SI Research: Singapore Telecommunications – A Buy Despite Subdued Telecom Sector?

The Telecommunication sector remains under pressure with the entry of two new Mobile Virtual Network Operators (MVNOs), Circles.Life and Zero Mobile as well as the impending debut of TPG Telecom (TPG) as the fourth mobile network operator. In an already-saturated market, existing operators will likely see their mobile average revenue per user (ARPU) and broadband ARPU pinched in the increasingly competitive environment. In anticipation of TPG’s entry, analysts are projecting that the new entrant could secure a market share of about six percent by 2021. Why then is Singapore Telecommunications (Singtel) still the sole buy pick in a subdued sector?

Transformation-Focused

Singtel aims to grow its digital business to strengthen competitiveness as competition intensifies in the telecom industry. The transformation is aimed at rapid digitalisation of its core businesses as well as expansion of its digital offerings including cybersecurity, data analytics and digital marketing.

Resilient Financial Performance

Despite the increasingly competitive environment, Singtel’s financial performance remains rather resilient: FY18 operating revenue still grew 4.9 percent to $17.5 billion, largely driven by growth in mobile and fixed broadband customer numbers at Singtel’s wholly-owned Australian subsidiary Optus, as well as higher contribution from Turn’s and Amobee’s media and social businesses from the Digital Life division.

While weaker performance from the Enterprise segment dragged on profitability, overall EBITDA still grew by 1.8 percent to $5.1 billion as the Digital Life segment saw EBITDA loss halved from $122.2 million to $51.3 million.

Despite that though, underlying net profit slid 8.4 percent to $3.5 billion owing to lower contributions primarily from its Indian associate Bharti Airtel (Airtel) and Indonesian associate Telkomsel. Overall, profit contributions from associates declined 14.7 percent to $2.5 billion.

But that did not induce Singtel into reducing its dividend payment. Instead for FY18, Singtel maintained its payout of 17.5 Singapore cents for ordinary dividends, while topping up a special dividend of three Singapore cents in 1H18 upon the divestment of stakes in Netlink NBN Trust. Excluding the special component, ordinary dividends constituted an 81 percent payout ratio, much higher than the group’s committed payout ratio of 60 to 75 percent. That said, going forward to FY21, management has guided that it would maintain an absolute payout of 17.5 cents, before resuming its regular payout guidance This demonstrates the management’s confidence that earnings would not be unduly affected by the intensifying competition in the telecom industry.

The sustainability of Singtel’s dividend payout is supported by its strong cash-generative abilities. In FY18, free cash flow increased 12.8 percent to $3.6 billion.

ARPU Pressure But Long-Term Fundamentals Intact

With regards to the changing mobile environment, the telco industry is seeing a transition. For the telco service providers, ARPU dilution is likely to persist as users are still substituting traditional voice services for data services. Also, more and more users are also switching out of the traditional bundled price plans for SIM-only plans. This would reduce the subscription fees, translating to weaker service revenue for the telcos.

However, data growth would eventually fully mitigate the decline in traditional voice services. Ultimately, the industry long-term fundamentals of being a defensive sector remain, though near-term headwinds are indeed challenging.

Headwinds Not Protracted

Besides, Singtel would be least affected by the debut of fourth mobile operator in Singapore as its overseas operations account for about 70 percent of its bottom-line contributions. Its growing exposure in digital-related business, combined with its entrenched position in the regional mobile markets, will continue to allow it to win new customers and capture strong growth for data demand.

Despite intense competition in India, Airtel continued to grow its mobile customer base. For FY18, Airtel registered a record 304 million of mobile customers and 15.2 million of data customers. This is notwithstanding the telco consolidation scene in India, after Airtel proposed to acquire Tata Teleservices in October last year.

Over in Indonesia, the mandatory prepaid SIM card registration exercise saw the Indonesia government blocking 100.9 million prepaid SIM cards in March. This exercise impacted Telkomsel’s total mobile customer base, as Telkomsel saw 43.3 million SIM cards blocked by the Indonesian government which resulted in the customer base falling by 3.6 million in 1Q18 as compared to an increase of six million in the preceding quarter.

However, in total, Telkomsel still registered double-digit growth of 14 percent in mobile customer over a one-year period to 193 million. The effort to clear up the data bank and combat the misuse of SIM cards by regulators would not have a lasting impact on Indonesian telco’s given that it is a one-off gradual exercise. Earnings will likely recover after the registration cut-off date of 1 May 2018.

New Grounds, New Hopes

The rising demand to digitalise the society and economy is providing significant growth opportunities for Singtel. Accelerating growth in demand for cyber security and digital marketing are essential drivers for the next leg of growth in the 21st century. Given its economies of scale and operating experience Singtel is equipped with the economic clout to compete in the digital era.

Even though Singtel is dealing with pressure on several fronts, its cost rationalisation exercise and a revised payout policy should reassure investors. Strong cash flow and sustainable dividend outlook should also instill confidence about Singtel.

While the market has sold down the stock owing to concerns about the competition TPG Telecom brings, Singtel’s diversified earnings, growing market share in digital-related businesses and entrenched position in the regional mobile market, should be analysed in an overarching perspective.

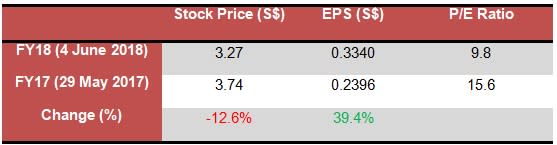

As at 4 June 2018, Singtel’s share price has fallen to a new 52-week low of $3.25 and currently hovers around $3.27 per share.

Presently, the stock is trading at a price-to-earnings (P/E) ratio of about 9.8 times, lower than 15.6 times a year ago. Excluding the gains from the sale of stakes in Netlink NBN Trust, adjusted P/E would be 15.3 times.

Regardless, Singtel still has a sound long-term prospect but is experiencing some challenges in the short-term. Its low valuation right now, along with an attractive yield of 5.4 percent is why it remains a preferred pick amongst Singapore telcos.

Yahoo Finance

Yahoo Finance