SI Research: How To Make Money Using The 52-Week Low Section

In this article on how to profit using Shares Investment, we present yet another feature that will be beneficial to investors.

As a value investor, the 52-week low section is the place where we will often look at from time to time whenever we wish to search for value. The 52-week low is the lowest price that a stock has traded at over the last one-year period.

Owing to the anchoring effect, there are usually increased interests and volatility as prices of stocks trade near either their highs or lows, and hence many investors view the 52-week low as an important benchmark in determining a stock’s current price against past trend, and also against its valuation.

Although there are no concrete statistics available to prove the likelihood if a stock will either breach this significant support or rebound from there – which in fact is very dependable on each individual company’s fundamentals and future prospects – nevertheless investors still pay much attention to this number as the potential opportunity of successfully catching a reversal may turn out to be very rewarding. Without further ado, we shall now begin our treasure hunt to see if there could be any under-valued stocks worth considering.

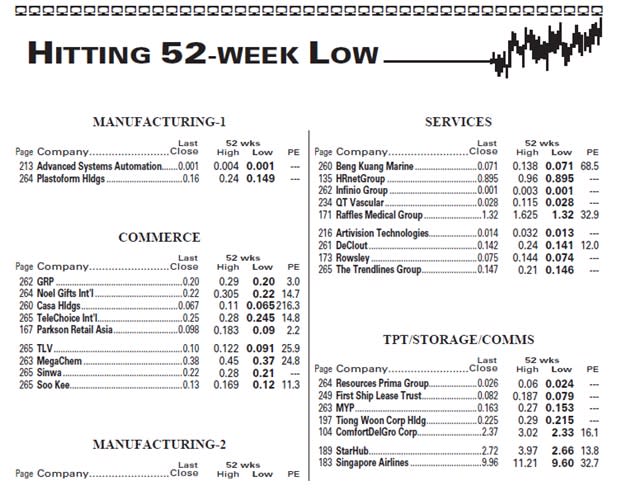

Hitting 52-Week Low

Scouring through the “Hitting 52-Week Low” section from Shares Investment Issue 565, one can find a total of 53 counters trading near their one-year lows. These counters come from various industries and sectors ranging from manufacturing, properties to hospitality and services.

(Extracted From Shares Investment Issue 565)

Filtering With Profitability And Valuation

Not all stocks which are trading at low prices are good bargains, as the chances of it going even lower remain a threat. As such, we will be adding some filters to help us separate the gems from the mediocre, as shown below:

Profitability – Selected candidates must be able to generate a profit, as companies which are making a loss may find itself unable to continue as a going concern.

Valuation – We are searching for value after all hence we will only be looking at shares which are trading at a discount to the book value. Specifically, price-to-book (P/B) ratio should be less than one.

Yield – Companies which pay out dividends are definitely an added sweetener, as shareholders are paid a return to their capital while waiting for the value of the companies to be realised. In addition, consistent dividend payouts are also indications that a company has the healthy profit and cash flow to continue to do so.

After applying the above filters, the list of counters in the 52-week low has now been narrowed down to just four, namely AF Global, King Wan Corporation (King Wan), GL and Singapore Airlines (SIA).

Source: Singapore Exchange; updated 3 July 2017

AF Global

AF Global, formerly known as LCD Global Investments, started out specializing in traditional Chinese medicines but sold off its pharmaceutical business in 1993 to focus on its property related business. Today, the group mainly own and operate hotels and serviced residences with presence in Singapore, Thailand, Vietnam, Laos, People’s Republic of China and the United Kingdom. With a market capitalisation of $175.2 million, the stock is thinly traded with an average three-month volume of only 50,000 shares.

Last closed at $0.163 on 3 July, AF Global is trading at a 5.8 percent premium above its 52-week low of $0.154. Nonetheless, the current price still offers a 30 percent discount to its book value. Furthermore, we especially like the attractive high dividend yield which the group pays out at 7.5 percent.

King Wan Corporation

King Wan’s core business is primarily involved in providing mechanical and electrical engineering services to clients who are mostly contractors in Singapore engaged in property development in public and private residential sectors. The group has a small market capitalisation of just $55.9 million.

Last closed at $0.16 on 3 July, King Wan is trading at its 52-week low. Despite current share price is being valued at a 30 percent discount to its book value, the price-to-earnings (P/E) ratio is relatively on the high side at 55.7 times. The group returned to the black in FY16 as a result of higher share of results from associates from the recognition of profits from its investment in the Skywoods residential development project, as well as the absence of impairment made on available-for-sale investments during the year. Nevertheless, net profit margin remained low at 1.1 percent.

GL

GL, formerly known as GuocoLeisure, owns, leases, and manages a chain of hotels comprising 37 hotels in the United Kingdom and 2 hotels in Malaysia. Besides its core business in hospitality which accounted for 90.2 percent of its FY16 revenue, the group also dabbles in oil and gas production in Australia, property development as well as casino gaming activities.

Last closed at $0.72, GL is trading slightly above its 52-week low of $0.70 by 2.9 percent. Current price offers an attractive 30 percent discount to book value, while P/E ratio is not too expensive at 16.3 times plus a decent dividend yield at 3.2 percent. Share price was beaten down as GL’s revenue and profit in recent years were affected by the weakening British Pound against the US Dollar, which happens to be its reporting currency. In spite of that, GL could well be a candidate worth considering for investors who expect the London hospitality market to return to growth in the following years.

Singapore Airlines

SIA should be a household name that requires no introduction. Being one of the constituents of the Straits Times Index, it is also the largest company found within the 52-week low list with a market capitalisation of $12 billion. Besides its core business in providing premium passenger air transportation services, the group is also involved in cargo transportation, engineering services as well as operations of budget carriers.

SIA’s share price plunged recently as a result of a shocking 4Q17 quarter loss which led to a 55.2 percent decline in net profit for FY17. The price has rebounded five percent from its 52-week low of $9.60 by closing at $10.08 on 3 July. Based on current market price, it is being valued at a P/B ratio of 0.9 times, P/E ratio of 33.4 times and dividend yield stood at two percent.

Upcoming Event

We managed to invite a few popular names in the finance and investment education world to speak at our upcoming Shares Investment Convention on 16 September 2017 (Saturday)!

They’ll be covering topics on personal finance, macroeconomics and investment strategies to help retail investors make more shrewd decisions especially in the current uncertain and volatile economy. Click on the button above to learn more and grab your early bird tickets. See you there!

P.S. Don’t forget to enter promo code “SHARES10” for a $10 discount!

Yahoo Finance

Yahoo Finance