SI Research: Is The Pawnbroking Industry A Lucrative Business?

Back in the eighties when pawnshops were often associated with poverty, people visited pawnshops to sell away their valuables in order to pay bills and to make ends meet. Pawnshops then were shunned, unless forced to, for fear of being associated with drug abusers, alcoholics or hard-core gamblers. However as the pawnbroking industry modernised over the years with pawnbrokers doing away with high counters and adopting a more attractive retail-like store fronts to attract the younger customers, people have become more receptive towards pawnbroking as a viable alternative for their credit needs.

There are three listed pawnbroking chains in Singapore that run almost half of all the pawnshops across the island when combined. They are long-time player ValueMax which has been around for nearly three decades, Aspial-backed Maxi-Cash Financial Services Corporation (Maxi-Cash) as well as MoneyMax Financial Services (MoneyMax) started by Soo Kee Jewellery.

One would tend to think of pawnbroking as a very profitable business, conjuring images of greedy pawnbrokers valuing items at a fraction of their worth to desperate customers needing fast cash urgently, while charging an exorbitant interest for the loans granted. With branches of pawnbroking chains proliferating across major shopping malls and the number of pawnshops doubling since 2008, is pawnbroking really such a lucrative business in reality?

Financial Performances

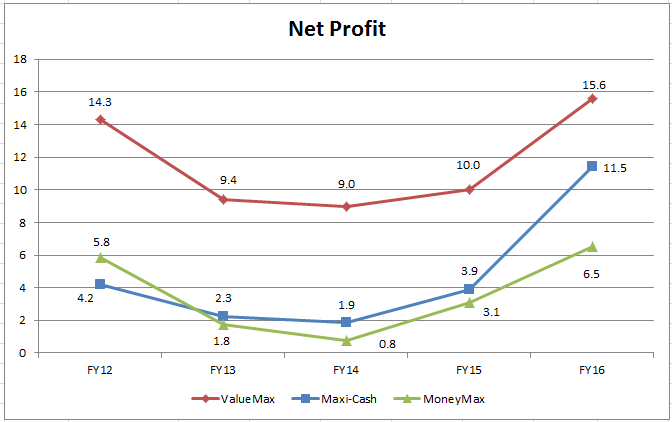

In terms of top and bottom-line performances, Maxi-Cash led the pack over the last five years. The group’s revenue grew at a compounded annual growth rate (CAGR) of 12.9 percent from $100.5 million in FY12 to $163.2 million in FY16. Correspondingly, net profit jumped to $11.5 million at a CAGR of 28.4 percent.

Maxi-Cash’s 9M17 results extended its upward momentum reporting 18.5 percent and 12.7 percent increment in its revenue and net profit respectively, underpinned by the higher interest income from the pawnbroking business as well as higher sales from the retail of jewellery, watches and branded bags business.

ValueMax, on the other hand, seems to be the underperformer of the group. Its revenue was seen on a steady decline shrinking from $509 million in FY12 to $253.3 million at a CAGR of negative 16 percent. We reckon that this could be due to aggressive competition by other pawnbroking chains to gain market share. Nevertheless, ValueMax’s net profit inched up marginally at a CAGR of 2.2 percent to $15.6 million in FY16.

ValueMax’s 9M17 revenue continued to dip 1.8 percent to $188.7 million dragged down by weaker contribution from its retail of pre-owned jewellery and gold business. However, net profit rose 20.5 percent to $13.9 million because of lower cost of sales and hence an improved gross profit margin to 16.7 percent.

Source: Company Annual Reports

Retailing Of Pre-owned Items Not As Lucrative

Pawnbrokers’ auctions are actually not as profitable as one would have expected. In the past, under the auction system, when a client does not redeem his valuables or renew the loan within six months, pawnbrokers are free to dispose of them in an auction. Although the auctions were open to the public, most of those who showed up were in fact second-hand dealers looking for bargains. According to estimates, only an average of six percent of the pledges put up for auction each month were bought, and usually 90 percent of the successful bids were lower than the outstanding debt due to the pawnbroker. Moreover, in the event that an item was sold for more, proceeds in excess of the auction expenses and interest due has to be returned to the client.

With effect from 1 April 2015, the Pawnbrokers Act has been revised to abolish the monthly public auction for unredeemed pledged articles from the pawnbroking business, so as to save on administrative costs and auction fees and to improve manpower efficiency. The authorities hoped that by doing so, pawnshop clients may also benefit from pawnbrokers passing on the cost savings to them through lower interest rates and higher valuations for pawned items.

Today, unredeemed valuables are either sold as second-hand jewellery in the pawnbrokers’ retail shops or melted as scrap gold. A look at the figures revealed that the margin for retailing of pre-owned jewellery is in fact not that fantastic. Take for instance, ValueMax’s retail of pre-owned jewellery segment accounted for the majority of the group’s FY16 revenue at 88.1 percent but merely contributed 5.9 percent to its profit before tax. Profit (before tax) margin for that segment is staggeringly low at only 0.4 percent. Meanwhile, profit margin for pre-owned luxury items segment of Maxi-Cash and MoneyMax are also not exceptionally high standing at 3.4 percent and 4.7 percent respectively.

Capital Intensive Business

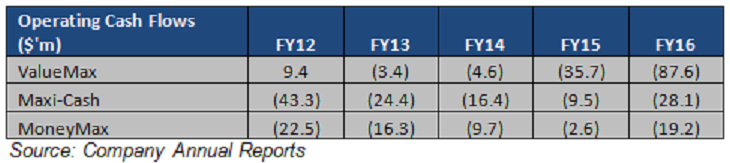

The pawnbroking business is a capital intensive one, as huge funds are required to be lent out as loans and capital being held up as receivables or inventories to be sold in the retail stores. This leads to a requirement for large working capital and hence often results in net cash outflow from operations. Unsurprisingly, all three pawnbrokers reported negative operating cash flows in most of their financial years.

The large capital requirements in the pawnbroking industry led to high borrowings and debts, giving rise to relatively leveraged balance sheets. As at 30 September 2017, MoneyMax has the highest net debt-to-equity ratio standing at 2.3 times, closely followed by Maxi-Cash at 2.1 times and ValueMax at 1.1 times. In fact, Maxi-Cash has initiated three rights issues consecutively within a short time frame in the last two years to raise funds from investors.Source: Company Annual Reports

Our Take

We feel that pawnbrokers’ capital intensive business does not align with the attributes of a stable dividend distributor, and neither does the lack of clear earnings trend qualify them to be strong growth stocks. Nevertheless, should an investor be keen to gain an exposure to the pawnbroking industry, Maxi-Cash is our pick in view of its robust bottom-line expansion over the years. That said, ValueMax’s relatively healthier balance sheet and overseas exposure in the Malaysian markets is also worth a mention.

Yahoo Finance

Yahoo Finance