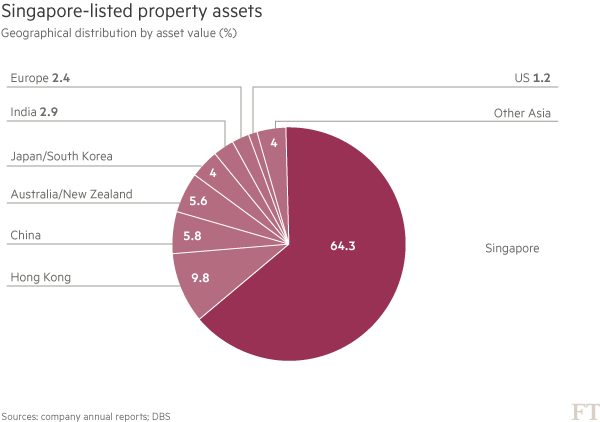

But S-REITs have expanded beyond the country’s shores. About 36% of the value of S-REITs is accounted for by foreign assets.

Source – The Financial Times

For example, Frasers Logistics & Industrial Trust raised US$672 million by listing Australian properties on the Singapore Exchange. This was the biggest IPO fundraising exercise in Singapore in more than three years.

Another company, Manulife Financial Corp, raised US$519 million by listing US properties in Singapore in May. This S-REIT is backed by three office buildings in Atlanta and Los Angeles.

Manulife, which is Canada’s largest life insurance company, had tried to launch a US$420 million issue in Singapore in 2015 but withdrew citing unfavourable market conditions. By a stroke of bad luck, the issue had been planned at the time of the market crash in China and the financial crisis in Greece.

REITs that invest in properties outside Singapore give investors the opportunity to benefit from real estate markets around the world. This is especially important when the Singapore property market is plagued by overcapacity and falling rents.

Global companies find Singapore an ideal destination to launch REITs because of the depth of the market in the city-state. Singapore’s REIT market is the second largest in Asia. Only Japan’s market is larger.

According to a report in the Financial Times, the market capitalisation of S-REITs is $68 billion, compared with a market cap of $894.7 billion for all Singapore-listed companies.

Investors in Singapore are fortunate to have the option of investing in the country’s S-REITs. Foreign assets give the REITs the ability to provide returns despite a lacklustre local property market.

When Singapore’s real estate market finally turns around, investors will gain as about two-thirds of S-REIT holdings are in local properties.

(By Ravinder Kapur)

Related Articles

- What is happening in Singapore property markets?

- Singapore residential market: Is it worth investing at the moment?

- Factors to consider before purchasing commercial property in Singapore

Yahoo Finance

Yahoo Finance