SI Research: PropNex – Dampened By Cooling Measures

PropNex is Singapore’s largest listed real estate brokerage with over 7,000 sales professionals. As an integrated real estate services group, PropNex operates four main business segments – Real Estate Brokerage, Training, Property Management and Real Estate Consultancy.

The group is the second real estate brokerage to make its SGX Mainboard debut on 2 July 2018 at $0.65 per share, after APAC Realty in September 2017.

While PropNex’s IPO was well-received and its shares traded higher during the first few days, a new round of property cooling measures announced just four days after turned its shares southwards. At the time of closing on 21 September 2018, PropNex’s shares last changed hands at $0.55, 15.4 percent below its IPO price.

Strong 1H18 Performance

Prior to the new cooling measures, Singapore’s real estate sector was well on track to recovery as the en bloc fever continued into the second half of 2018. The increased real estate activity contributed to an increase of 7.3 percent in private home prices for the first half of the year.

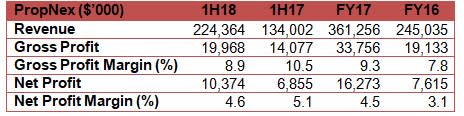

Supported by the increase in transaction value, PropNex delivered a strong 1H18 performance as revenue and net profit grew by 67.4 percent and 51.3 percent respectively. Excluding IPO expenses of $1.1 million, net profit would have been 67.6 percent higher at $11.5 million.

PropNex’s asset-light business model allows it to keep operating expenses low and maintain stable margins. The bulk of the group’s operating expenses in 1H18 was made up of staff costs amounting to $4.8 million. Property agents are commission-based and the commission is recorded under cost of services rendered. As such, the group’s growing salesforce will not result in a significant impact on its bottom line in the event of a property downturn, while allowing it to receive the full benefits in a property boom.

Impact Of Cooling Measures

The latest round of cooling measures has started to show its effect, as is evident from the 50.6 percent decrease in new private home sales in August 2018. The slump was partly attributed to the traditionally quieter period as property developers held back launches due to the Hungry Ghost Festival. Additionally, August was the first month right after the implementation of the new cooling measures and buyers were still adjusting to the effects.

The en bloc fever is no longer, as the list of en bloc projects that have gone unsold is growing due to the higher land acquisition costs. This certainly does not bode well for the private primary market segments of real estate brokerages. However, the impact will only be seen in the longer term as the pipeline of project launches remain strong.

In the primary market, PropNex has secured another 20 upcoming new project launches, representing 10,800 units. The group plans to launch 15 projects with a total of 5,462 units within the next five months.

Meanwhile, PropNex’s leading 45.3 percent market share of the residential HDB resale market is expected to maintain a strong contribution to the group’s financial performance.

Geographical Diversification

Part of PropNex’s business strategies and future plans include both local and regional expansions through franchising, licensing or merger and acquisitions. Having entered into a master franchise agreement with PT PropNex Realty Indonesia in 2016, the group has since established its presence in Indonesia with approximately 600 salespersons and 15 offices.

In March 2018, the group ventured into Malaysia through a licensing agreement with PropNex Realty Sdn Bhd. Currently, the venture is still in the early stage comprising one office and approximately 100 salespersons.

In line with the group’s regional expansion plans, PropNex entered into a master franchise agreement with PropNex Realty (Vietnam) Company Limited in August 2018. As one of Southeast Asia’s fastest-growing economies, Vietnam’s real estate sector holds much potential and an early venture could pay off well for PropNex. The group will leverage on its existing professional and personal development programs to grow its Vietnamese franchisee, which currently comprises over 80 salespersons.

Going forward, PropNex’s geographical diversification plans will reduce its reliance on the Singapore property market, which has been hit by several rounds of cooling measures since 2010.

Management Confidence

Despite the challenging operating environment in the local real estate sector, PropNex’s management remains confident. Since July 2018, PropNex chief executive officer Ismail Gafoor has purchased almost five million shares from the market, displaying his confidence in the company’s future prospects.

With the key management holding ownership of over 70 percent of the company, shareholders can be assured that the management will remain dedicated to the long-term success of the company.

Valuations Remain Attractive

Although PropNex does not have a fixed dividend policy, the group intends to recommend and distribute dividends of at least 50 percent of its net profit for the period from the listing date to 31 December 2018 and FY19.

Assuming PropNex is able to report a 2H18 that is comparable to its 1H18 performance, the group’s current share price could present an opportunity for an attractive five percent dividend yield.

PropNex is now trading at an undemanding trailing 12-month price-to-earnings (P/E) of 10.6 times, comparable to its valuations at the time of listing.

While the local real estate might not be the best choice for investment at present, PropNex would be a good choice to consider for investors seeking to enter the sector as a low-risk approach.

Yahoo Finance

Yahoo Finance