SI Research: Wheelock Properties (Singapore) – Developer With Deep Pocket

Based on statistics from the Urban Redevelopment Authority of Singapore, property price index slumped across the residential and commercial sectors in 1Q17. But the latest tweaks to property curbs in March 2017, which saw some measures being scaled back, helped to fuel sentiments that a gradual recovery in the property market – from a 3.5 year slump – is underway.

Reflecting the improved sentiments, the FTSE Real Estate Holding and Development index is the second largest gainer amongst Singapore’s sector index, registering about a 23 percentage gain since the start of the year. In contrast, the local benchmark Straits Times Index only rose 12.4 percent.

With brokerage houses also giving more calls to go long on the property sector, we look to Wheelock Properties (Singapore) (Wheelock), a deep pocketed developer that is seemingly undervalued.

About Wheelock

Wheelock is a primarily a property investor and developer with focus on luxury residences. Amongst its ongoing residential development projects in Singapore are Scotts Square Residences, Ardmore Three and The Panorama. In addition, the company has one residential development project in China’s Fuyang district comprising villas, townhouses and duplexes on a site area of 3.2 million square feet.

Apart from residential development, the company also owns two commercial properties, Wheelock Place and Scotts Square in the bustling district of Orchard Road, under its investment portfolio.

Financial Performance

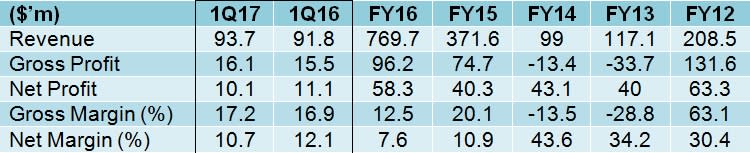

Source: Company

As with all property counters, financial performances fluctuate to some degree due to the project-based nature of the business. For Wheelock, revenue is recognised on the percentage of completion method for properties in Singapore while revenue from sale of development properties in China is recognised upon the handover of ownership to purchasers. The difference in recognition results in volatility of earnings between comparable periods.

Nonetheless, for 1Q17, Wheelock generated about 2.1 percent higher revenue of $93.7 million owing to increase in sales of Ardmore Three and Fuyang’s property. However, Wheelock’s net margin was corroded by expenses relating to higher selling and marketing efforts. As a result, net profit was dropped about 9.9 percent to $10.1 million.

As of 1Q17, most of Wheelock’s existing development properties are near the end of the project life. The company has also not announced any new undertaking of land tenders or new development projects in the recent years. Therefore, going forward, we do not expect incremental growth in financial performance.

Deep Pocket

The argument for Wheelock is not in its upcoming financial performance but rather the deep value entrenched within its balance sheet. We argue, with its strong balance sheet and excess cash, Wheelock may well be one of the developers best positioned to capitalise on any investment opportunities when Singapore’s property market turnaround.

In its latest financial 1Q17 result, Wheelock has a cash balance of $530.6 million and zero debt. This gives Wheelock a net cash position of $0.443 per share or 23.6 percent of the current share price of $1.88. Meanwhile, investment properties and development properties amounted to a value of $1.9 billion or about $1.57 per share. In other words, after accounting for the cash portion, investors are effectively getting an 8.5 percent discount for Wheelock’s properties alone!

Conversely, Wheelock’s total liabilities only amounted to $203.6 million while current assets itself amounts to $1.3 billion. Reasonably, barring that the company seeks out acquisitions or land-banking opportunities, we can expect that Wheelock’s cash assets would increase to over $1 billion in next few quarters as it continues to book in sale proceeds.

In addition, Wheelock already recorded a fair value loss on both Wheelock Place and Scotts Square by a total of $54.3 million in 4Q16. Given that, we can assume that a turnaround in the property market may help lift Wheelock’s investment properties value for FY17 and hence give investors deeper value at the current share price.

Privatisation Candidate

As a whole, Wheelock has a massive net asset value of $3 billion ($2.52 per share). Against the current share price of $1.88, Wheelock is thus changing hands at 0.75 times price-to-book (P/B) or at a 25 percent discount.

With the steep discount of its shares, getting economically viable funding options from the equity market might be a challenge for Wheelock. This is in addition to the fact that the company has to incur costs for listing on the Singapore Exchange. Given that the company’s land-banking activities also have been somewhat muted, there may be possibility that there is intention for Wheelock to be privatised.

Wheelock and Company, the parent of Wheelock, owns about 76 percent of the company. Assuming the parent offers a 15 percent premium to the current share price, it would only require slightly over $620 million to take Wheelock private. In doing so, the parent will be able to gain excess to its ballooning cash pile that potentially could be over $1 billion.

Valuation

Source: Company

Comparing against the selected peers, Wheelock is trading at the lowest P/B (along with UOL Group) and is the only counter that stands at a net cash position. On the other hand, Oxley trades at a higher P/B multiple although its net debt outweighs its market capitalisation.

Even if a privatisation of Wheelock does not materialise to unlock shareholder value for investors, Wheelock’s consistent yearly dividend per share of $0.06 still offers an attractive 3.2 percent yield on the current discounted share price.

Yahoo Finance

Yahoo Finance