The ‘silver lining’ in the dismal U.S. jobs report

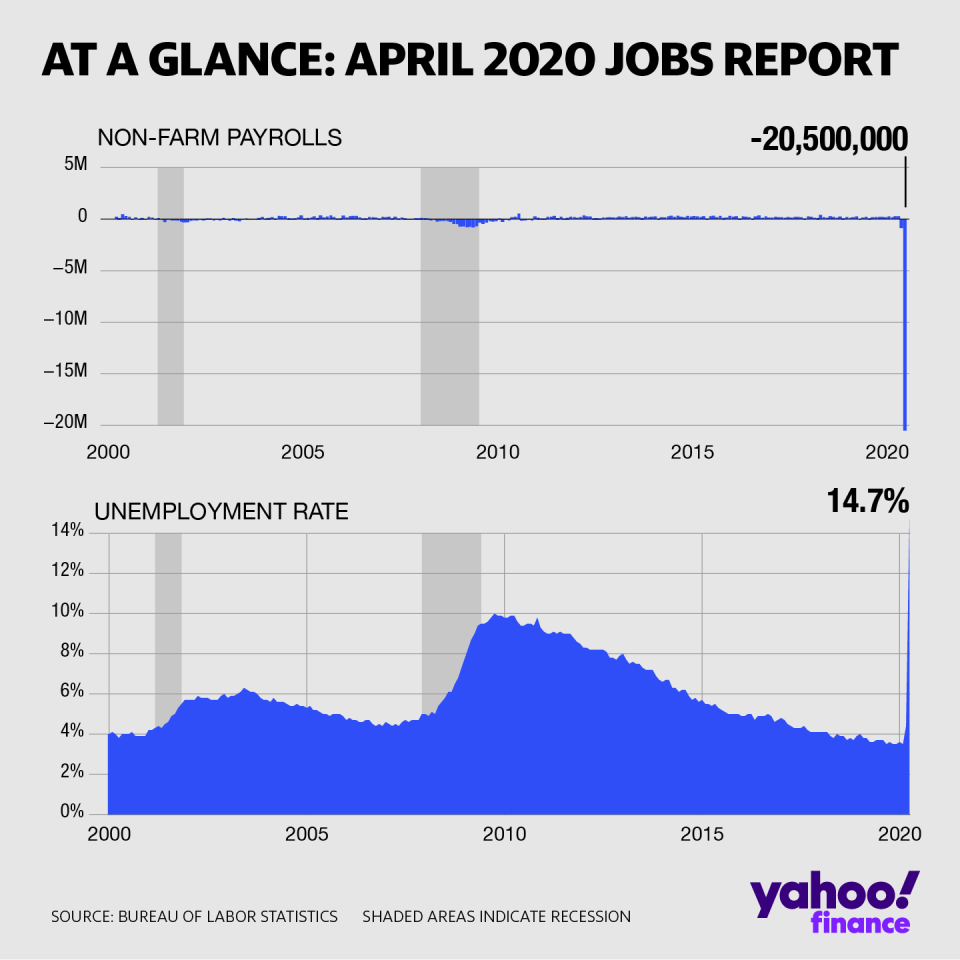

Despite shedding a whopping 20.5 million payrolls and unemployment soaring to 14.7% in April, the U.S. labor market saw one worker category spike that gives hope for a quick economic recovery.

“If you do want to find a silver lining within the data, almost all of the increase in people that lost their jobs believe that the layoff is temporary at this point, about 97%,” Matthew Luzzetti, U.S. chief economist at Deutsche Bank tells Yahoo Finance. ”If that proves to be accurate, it is a positive sign.”

The number of unemployed people who reported being on a temporary layoff, according to the Bureau of Labor Statistics’ household survey, increased to 18.1 million in April from just 1.8 million in March and 801,000 in February. In other words, most of these workers expect to get their old jobs back.

“In a normal recession, nearly all the unemployed are permanent job losers,” Paul Ashworth, chief economist at Capital Economics notes. “Admittedly, temporary layoffs may still turn into permanent job losses. But, for now at least, the hope is that this means the unemployment rate will fall back much more quickly than normal, as the lockdowns are eased.”

[Read More: Stock market news live updates: Wall Street rallies as data show historic jobs report collapse]

Despite the temporary layoff figures, Luzzetti expects unemployment will decline slowly as states begin re-opening. He predicts double digit unemployment even towards the end of the year, and a 7% rate by the end of 2021.

“My concern is that re-opening is not flipping a switch and it's not just going back to 100% for a lot of these businesses. It’ll be a much slower process.”

Luzzetti also cautions that the April unemployment rate may be underestimating the job loss pain, pointing to the BLS’s caveat signaling the rate could’ve been 5 percentage points higher because of how the household survey interviewers are classified.

He also notes that the labor market continues to deteriorate, as refelcted by another 3.169 million Americans filing for first time unemployment benefits last week.

That said, much will hinge on how quickly businesses re-open, and whether most of the jobs lost actually prove to be temporary.

“If we are able to reopen more quickly, there is obviously a demand for small businesses to get back up and running and to bring people back onto their payrolls,” said Luzzetti. “If these people who believe it’s temporary prove to be correct, you could see a much more rapid decline in unemployment rate.

Ines covers the U.S. stock market from the floor of the New York Exchange. Follow her on Twitter at @ines_ferre

Read more:

'The market is getting way ahead of itself now:' portfolio manager

It would be unprecedented for a bear market to be this short: Wells Fargo Strategist

Recent rally could be a ‘bear market trap’: Miller Tabak Strategist

A view from the trading floor: Algorithms having ‘outsized impact’ amid coronavirus impact

Find live stock market quotes and the latest business and finance news

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Yahoo Finance

Yahoo Finance