SI Research: Singapore Exchange – The Undervalued World Class Stock Exchange

Yes, the enbloc fever is back in Singapore, and so is the “IPO fever”! Just last month, in November alone, there were five additions to the local stock market! The slew of the latest IPOs paints a good picture of the current sentiments: Early childhood educator MindChamps Preschool was 21.4 times oversubscribed with its share price closing 7.2 percent above its debut price. Meanwhile, the public offer for RE&S Holdings was 37.8 times oversubscribed and the Japanese food and beverage concept operator and owner saw its shares pop 61.4 percent above its IPO price on debut day.

Generally speaking, for more companies to IPO this year, the companies themselves must feel that they are able to draw on stronger investors’ interest. In all, the 19 IPOs in the first 11 months this year have collectively raised $4.6 billion – twice the amount in 2016. The listings added a staggering $8.3 billion in market cap to the local stock bourse, compared to 16 IPOs last year which only added $4.4 billion. This is a good sign for the bourse operator who is none other than Singapore Exchange (SGX).

Trading Volume Is Returning For Equities and Fixed Income

The business of a stock bourse operator is simple and intuitive: SGX generates revenue primarily from securities (equities, fixed income and derivatives) clearing and settlements and provision of issuer services (IPOs). One key metric investors look at is trading volume.

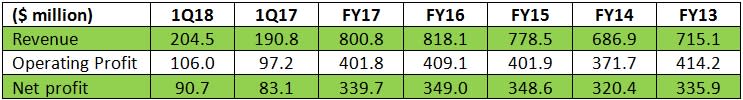

Compiled by Shares Investment

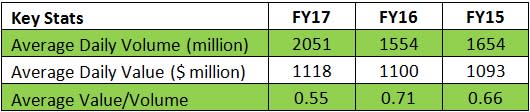

During FY14 to FY16, the equities and fixed income (EFI) segment saw a period of decline in trading volume as Singapore’s economy was hurt by the crash in oil price. In FY16, total securities traded under this segment were only 389 billion, almost half of what it used to be in FY13 prior to the oil price crash. But in FY17, EFI trading volume began to recover and total securities traded ended up about 32 percent above the previous year, with some 515 billion total EFI securities being traded.

In the current 1Q18, total EFI securities traded volume was 133 billion, translating to a further 33 percent improvement to the volume of 100 billion in 1Q17. Correspondingly, total traded value increased 17.7 percent to $73.2 billion. Assuming trading volume continues to recover at a constant rate of 33 percent for the full financial year, FY18 forecasted volume would go near FY14 level, at 685 billion total securities being traded.

The simple assumption is not out of SGX’s reach. For one, business operations have expanded significantly since FY14. Recently, SGX has planted a new office in Chicago and also began working with the world’s largest and tech-heavy Nasdaq to enhance companies’ access to funding and increase their profile in both US and Singapore markets.

Derivatives Boosting Performance

Despite the lower trading volume in the equities and fixed income segment, SGX’s revenue still trended upwards as a result of the strong growth in the institutional-driven derivatives business.

The segment has been the key growth driver for SGX in recent years. From FY13 to FY17, derivatives volume increased from 101.1 million to 165.2 million and its contribution amounted to 39 percent of SGX’s total revenue, up from 21 percent in FY10. In 1Q18, derivatives volume continued to register double-digit growth of 15.2 percent, from 40.1 million to 46.2 million.

The derivatives segment has propped up SGX’s financial performances in recent years, but overall performance was still rather mixed. From FY13 to FY17, total operating revenue rose from $715.1 million to $800.8 million, but net profit was fairly flat at $339.7 million. This was largely due to higher technology-related capital expenditure, variable staff costs as well as acquisitions related costs. For instance, SGX acquired Baltic Exchange in FY17 which led to consolidation of the latter’s costs. As such, it is not too worrisome since profitability was not weighed down by any negative factors and that SGX should see the value enhancement after the gestation period.

Financial Highlights

FY18 – Year To Shine For SGX?

While most major market indices have risen to record territories, the local Straits Times Index (STI) has yet to even recover to its 2007 level of around 3,477. Currently at 3,440 points, the STI is trading at 11.3 times price-to-earnings, trailing other major indices such as Hang Seng Index’s 15.6 times, US S&P 500’s 24.9 times, UK FTSE 100’s 22 times and Japan Nikkei 225’s 19.2 times.

At such low valuations, the local stock market presents many deep value counters. As the aging bull market goes into its ninth year, we could potentially see more money rotating into value stocks in Singapore as investors seek to reduce their market risks.

Apart from the enbloc fever which has reignited interests in property stocks, higher oil prices have also trickled down to benefit our bank stocks. Back in 2015, low oil prices caused many oil companies to go belly up and hence the local banks recorded hefty write-offs of non-performing loans (NPLs). But since then, most NPLs should have been dealt with, leading to healthier assets in our banks’ balance sheet.

Oil stocks will also begin to see rising interest as Saudi Aramco – the largest National Oil Company in the world by proven reserves – blaze ahead to IPO in 2018. That means the Saudi government has incentives to ensure oil prices stay higher so that reserves are worth more right?

With almost every major industry in Singapore seeing a brighter outlook in 2018, trading activities for equities and fixed income securities are expected to be even warmer and hence translating to higher revenue for SGX. Not to mention that SGX CEO Loh Boon Chye is bullish that SGX could clinch a listing of the shares of the oil giant, in what could be the largest IPO ever seen.

Going forward, we also expect derivatives volume to continue increasing as SGX add more to its product offerings. Notably, REITs index futures (which Japan’s bourse offers) could be a potential catalyst for SGX, as REITs are well-demanded by Singapore investors.

Relatively Undervalued

We compared SGX to the other major exchanges in Hong Kong, US, Japan and London. On average, SGX’s peers trade at a higher valuation of 37.8 times price-to-earnings (P/E), while their yield averaged just 1.7 percent. On the other hand, SGX trades at just 23.3 times P/E while its yield was superior at 3.1 percent, based on its current trading price $7.50 per share.

On a standalone-basis, SGX is also trading at the lowest P/E, highlighting the fact that SGX could be undervalued when compared to other major exchanges. On the back that Singapore is one of the world’s finest financial cities, we think shares of SGX should therefore trade at valuations closer to its peers. With better sentiments bolstering trading activities and expectations of a healthy pipeline of IPOs, 2018 might just be the year for SGX to shine.

Yahoo Finance

Yahoo Finance