SI Research: Which Offshore And Marine Stocks To Look At?

The shipping and marine industry once again came under scrutiny when Ezion Holdings (Ezion) called for trading suspension on 14 August 2017. Once touted to be a standout survivor of the offshore and marine (O&M) downturn, the group has kicked off debt restructuring in face of its third consecutive quarterly loss.

Singapore’s O&M industry has been battered by a series of bad news after oil prices tanked in late 2015. Amongst them, high-profile counters like Ezra Holdings (Ezra), Swiber Holdings (Swiber) and Nam Cheong (recently) have ran aground as oil prices continue to stay under pressure.

Yet, the FTSE ST Maritime is one of the best performing sector indices in 2017, posting over 70 percent gain since the beginning of the year. Why are some O&M counters going belly-up while some are seeing their share prices run higher? Which O&M counters should investors look at and which counters should they avoid?

The Better Performing Sector

For investors looking to dabble into O&M stocks now, a better understanding of the local shipping industry might make the difference between making and losing money. In general, the industry can be categorised into two sectors – oil and gas (O&G) and bulk shipping.

Companies the like of Ezion, Ezra, Swiber and Nam Cheong, all predominantly operate in the O&G sector. They are typically service providers to international oil companies (IOCs), servicing and chartering vessels or building ships that cater to their clients’ offshore oil or gas fields. When oil prices tanked, offshore fields saw the most capex cuts from IOCs due to significantly higher operating costs than onshore fields. In face of the downturn, these service providers saw contract flow dry up while existing contracts were delayed or cancelled and hence culminating severe cash flow problems for the highly-leveraged industry.

On the other hand, the dry bulk shipping sector that involves the transportation of cargos of various raw materials is currently the better performing sector as it undergoes a recovery. In the last financial crisis in 2007, weak global trade created a huge overhang from oversupply of bulk carries but the continuous scrapping of older vessels and stronger economic conditions has tightened the demand-supply equilibrium.

To further support the argument for the bulk shipping sector, the Baltic Dry Index – a shipping and trade index that measures the cost to transport for various raw materials – has steadily risen 312.4 percent to above 1200 points, from its low of 291 points in February 2016. Comparatively, WTI crude oil price has only recovered 62.6 percent to US$47.9 per barrel, since bottoming out at US$29.4 in same period

Baltic Dry Index

(Source: Bloomberg)

Mostly In The Green

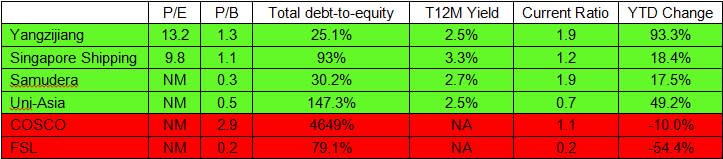

There are six counters in the bulk shipping sector listed on our local exchange: Yangzijiang Shipbuilding Holdings (Yangzijiang), COSCO Shipping International (Singapore) (COSCO), First Ship Lease Trust (FSL), Samudera Shipping Line (Samudera), Singapore Shipping Corporation (Singapore Shipping) and Uni-Asia Group (Uni-Asia).

It is not uncommon knowledge for investors to know that Yangzijiang is one of the best performing counters in the 2017. The Chinese shipbuilding firm is one of the largest builders of bulk carriers in the world, benefiting from its scale and more robust balance sheet. Leading the fleet in the rebound, the stock rallied over 93.3 percent to $1.585 since the beginning of year, after posting improving profitability and substantial new order flow that boosted its outstanding order book to US$4 billion.

From the table, Yangzijiang is clearly trading at a premium to its peers, but that is also because it has the lowest debt level and also manages to pay out modest dividends. But how do other smaller bulk shipping peers fare against the $6 billion market cap giant?

For Singapore Shipping, the company has also stayed profitable throughout the downturn and is trading “cheaper” than Yangzijiang while its shares offer a more attractive 3.3 percent dividend yield. At the meantime, Samudera and Uni-Asia have both risen from the ashes and have generated half-yearly profits in 1H17. Despite that, both share prices are still languishing below their respective book value, screaming a big discount of more than 50 percent.

That said, for the case of Uni-Asia, its highly leveraged balance sheet may have been the element keeping its share price depressed (or could it be the lingering effects of 2013 penny stock debacle?). But the group is unique for it is not purely a bulk shipping company; the group is also a hotel property owner and derives slightly more than half its income from its hotel operations. As such, its borrowings can be backed by both the group’s ships as well as its properties.

(Source: Shares Investment)

Be Selective

Despite more money flowing back, not all counters in the sector are a screaming bargain. In particular, COSCO and FSL are still loss-making and have yet to deliver a positive quarter. As a result, the market continues to punish the stocks and hence investors are encouraged to avoid them.

For risk-tolerant investors looking to chase the rebound, betting on the small-cap counters might be a suitable strategy as their valuations are still lagging behind the sector leader. While we have made our case based on a valuation stand point, investors should keep in mind of other various idiosyncratic factors that also affect the particular share price for example, operating geography.

On the other hand, if you cannot stomach the choppy movements of small cap stocks, banking on Yangzijiang may seem like the safest bet.

Yahoo Finance

Yahoo Finance