SI Research: QAF – Could Strategic Review Increase Shareholder Value?

Consumers in Singapore would have heard of, or even consumed at some point of time, the well-known brand of packaged bread, Gardenia, which is a staple in most grocery stores. While most consumers are mainly concerned about the quality of products, not all are aware that they can in fact invest in the company which produces these staples.

QAF is a leading multi-industry food company with core businesses in bakery, primary production, as well as trading and logistics. With an annual capacity of almost one billion loaves of bread, buns and snack cakes, the group’s branded packaged bread, Gardenia, is the top selling brand in Singapore, Malaysia and Philippines.

Apart from QAF’s strong packaged loaf bread segment in the region, the group’s primary production segment continues to deliver positive results. The segment largely consists of QAF’s integrated pork production operations in Australia under the brand, Rivalea. In 2016, Rivalea produced and sold over 800,000 heads or more than 68,000 metric tonnes of meat, giving it an approximate 17 percent of the total market share in Australia.

Over the past year, QAF’s shares gained over 15 percent to $1.28 as at 17 July 2017, while providing a dividend yield of 3.9 percent. The group’s shares had reached a 52-week high of $1.585 in February this year, before the release of its FY16 financial results which led to a sharp decline of over 10 percent the next trading day.

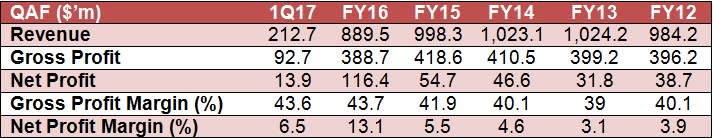

Financial Results

(Source: Shares Investment)

Given that the group’s performance for FY16 was the strongest in terms of net profit as well as margins since FY12, what caused the decrease in QAF’s share price, which is now almost 20 percent below its 52-week high?

For FY16, revenue was the lowest in five years mainly attributable to deconsolidation of financial results of Gardenia Bakeries (KL). In compliance with regulatory requirements, QAF sold 20 percent of its shareholdings in its Malaysian unit Gardenia Bakeries (KL) in April 2016, reducing its stake to 50 percent. Gardenia Bakeries (KL) then ceased to be a subsidiary and has become a joint venture of the group.

The sale and the remeasurement of the remaining stake in Gardenia Bakeries (KL) resulted in a net exceptional gain of $59.4 million, which boosted net profit to a high of $116.4 million. Excluding the one-off gains, net profit would still have increased by 4.2 percent while registering an improved net profit margin of 6.4 percent.

Increasing Competition

Going forward, the group could face intense competition in the industry, especially from retailer’s own house brands. Supermarket operators such as NTUC, Sheng Siong Group and Dairy Farm International have put in much effort to develop their own house brands for various products.

While house brands are beneficial to the supermarket operators as these products typically command a higher margin, it conversely increases competition for producers such as QAF. The impact is magnified with the supermarket operators own efforts in promoting these house brands, which are often already at a lower pricing.

However, house brands are not yet a major cause of concern for the group. In fact, the group’s primary production business has overtaken the bakery business as the top revenue contributor making up 44.9 percent of total revenue for FY16.

Strategic Review

In May 2017, QAF announced that it is conducting a strategic review of its options to enhance shareholder value in relation to the group’s primary production business in Australia which may include a listing of the Primary Production Business in Australia or a sale of the said business in its entirety.

QAF’s primary production segment, Rivalea is beginning to face increased competition resulting from a general oversupply situation in the industry and expects some pressure on selling prices and margins. However, Rivalea is expected to mitigate this situation by boosting its efficiency and productivity, reaping benefits accruing from the scale of its operations as well as the continued development of a good product mix and lower production costs, particularly the cost of feed.

As at FY16, QAF’s primary production segment had $247.6 million worth of assets and $53.7 million in liabilities. Currently, the strategic review is in its preliminary stages and there is no assurance that the proposed listing of the primary production business or the proposed sale will materialise in due course. However, an Australian news source reported that some market analysts believe it will sell for less than $100 million, an estimate that would be rather underwhelming for shareholders.

Net Cash

As at 1Q17, QAF sits in a net cash position of $38.4 million despite its relatively large market capitalisation of $729.3 million, in fact, QAF has been in a net cash position since FY14. Although the amount is hardly significant, it would certainly allow QAF access to more financing options.

Currently, QAF is focused on establishing new bakery plants in its core countries to expand its capacity to further capitalise on its economies of scale. In the Philippines, the group has announced a $31 million expansion plan to build a new Mindanao plant and purchase land at Luzon province for another plant.

Just across the causeway, a new $56 million plant in Johor will come into production this year while another $57 million plant in Bukit Kemuning, Selangor, will be completed by 2018. Upon completion, these new plants will increase the group’s total bakery plants to 16.

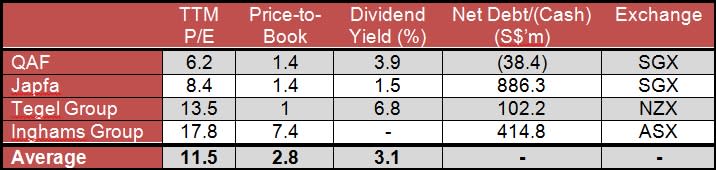

Valuations

(As at 17 July 2017)

To find out how QAF’s valuations fare against its peers, we take a look at local-listed Japfa which has a business model spanning across all three distinct stages of the value chain, as well as foreign-listed Tegel Group and Inghams Group both of which have their main business in poultry.

In terms of trailing 12-month price-to-earnings (P/E), QAF’s shares are currently valued the lowest at 6.2 times, far below that of its peers. The group’s price-to-book stands at 1.4 times, below the average of 2.8 times, though it is notable that the average was skewed higher due to Inghams Group.

QAF ranks second in terms of dividend yield at 3.9 percent, falling behind Tegel Group’s 6.8 percent. However, the group’s dividend yield is more than double that of local competitor Japfa. Also, given that QAF is the only net cash company of the four mentioned, we believe that the group’s shares have much potential to trade towards the average P/E.

Yahoo Finance

Yahoo Finance