Singapore Post – Improved Profitability, But E-commerce Still A Drag

Singapore Post (SingPost) reported a 7.6 percent year-on-year rise in total revenue to $441.4 million for 3Q19. Total net profit attributable to shareholders rose 15.6 percent to $50.2 million, mainly due to an exceptional item of $31.8 million relating to the gain on dilution of interest in 4PX, an associated company.

It was earlier announced that 4PX has issued additional shares to its existing shareholder Zhejiang Cainiao Supply Chain Management. As a result, SingPost’s shareholding, through Quantium Solutions, has been diluted down to 19.75 per cent.

A summary of the quarterly financials is shown below:

Summary Financials | 3Q 2018 | 2Q 2019 | 3Q 2019 |

Revenue ($’000) | 410,390 | 368,672 | 441,375 |

QoQ change in Revenue (%) | 19.7% | ||

YoY change in Revenue (%) | 7.6% | ||

Operating Profit ($’000) | 46,143 | 39,953 | 42,227 |

Operating Profit Margins (%) | 11.2% | 10.8% | 9.6% |

QoQ change in Operating Profit (%) | 5.7% | ||

YoY change in Operating Profit (%) | -8.5% | ||

Net Profit Attributable to Shareholders | 43,413 | 25,149 | 50,202 |

Net Profit Margins (%) | 10.6% | 6.8% | 11.4% |

QoQ change in Net Profit (%) | 99.6% | ||

YoY change in Net Profit (%) | 15.6% |

Despite the impressive rise in quarterly and yearly rise in the overall net profits attributable to shareholders during 3Q19, a closer look at the income statement would have uncovered that the five-year trends in the operating profit margins since 3Q15 has been declining.

Source: Company’s financials

One of the reasons for analysing the group’s third quarter is that it coincides with the December year-end. Typically, it tends to be a busy quarter where due to high shipment volumes during the season of gift giving.

Looking at the operating profit trend of SingPost, we think that SingPost might not be maximising its operating profit per unit dollar of revenue even as it increases in operating capacities.

Balance Sheet And Cash Flow

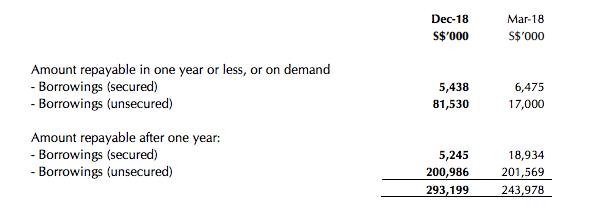

As at 31 December 2018, the Company has cash and cash equivalent of $345.9 million, along with total interest bearing debt of $293.2 million. A breakdown of the short-term and long-term borrowings, and their maturity terms is shown below:

Source: Company’s Financials

The Company’s net cash from operating activities (net OCF) has also declined to $99.3 million during the nine months ending 31 December 2018. This is down from the $146.5 million in net OCF during the same period last year. The interest coverage ratio (EBITDA/Interest Expense) also rose to 25.2 times in 3Q FY19 from 20.3 times in 3Q18.

E-commerce Business Still A Drag

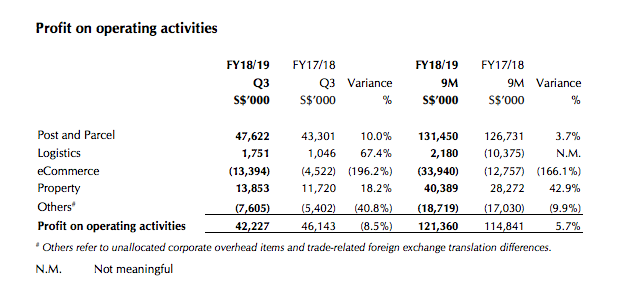

As shown below in the segmental information, while most of the business segment recorded better profitability, the e-commerce business continued to stay in the red with a loss of $13.4 million during the latest quarter, more than the $4.5 million loss suffered in the previous year.

The Company noted in the press release that the loss suffered at the e-commerce business was due to the intensified pressures in the US and several businesses in the e-commerce sector have already filed for bankruptcies. It also noted that while the US businesses recorded higher revenue during the quarter, costs also rose significantly to support these businesses, including costs incurred through freight outsourced services, which resulted in compressed margins despite the critical peak season.

Source: Company’s Financials

Many Unanswered Questions

As readers might have noted, SingPost’s bottom line in 3Q19 was supported by exceptional items. Meanwhile, although international mail revenue rose 16.3 percent owing to higher cross-border volumes from Alibaba Group (BABA), through 4PX, during the Single’s Day (11 November 2018) event, there has not been much information being disclosed on the extent of the partnership agreement which was being forged in May 2014.

As noted in 13 November 2018 article entitled, “Has SingPost Benefited From Alibaba Partnership?), BABA has acquired a 10 percent stake worth $313 million (Rmb1.5 billion) in SingPost back in May 2014. However, management has not discussed in detail the progress of the partnership with BABA.

We noted that while Post and Parcel business segment might have been positively impacted by the Single’s Day event in 2018, investors might be wondering why it has not improved fundamentals for the e-commerce business segment. Has SingPost explored on partnering with BABA in various e-commerce initiatives while trying to reduce their reliance on the US e-commerce business?

Likely, there will also be many questions which management needs to address, including the various incidents of theft and misappropriation of mail by rogue employees happening recently which was reported by the press. As this is the second year of the new management team under CEO Paul Coutts, it might be timely for shareholders to be updated on the progress of the overall corporate restructuring efforts.

Related Article:

Yahoo Finance

Yahoo Finance